For those who’d prefer to earn TD Rewards Factors to place in the direction of flights, inns, short-term leases, holidays, and extra, you’ll want to take a look at the present provide on the TD First Class Journey® Visa Infinite* Card.

At the moment, there’s a record-high welcome bonus of as much as 165,000 TD Rewards Factors† up for grabs, and past that, there are lots of causes to maintain the cardboard in your pockets 12 months after 12 months.

Let’s have a look at 7 the explanation why the TD First Class Journey® Visa Infinite* Card must be a part of your general bank card journey technique.

TD First Class Journey® Visa Infinite* Card

- Earn 20,000 TD Rewards Factors upon making your first buy†

- Earn 145,000 TD Rewards Factors upon spending $7,500 inside 180 days of account opening†

- Plus, earn a Birthday Bonus of as much as 10,000 TD Rewards Factors†

- Plus, earn 8x TD Rewards Factors† on eligible journey purchases whenever you e book via Expedia® for TD†

- Get an annual TD Journey Credit score† of $100 whenever you e book via Expedia® for TD†

- Use your rewards for any journey bookings out there on Expedia® for TD†

- 4 complimentary lounge visits via the Visa Airport Companion Program†

- Minimal revenue: $60,000 private or $100,000 family

- Annual price: $139, rebated for the primary 12 months†

- Supply efficient as of September 4, 2025†

1. File-Excessive Welcome Bonus

The present welcome bonus on the TD First Class Journey® Visa Infinite* Card matches the best we’ve ever seen.

For those who apply and are authorised for the cardboard on or after September 4, 2025,† you may earn as much as 165,000 TD Rewards Factors within the first 12 months.†

To unlock the complete welcome bonus, you’ll want to fulfill the next circumstances:

- Earn 20,000 TD Rewards Factors upon first buy†

- Earn 145,000 TD Rewards Factors upon spending $7,500 within the first six months†

In different phrases, you’ll have to spend a mean of $833 on eligible purchases in every of the primary six months as a cardholder to earn the complete welcome bonus.

Plus, you’ll profit from incomes extra factors alongside the best way, because of the cardboard’s class incomes charges, which we’ll focus on under.

When it comes time to redeem, you may redeem 165,000 TD Rewards Factors for as much as $825 value of journey booked via Expedia® for TD, or for as much as $726 for journey booked instantly with its lately launched characteristic “Repay purchases”.†

The construction of the present provide is such that you’ve got a sizeable welcome bonus paired with an inexpensive minimal spending requirement, and a full six months to finish it.

With a record-high welcome bonus up for grabs, there’s no higher time to use for the TD First Class Journey® Visa Infinite* Card; nonetheless, there are lots of different compelling causes to have this card, which we’ll focus on under.

2. First-Yr Annual Payment Rebate

The TD First Class Journey® Visa Infinite* Card usually comes with an annual price of $139.†

In tandem with the traditionally excessive welcome bonus, the present provide features a first-year annual price rebate, which applies to each the first cardholder and the primary supplementary cardholder.†

Whereas the TD First Class Journey® Visa Infinite* Card will surely be worthwhile even with a $139 annual price, the first-year annual price rebate actually makes this provide much more compelling.

Plus, in case you have a TD Limitless or All-Inclusive banking account, you may have the annual price waived on one TD bank card of your alternative, together with the TD First Class Journey® Visa Infinite* Card, on an ongoing foundation.

3. Elevated Class Incomes Charges

The TD First Class Journey® Visa Infinite* Card additionally has a four-tier incomes construction, which lets you earn extra factors on many eligible on a regular basis purchases.

These class multipliers are helpful as you’re employed to fulfill the minimal spending requirement, in addition to whenever you proceed to pad your TD Rewards Factors steadiness over the long-term.

At the moment, the incomes charges on the TD First Class Journey® Visa Infinite* Card are as follows:

- Earn 8 TD Rewards Factors per greenback spent on eligible journey booked via Expedia® for TD†

- Earn 6 TD Rewards Factors per greenback spent on eligible groceries and eating places†

- Earn 4 TD Rewards Factors per greenback spent on eligible recurring payments†

- Earn 2 TD Rewards Factors per greenback spent on all different eligible purchases†

It’s value noting that there’s an annual spending cap for the elevated incomes charges within the groceries, eating places, and recurring invoice cost classes.

After you’ve spent $25,000 throughout the 12 months, the incomes charges in these classes will likely be lowered to 2 TD Rewards Factors per greenback spent.†

For those who redeem TD Rewards Factors for a worth of 0.5 cents per level by reserving journey via Expedia® for TD, these charges are equal to a 4%, 3%, 2%, or 1% return, respectively.

These are stable incomes charges, which can assist you to shortly earn factors to offset the price of journey all year long.

Plus, in your cardholder anniversary date, you’ll get an extra increase to your steadiness with one of many card’s different hallmark options.

Be happy to make use of our rewards calculator under to estimate what number of TD Rewards Factors you may earn primarily based in your month-to-month spending:

4. 10% Annual Birthday Bonus

Along with the robust incomes charges on day-to-day spending, you’ll additionally obtain a 10% Birthday Bonus within the type of TD Rewards Factors.†

Every year in your cardholder anniversary date, you’ll earn an extra 10% bonus on all of the TD Rewards Factors you’ve earned over the previous 12 months, as much as a most of 10,000 factors.†

To maximise this profit, which is value as much as $50 for those who redeem the factors for journey booked via Expedia® for TD, you’d have to earn a complete of 100,000 TD Rewards Factors organically all year long.

To place this into perspective, you’d have to spend round $1,380 per thirty days on eligible groceries and eating purchases†, or some other mixture to convey you throughout the edge of 100,000 factors.

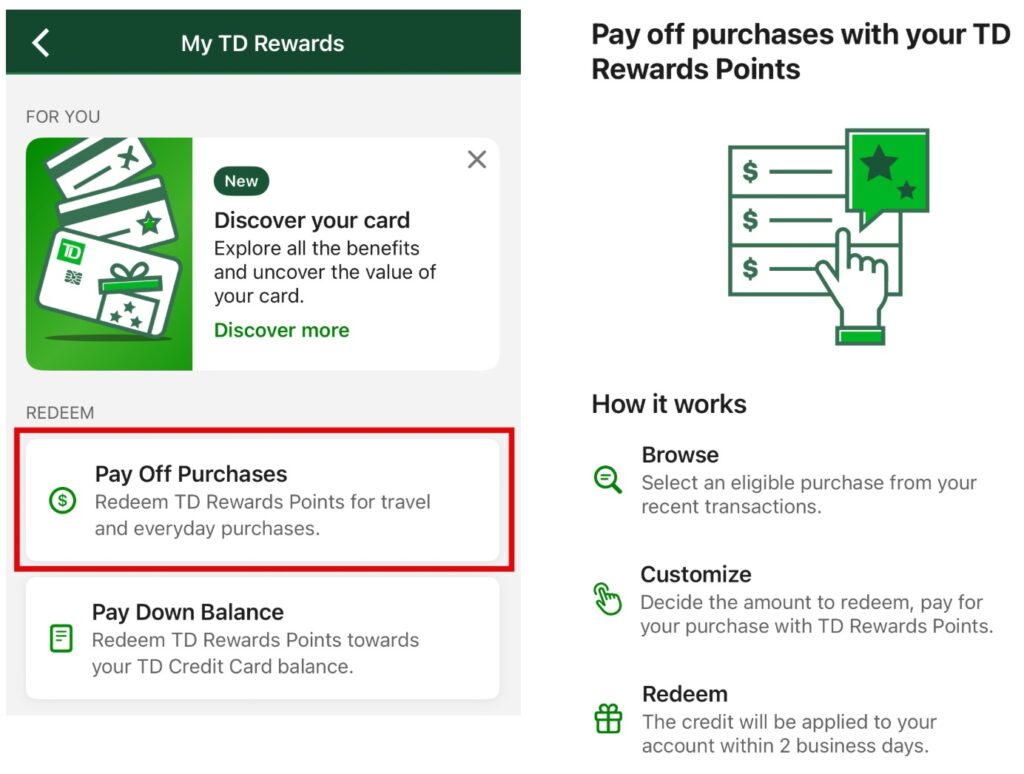

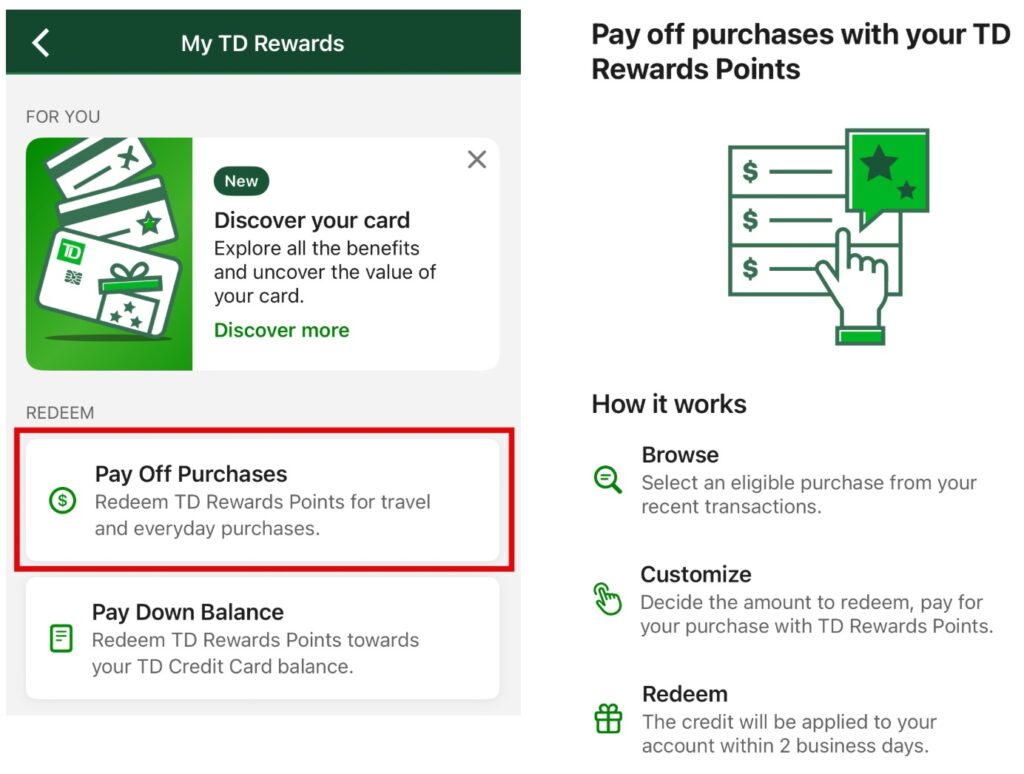

5. Versatile Redemptions with TD Rewards Factors

When it comes time to redeem your factors, you’ll be pleased to know that TD Rewards Factors are pretty versatile.

Whilst you can’t switch your factors to any exterior airline or resort loyalty packages, the most effective (and most respected) strategy to redeem TD Rewards Factors is for journey, both booked via Expedia® for TD or instantly with any vendor.

In actual fact, TD Rewards Factors are significantly helpful to have available with regards to filling the gaps for journey that may’t be booked via different loyalty packages.

Essentially the most useful strategy to redeem TD Rewards Factors is thru Expedia® for TD, which provides you with a worth of 0.5 cents per level.

On the platform, you may e book flights, inns, automotive leases, cruises, excursions, and even Disney tickets, amongst different issues, and get the utmost doable worth out of your factors.

Since many of those bills are usually troublesome to e book with different factors currencies, utilizing TD Rewards Factors to e book journey at a hard and fast worth of 0.5 cents per level is a superb redemption alternative, and will find yourself saving you a major amount of money in your subsequent journey.

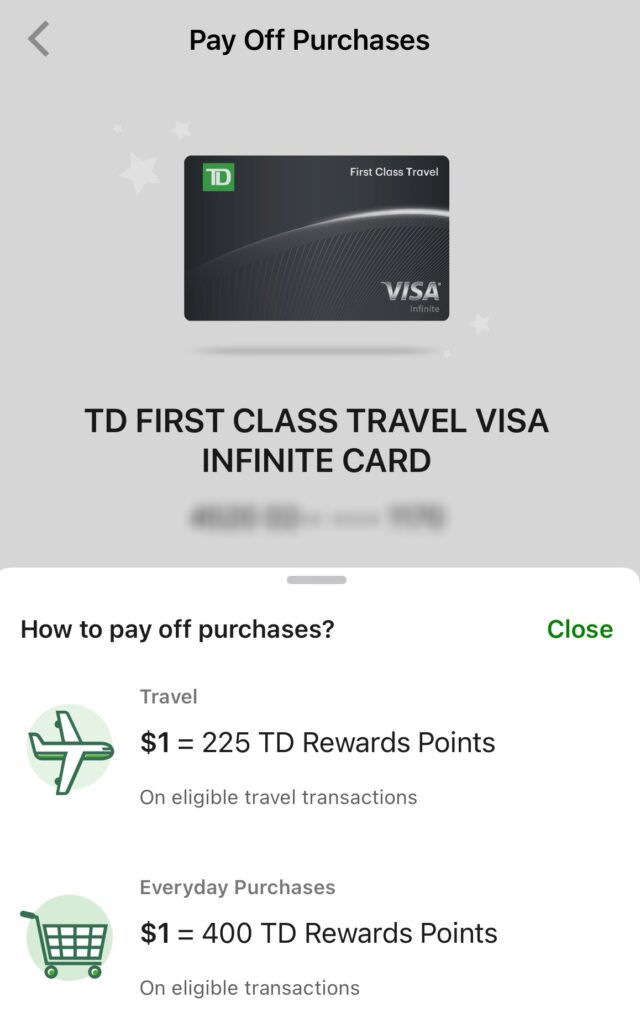

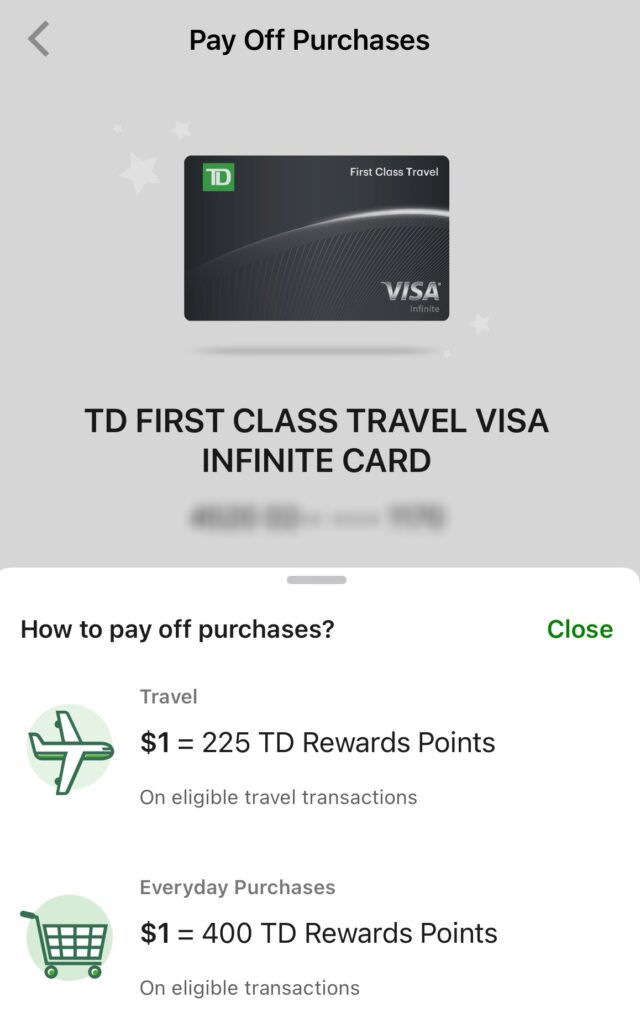

However, if you wish to e book journey instantly with distributors, you may nonetheless redeem TD Rewards factors for these purchases by exchanging the factors for a press release credit score at a hard and fast price of 0.44 cents per level in opposition to eligible journey purchases charged to the cardboard.†

For instance, with the Pay Off Purchases characteristic, you may e book instantly with an unbiased resort after which apply your TD Rewards Factors as a press release credit score to offset the price.

This methodology additionally enables you to maintain and revel in your loyalty standing perks, because you’re reserving instantly relatively than via an internet journey company.

To redeem TD Rewards Factors in opposition to journey purchases booked instantly, merely log in to the TD app and apply your factors towards any eligible journey transactions made throughout the previous three statements.†

6. Annual Journey Credit score and Lounge Entry

One of many different options on the TD First Class Journey® Visa Infinite* Card that makes it worthwhile to maintain for the long-term is the $100 annual journey credit score.†

The $100 annual journey credit score helps to offset the cardboard’s $139 annual price, bringing it all the way down to an efficient $39 annual price year-after-year. Nonetheless, with an eligible checking account, you’ll take pleasure in an annual price rebate anyway, which makes the $100 annual journey credit score much more enticing.

Starting within the second 12 months of card membership, you’ll earn a $100 journey credit score every year in your cardholder anniversary date, which may then be used in the direction of lodging and trip packages booked via Expedia® for TD.

Importantly, the credit score applies to eligible purchases of $500 or extra. Due to this fact, you can too consider it as as much as a 20% low cost on lodging or trip packages on considered one of your subsequent journeys.

On prime of that, the cardboard comes with 4 complimentary annual lounge passes via the Visa Airport Companion Program.

These passes grant entry to collaborating lounges all over the world, letting you calm down in consolation earlier than your flight.†

With the latest information that American Specific Platinum playing cards will restrict lounge visits beginning in 2027, this card serves as a good way to complement your further visits — guaranteeing you continue to have entry to airport consolation even when different playing cards start tightening entry.

7. Sturdy Insurance coverage Protection

Lastly, the TD First Class Journey® Visa Infinite* Card comes with aggressive insurance coverage protection. It is a key characteristic for a powerful journey bank card, and one that you simply’ll actually need to pay attention to as a cardholder.

The great insurance coverage protection provided by the cardboard can finest be divided between journey insurance coverage and retail insurance coverage.

When it comes to journey insurance coverage, the cardboard offers the next:

- Emergency medical insurance coverage: As much as $2 million for journeys as much as 21 days for these aged 64 and underneath, and as much as 4 days for these aged 65 and older†

- Journey cancellation: As much as $1,500 per individual (most of $5,000 per journey)†

- Journey interruption: As much as $5,000 per individual (most of $25,000 per journey)†

- Widespread service journey accident insurance coverage: As much as $500,000 of protection for losses whereas travelling on a typical service (bus, ferry, aircraft, practice, or automotive rental)†

- Flight delay: As much as $500 per individual for delays of 4 hours or longer†

- Baggage delay: As much as $1,000 per individual for delays of six hours or longer†

- Automotive rental: As much as 48 days of insurance coverage on a automobile with an MSRP of as much as $65,000†

- Lodge/motel housebreaking insurance coverage: As much as $2,500 of protection per incidence of stolen private gadgets that belong to the cardholder or eligible relations travelling with the cardholder†

Except for emergency medical insurance coverage, you’ll have to cost the complete price of your journey to be eligible for the opposite advantages.†

Not solely can the included journey insurance coverage protection on the cardboard prevent cash, however you’ll be assured that you simply received’t incur any further bills within the occasion of disruptions to your journey plans.

In terms of retail insurance coverage advantages, cardholders can profit from the next:

- Cell gadget insurance coverage: As much as $1,000 within the occasion of loss, theft, unintentional injury, or mechanical breakdown for eligible cell gadgets.†

- Buy safety: You’ll be protected if an merchandise is stolen or broken inside 90 days of buy.†

- Prolonged guarantee safety: If you buy an merchandise that comes with a producer’s guarantee, you’ll obtain double the guarantee as much as a most of 12 further months.†

Of those, cell gadget insurance coverage and prolonged guarantee safety will be significantly helpful if one thing occurs to an eligible product bought on the cardboard.

As at all times, it’s necessary to learn the insurance coverage booklet to completely perceive what’s lined and eligibility standards in your distinctive state of affairs.

Conclusion

The TD First Class Journey® Visa Infinite* Card is a formidable card that comes with robust journey advantages and aggressive incomes charges.

For those who’re available in the market for a brand new bank card, you need to actually take into account the TD First Class Journey® Visa Infinite* Card, particularly with its record-high welcome bonus and first-year annual price rebate.

There’s no introduced finish date for this record-high provide, however these promotions not often final lengthy, so you’ll want to apply sooner relatively than later.

† Phrases and circumstances apply. Discuss with the cardboard issuer’s web site for full, up-to-date info.