The Scotiabank Gold American Categorical® Card is likely one of the finest pound-for-pound journey playing cards within the Canadian market, because of its beneficiant incomes charges, no overseas transaction charges, and quite a few journey perks.

With the cardboard packed filled with options and advantages, you may be questioning how one can get essentially the most out of the cardboard and actually reap the benefits of all that it has to supply.

On this information, we’ll present you find out how to maximize the potential of the Scotiabank Gold American Categorical® Card, together with by incomes and redeeming rewards and the whole lot in between.

1. Get a Kickstart with the Welcome Bonus

You’re off to an excellent begin in maximizing your Scotiabank Gold American Categorical® Card with its welcome bonus. Presently, new cardholders can earn as much as 50,000 Scene+ factors,

The primary batch of Scene+ factors is earned upon assembly a modest minimal spend requirement of $2,000 throughout the first three months of the cardboard account opening.

The second batch of Scene+ factors is earned upon spending a $7,500 throughout the first yr of card membership.

Whereas $7,500 could sound steep, it really works out to simply $625 a month — an achievable goal for a lot of households, particularly in case you’re utilizing the cardboard for groceries, eating, gasoline, and payments.

On prime of that, the $120 annual charge is waived within the first yr, and the private annual revenue requirement is a modest $12,000 yearly — unusually low for a card with this stage of rewards.

Whether or not you’re a scholar with a part-time job or a newcomer to Canada simply beginning out, this can be a robust card that’s completely price contemplating.

Scotiabank Gold American Categorical® Card

- Earn 30,000 Scene+ factors upon spending $2,000 within the first three months

- Plus, earn an extra 20,000 Scene+ factors upon spending $7,500 within the first yr

- Earn 6x Scene+ factors at Sobeys, IGA, Safeway, FreshCo, and extra

- Plus, earn 5x Scene+ factors on groceries, eating, and leisure

- Additionally, earn 3x Scene+ factors on gasoline, transit, and choose streaming providers

- Redeem factors for an announcement credit score for any journey expense

- No overseas transaction charges

- Benefit from the unique advantages of being an American Categorical cardholder

- Annual charge: $120 (waived for the primary yr)

2. Increase Your Steadiness on On a regular basis Spending

When you’ve earned the complete welcome bonus on the Scotiabank Gold American Categorical® Card, you may proceed to pad your Scene+ steadiness with the cardboard’s glorious on a regular basis incomes charges.

By paying for a lot of of life’s necessities together with your Scotiabank Gold American Categorical® Card, you may take pleasure in the next incomes charges:

- Earn 6 Scene+ factors per greenback spent at Empire Firm grocery shops† (Sobeys, Safeway, FreshCo, and extra)

- Earn 5 Scene+ factors per greenback spent at eligible eating places and grocery shops†

- Earn 5 Scene+ factors per greenback spent on eligible leisure purchases†

- Earn 3 Scene+ factors per greenback spent on eligible gasoline and every day transit purchases†

- Earn 3 Scene+ factors per greenback spent on eligible streaming providers†

- Earn 1 Scene+ level per greenback spent on all different eligible purchases (together with overseas transactions)†

The cardboard is backed by the Scene+ program, which lets you earn and redeem factors at an elevated price at a myriad of companions, similar to:

- Empire Firm shops (Sobeys, Safeway, FreshCo, Lawton Medicine, and so forth.)

- Recipe Limitless eating places (Harvey’s, Swiss Chalet, East Facet Mario’s, and so forth.)

- Cineplex (together with The Rec Room and Playdium)

- House {Hardware}

Likewise, the Scene+ program lets you flexibly redeem your factors in direction of journey purchases, merchandise, and reward playing cards, amongst different choices. The flexibleness of Scene+ factors can be notable in that you simply’re ready to make use of your factors for bills like boutique inns or low-cost flights that aren’t bookable by airline or lodge loyalty packages.

The cardboard can be backed by American Categorical, which is accepted in 160+ nations and territories – even in nations that you simply assume it won’t be, similar to Nicaragua, Peru, Vietnam, and Kazakhstan. Moreover, in Canada, extra companies are accepting American Categorical because of initiatives like Store Small.

3. As much as 6x Scene+ Factors on Groceries

The Scotiabank Gold American Categorical® Card presents one of many highest incomes charges on groceries amongst Canadian bank cards. By utilizing your card at eligible grocery shops, you’ll profit from the next incomes charges:

- 6 Scene+ factors per greenback spent at Empire Firm’s manufacturers, together with Sobeys, Safeway, IGA, Foodland, FreshCo, and Thrifty Meals

- 5 Scene+ factors per greenback spent in any respect different eligible grocery shops

Even higher, as companions of the Scene+ program, Empire Firm grocery shops allow you to earn extra factors with weekly specials and promotions. You will discover many of those presents by looking the digital or print flyer of your favorite Empire Firm grocery retailer.

For instance, you may participate within the weekly Scene+ Inventory Up deal at Sobeys and simply obtain 1000’s of additional factors by merely buying the featured gadgets.

Needless to say you might also redeem your Scene+ factors for an on the spot rebate in your groceries at Empire Firm shops at a price of 1,000 factors = $10. Furthermore, you may earn and redeem Scene+ factors on the identical transaction and really maximize your financial savings.

4. 5x Scene+ Factors on Eating and Leisure

One other thrilling function of the Scotiabank Gold American Categorical® Card is its accelerated incomes price of 5 Scene+ factors per greenback spent on eligible eating and leisure, which lets you shortly construct up your factors steadiness when having fun with an evening out.

To maximise the variety of factors you earn past these earned with the bank card, you should use the Scene+ app to observe for presents from partnered Recipe Limitless eating places and use these to earn as much as 15x extra factors on eligible transactions.

As an example, you would load the 15x provide at Kelsey’s Authentic Roadhouse and earn 15 Scene+ factors per $3 spent. Plus, these earnings are on prime of what you earn with the Scotiabank Gold American Categorical Card, with which you’ll get one other 15 Scene+ factors per $3 spent.

That implies that by combining the particular provide and spending in your Scotiabank Gold American Categorical® Card, you’ll earn 30 Scene+ factors per $3 spent, which is equal to a ten% return on spending – among the many most beneficiant rewards you’ll get from a restaurant in Canada.

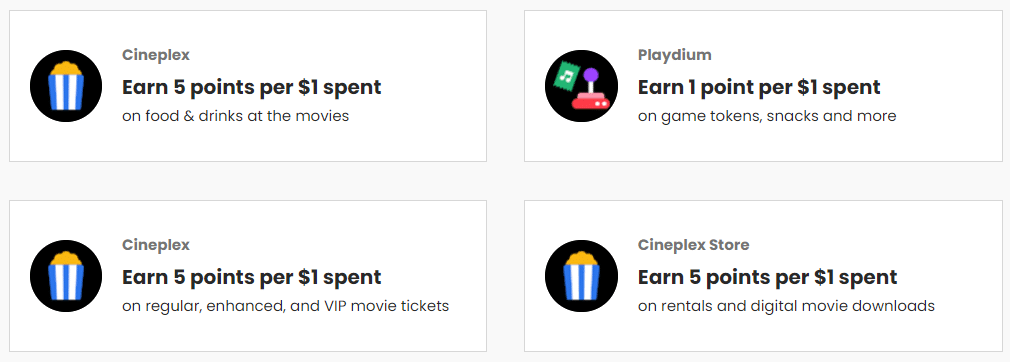

Your film nights may also be extra rewarding once you use your Scotiabank Gold American Categorical® Card in tandem together with your Scene+ membership at Cineplex.

By utilizing your Scene+ membership alone, you’ll earn 5 factors per greenback spent on tickets, meals, and drinks; nevertheless, once you use your Scotiabank Gold American Categorical® Card to pay, you’ll get one other 5 factors per greenback spent on the identical purchases, doubling your earnings to 10 factors per greenback spent, or as soon as once more, a ten% return.

5. 3x Scene+ Factors on Gasoline and Day by day Transit

One other priceless accelerated incomes price on the Scotiabank Gold American Categorical® Card is the 3x Scene+ factors earned on eligible gasoline purchases and every day transit.

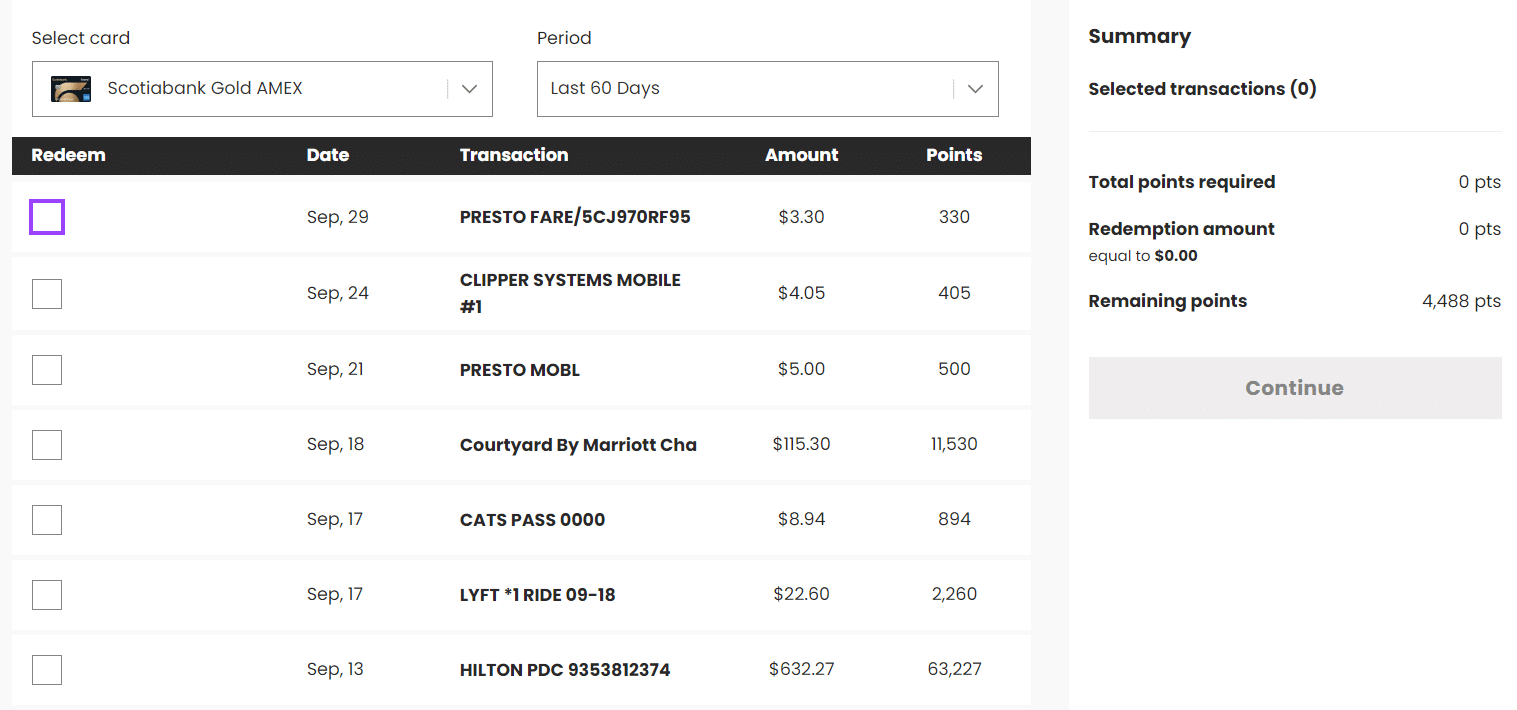

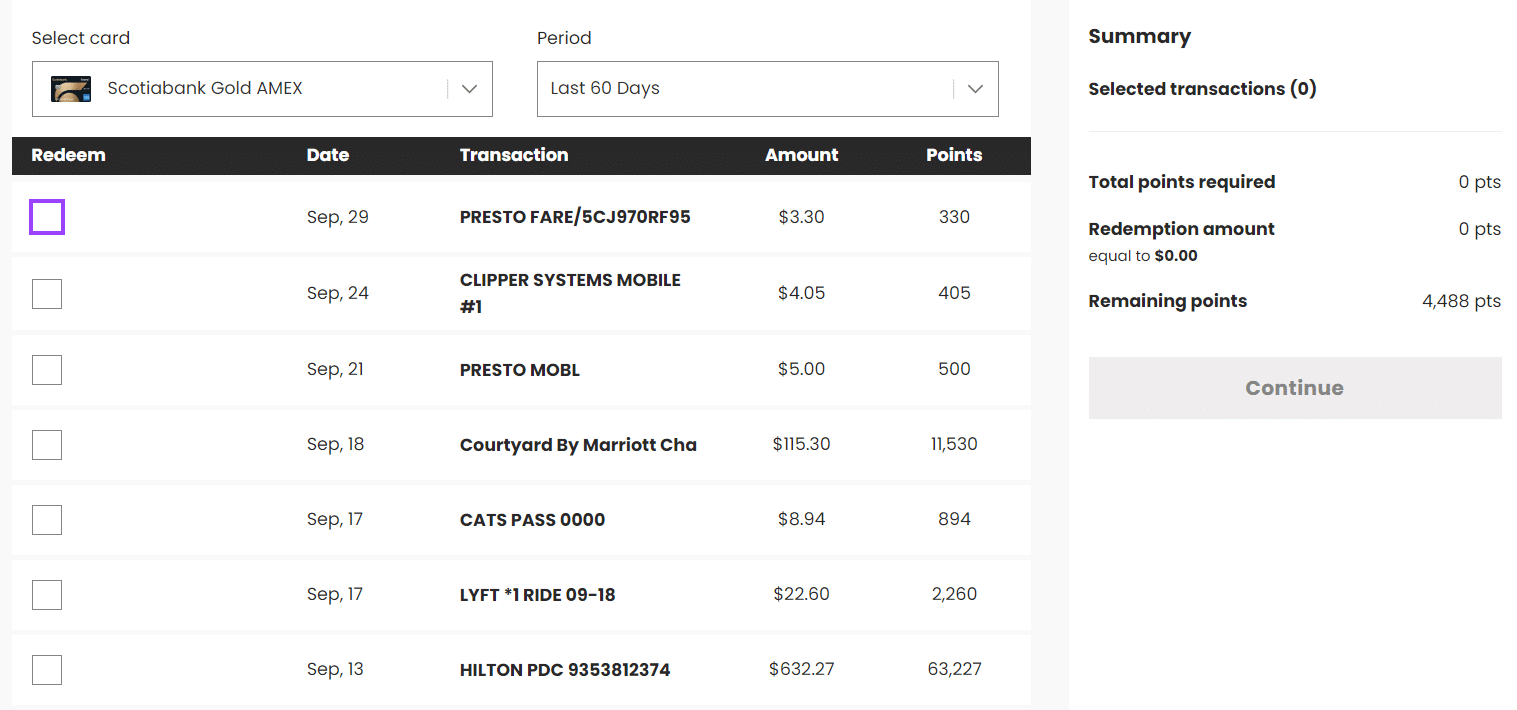

You’ll discover this profit particularly priceless today, since PRESTO, the fee system for a lot of transit businesses in Ontario, now accepts bank cards tapped straight onto its fee units.

That implies that once you take the bus, streetcar, and subway in Toronto, you may faucet your Scotiabank Gold American Categorical® Card straight onto the PRESTO gadget and simply earn 3 factors per greenback spent in your fares, which is equal to a 3% return.

6. No International Transaction Charges

One of the crucial compelling options of the Scotiabank Gold American Categorical® Card is that it doesn’t cost a overseas transaction charge on purchases made in foreign currency echange.

This implies you’ll pay your overseas forex transactions based mostly solely on the mid-market trade price, with none extra charges tacked on.

Most Canadian bank cards cost 2.5% or extra on overseas transactions, so in case you have a tendency to spend so much of time outdoors of Canada, these further charges can actually add up.

With the Scotiabank Gold American Categorical® Card, you’ll not solely save the two.5% on all overseas forex transactions, however you’ll additionally earn 1 Scene+ level per Canadian greenback spent on all overseas forex transactions (calculated after the forex trade).

Scotiabank Gold American Categorical® Card

- Earn 30,000 Scene+ factors upon spending $2,000 within the first three months

- Plus, earn an extra 20,000 Scene+ factors upon spending $7,500 within the first yr

- Earn 6x Scene+ factors at Sobeys, IGA, Safeway, FreshCo, and extra

- Plus, earn 5x Scene+ factors on groceries, eating, and leisure

- Additionally, earn 3x Scene+ factors on gasoline, transit, and choose streaming providers

- Redeem factors for an announcement credit score for any journey expense

- No overseas transaction charges

- Benefit from the unique advantages of being an American Categorical cardholder

- Annual charge: $120 (waived for the primary yr)

7. Complimentary Concierge Service

Whereas the Scotiabank Gold American Categorical® Card is engaging for its excessive incomes charges, it’s additionally supplemented by a slew of options that you may maximize on your travels.

One among these useful options is the complimentary concierge service, which Scotiabank gives in partnership with Ten Way of life Group.

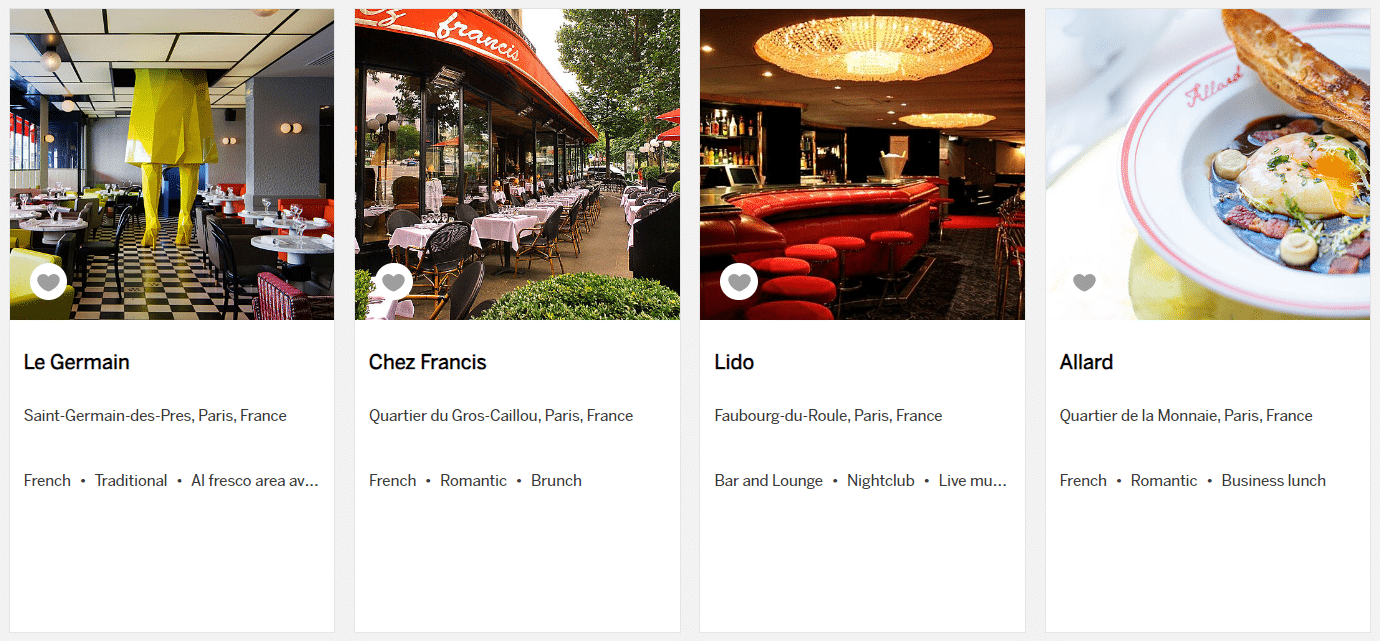

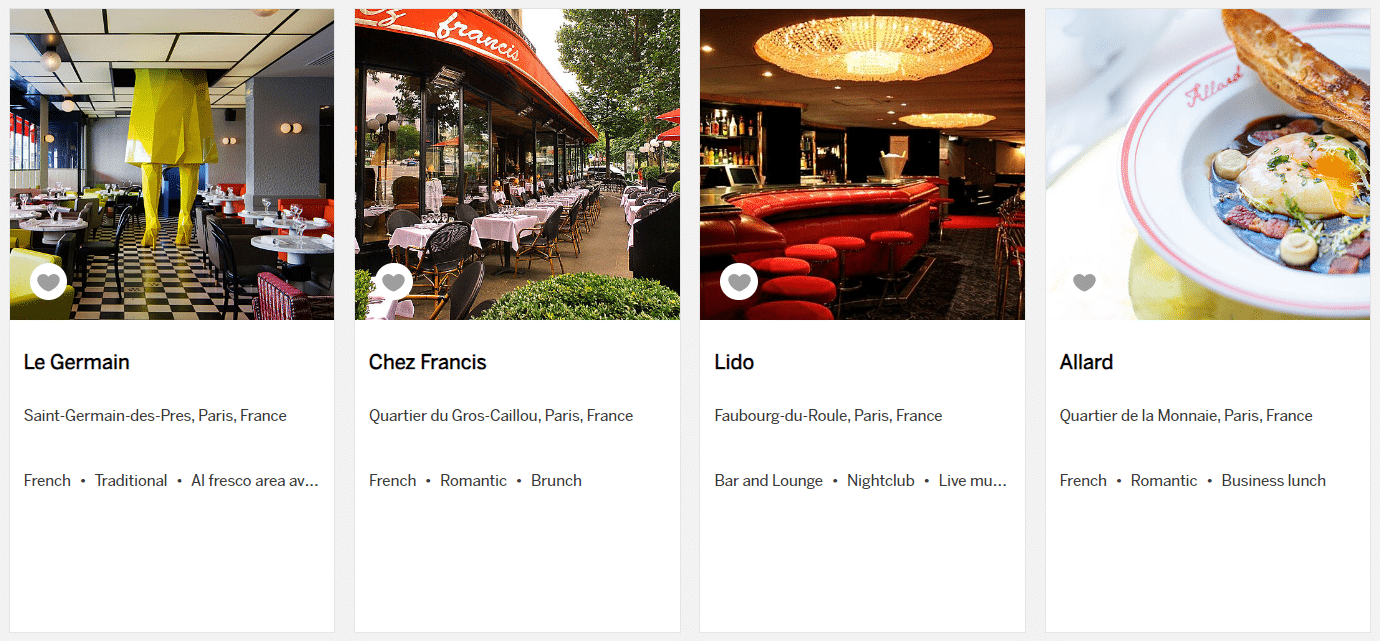

The concierge service can help you in reserving eating places, inns, and leisure (amongst different providers) in Canada and around the globe. As a matter of truth, the service has specialists for every geographic area who’re outfitted to supply personalised suggestions.

For example, this service can take away the effort of getting in contact with eating places and inns which might be in a unique time zone or that talk a unique language.

As well as, the concierge service presents particular perks similar to complimentary wine at eating places, expertise credit at inns and resorts, and unique VIP tickets for sporting occasions.

8. Amex Provides

American Categorical is understood for its presents that assist offset its bank cards’ annual charges. Fortuitously, with the Scotiabank Gold American Categorical® Card, you may simply participate in these presents since you may register for Amex Provides by a devoted portal.

Some examples of standard Amex Provides embrace a $60 assertion credit score upon spending $250 at Marriott-affiliated inns in Canada and the US, in addition to a $150 assertion credit score once you spend $750 with United Airways. In each these instances, the Amex Supply basically permits you to save as much as 20% on the related flights and lodge stays.

When you’re capable of reap the benefits of these Amex Provides and extra over the course of a yr, you’ll greater than offset the Scotiabank Gold American Categorical® Card’s modest $120 annual charge.

Conclusion

The Scotiabank Gold American Categorical® Card is a powerhouse for on a regular basis spending, at dwelling or overseas, particularly in case you eat out, purchase groceries, or journey even semi-regularly.

It’s uncommon to discover a card that mixes robust earn charges, no overseas transaction charges, and a low revenue requirement. Throw in a beneficiant welcome bonus, entry to Amex Provides, and useful perks like concierge service, and also you’ve received a card that actually pulls its weight.

When you’re after a versatile card that delivers nice worth with out including complexity, this one’s a stable decide on your pockets.