In recent times, “pay-over-time” installment plans have develop into more and more widespread within the Canadian bank card market. These merchandise permit clients who make giant purchases to arrange fee plans with mounted month-to-month charges, fairly than carrying a steadiness and being topic to their bank card’s common rate of interest.

Whereas we all the time suggest paying your bank card steadiness in full every month to keep away from curiosity fees, typically surprising bills go away you with a steadiness at month’s finish.

On this article, let’s take a more in-depth have a look at American Specific Canada’s pay-over-time providing – often known as Plan It – to grasp the way it works and whether or not or not it’s really a great deal in comparison with carrying a steadiness in your bank card.

What Is American Specific Plan It?

Probably the most widespread considerations that buyers have about bank cards is excessive rates of interest. With annual proportion charges (APRs) hovering round 20.99% for many Canadian bank cards, curiosity fees can shortly add up for many who spend greater than they will instantly afford to repay.

That is the place “pay-over-time” plans are available. These installment plans are designed to simplify funds for big purchases with mounted charges, as an alternative of creating customers take care of the customarily complicated calculations of bank card curiosity.

Many Canadian banks now provide customers “pay-over-time” merchandise, together with CIBC Tempo It, Scotiabank SelectPay, and American Specific Plan It, amongst others.

These merchandise cost both a set month-to-month installment price, a lowered APR, or some mixture of the 2 for patrons who wish to cut up funds for big purchases over time, fairly than carrying a steadiness ahead every month.

Amex Plan It stands out for its simplicity – it makes use of mounted month-to-month installment charges as an alternative of extra sophisticated APR calculations.

At present, Plan It’s obtainable on the next American Specific private and small enterprise playing cards:

It’s value noting that Plan It isn’t obtainable to cardholders in Quebec, Nova Scotia, Nunavut, or Prince Edward Island.

How Does American Specific Plan It Work?

To make use of Amex Plan It, you’ll be able to both make a qualifying buy of a minimum of $100 after which create a plan, or select to pay down a portion of your most up-to-date month-to-month assertion steadiness utilizing Plan It.

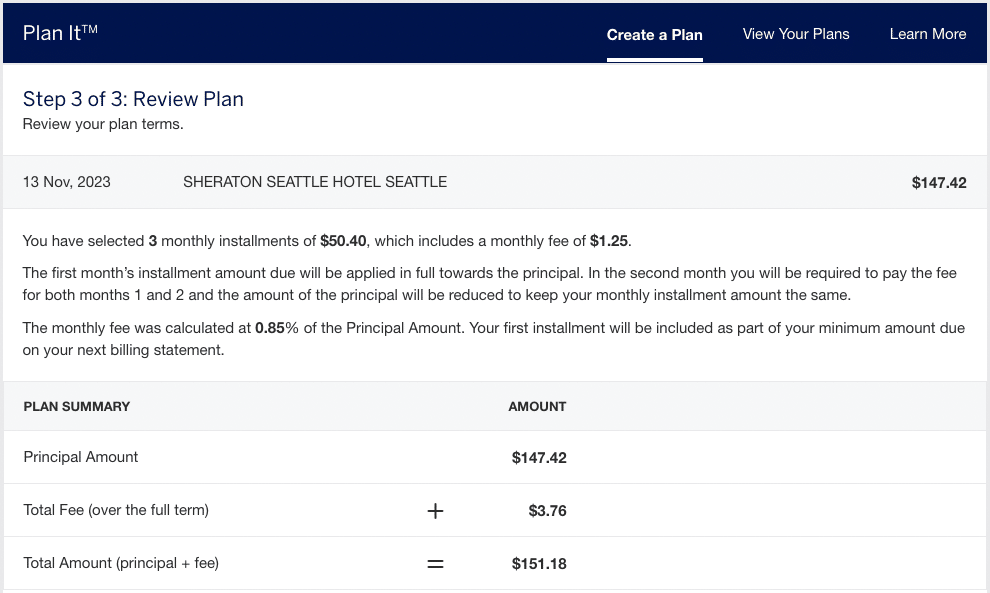

Organising a Plan It installment plan is a straightforward three-step course of.

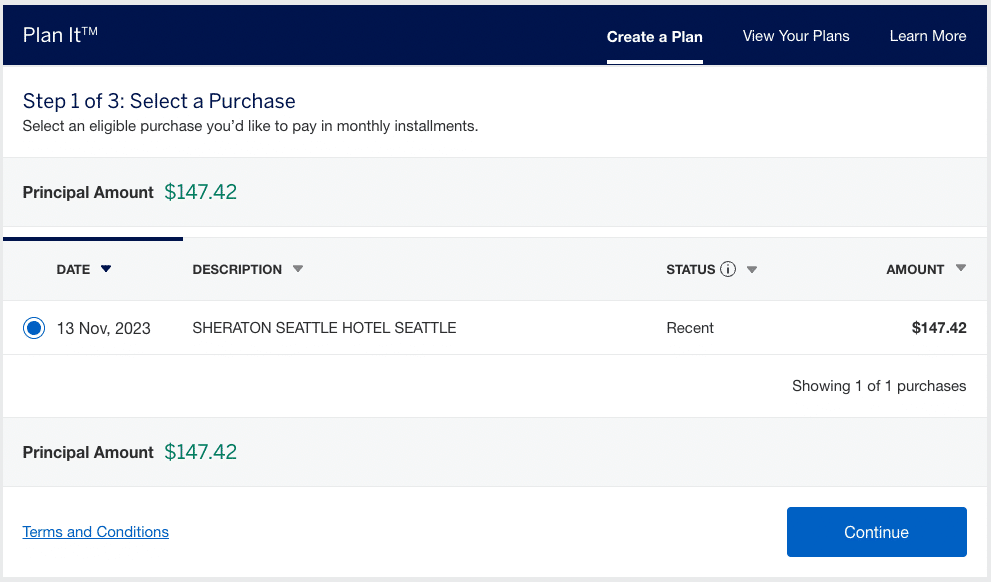

First, in your Plan It touchdown web page (accessible via your American Specific account), you’ll see a listing of eligible purchases for which you’ll create a plan. On this display screen, you’ll be able to choose a number of purchases, and the entire of the principal quantities might be displayed.

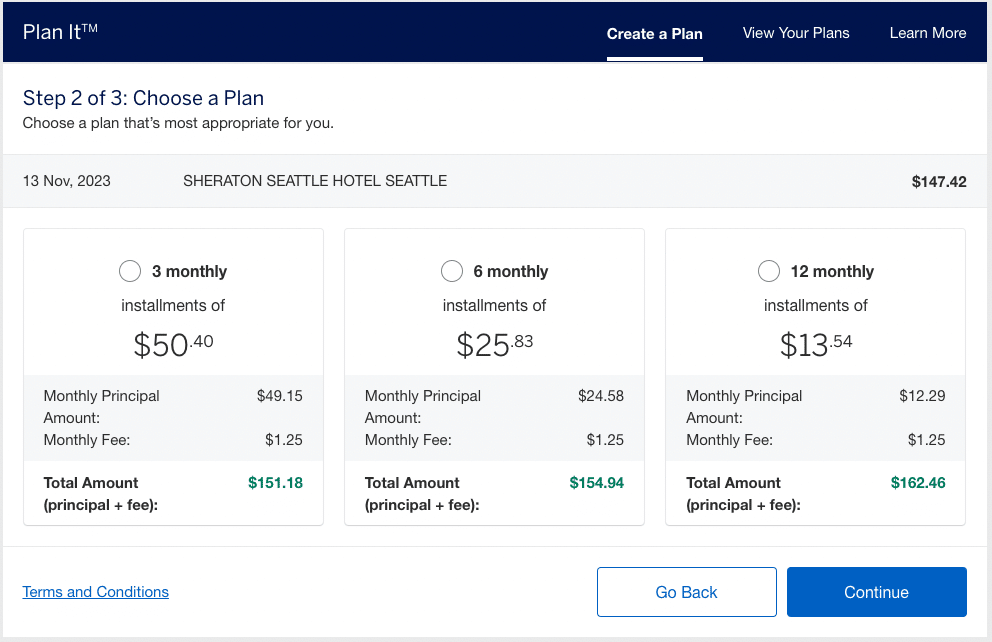

Subsequent, you’ll see three choices for Plan It installment plans. For every, you’ll see the month-to-month principal fee quantity, the month-to-month price, and the entire month-to-month fee (principal + price).

After choosing certainly one of these choices, you’ll be taken to a abstract web page that particulars what you’re signing your self up for. The phrases of your installment plan, together with the month-to-month price calculation and the entire quantity you’ll pay over the course of the plan, are displayed alongside this system’s phrases and circumstances.

If the whole lot appears good, click on “Submit,” and your Plan It installment plan might be arrange shortly.

As soon as your plan is established, the entire quantity might be deducted out of your obtainable credit score, the cost(s) included in your Plan It installment plans received’t accrue curiosity, and your month-to-month minimal funds will embody the agreed-upon quantity (principal + month-to-month price).

You have to make the minimal fee every month, or your installment plan might be cancelled and the fees will accrue curiosity as standard. In case you have pre-authorized funds arrange, the minimal fee (together with the Plan It principal + month-to-month price) might be mechanically deducted out of your account.

Is American Specific Plan It a Good Deal?

Earlier than we dive into whether or not Plan It’s worthwhile, let’s reiterate that the most effective monetary technique is to repay your bank card steadiness in full every month. This manner, you keep away from curiosity fees that successfully scale back the worth of any factors or rewards you earn out of your card.

Nonetheless, if you end up with surprising bills which you can’t repay instantly, it’s time to look any choices which will scale back the quantity you pay in curiosity.

When you’re enthusiastic about utilizing Plan It, perceive that it comes with a value, which is clearly proven throughout setup. The speed you’re charged will differ, so it’s essential to test the month-to-month price calculation fee every time to see the way it compares to your card’s annual rate of interest.

The month-to-month price could be as little as 0% throughout promotional durations, however usually ranges from 0.35–0.9% of the principal quantity.

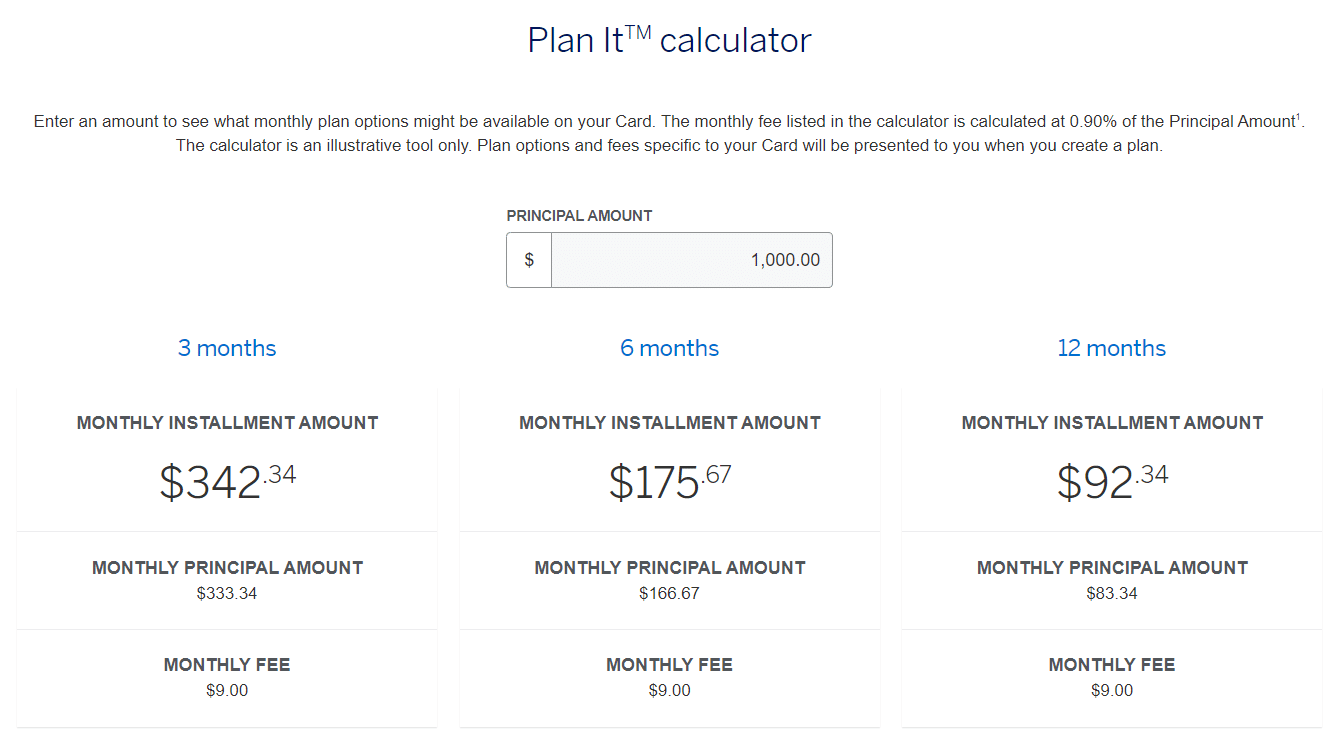

For instance, let’s have a look at a $1,000 (CAD) buy with a month-to-month price calculated at 0.9% of the principal.

You may be offered with three choices, every with a month-to-month price of $9 plus the principal quantity, divided into three, six, or twelve equal funds.

Relying on which plan you select, you’d pay completely different whole charges in comparison with paying off the acquisition instantly:

- Three months: $27 in charges

- Six months: $54 in charges

- Twelve months: $108 in charges

If as an alternative of utilizing Plan It, you carried a $1,000 steadiness in your bank card with an APR of 20.99% and paid it off in the identical time frames, you’d pay the next:

- Three months: $35.19 in curiosity

- Six months: $62.11 in curiosity

- Twelve months: $117.31 in curiosity

As you’ll be able to see, you’d save a small quantity by utilizing Plan It versus carrying a steadiness and paying it off over the identical interval on this instance. This additionally assumes you’re not making another purchases on the cardboard throughout this time.

When you obtain a suggestion with a decrease month-to-month installment price, the efficient APR in your Plan It provide decreases, probably saving you extra money in comparison with carrying a steadiness.

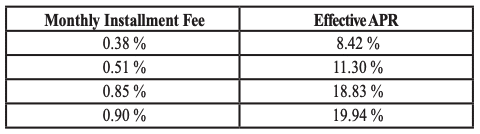

Within the phrases and circumstances of eligible American Specific playing cards, you’ll discover a desk exhibiting the efficient APR charges for various month-to-month installment price percentages.

As you’ll be able to see, a month-to-month installment price of 0.90% equals an efficient APR of 19.94%, whereas a price of 0.38% equals an efficient APR of simply 8.42%.

So if in case you have a decrease month-to-month installment price provide via Plan It (which could be as little as 0% throughout promotions), you possibly can save considerably in comparison with carrying a steadiness in your bank card and paying it off over the identical interval.

When you see Plan It as an possibility in your account, fastidiously overview the provide particulars to find out if it’s a great deal in your scenario.

If the efficient APR is increased than what you may get with a steadiness switch provide, a low-interest bank card, or a line of credit score, you’re higher off exploring these alternate options to reduce your curiosity prices.

When you’re not sure which possibility is greatest in your scenario, contemplate consulting a monetary skilled for customized recommendation.

Conclusion

Amex Plan It presents eligible cardholders the power to repay purchases over time for a hard and fast month-to-month price as an alternative of coping with common bank card rates of interest.

The product is kind of easy to make use of if in case you have an eligible American Specific Canada bank card and make a qualifying buy.

Nonetheless, earlier than leaping in, examine the charges in opposition to your card’s APR and another credit score choices you may need entry to. You possibly can probably get monetary savings via steadiness transfers, low-interest playing cards, or strains of credit score.