Few issues make journey really feel extra luxurious than escaping the crowds and enjoyable in an airport lounge. Whether or not it’s complimentary snacks, an open bar, or only a quiet seat away from screaming toddlers, lounge entry can take the sting off journey days.

In case you’re a Canadian trying to rating free airport lounge entry, you don’t want elite airline standing or a firstclass ticket—you simply want the correct bank card.

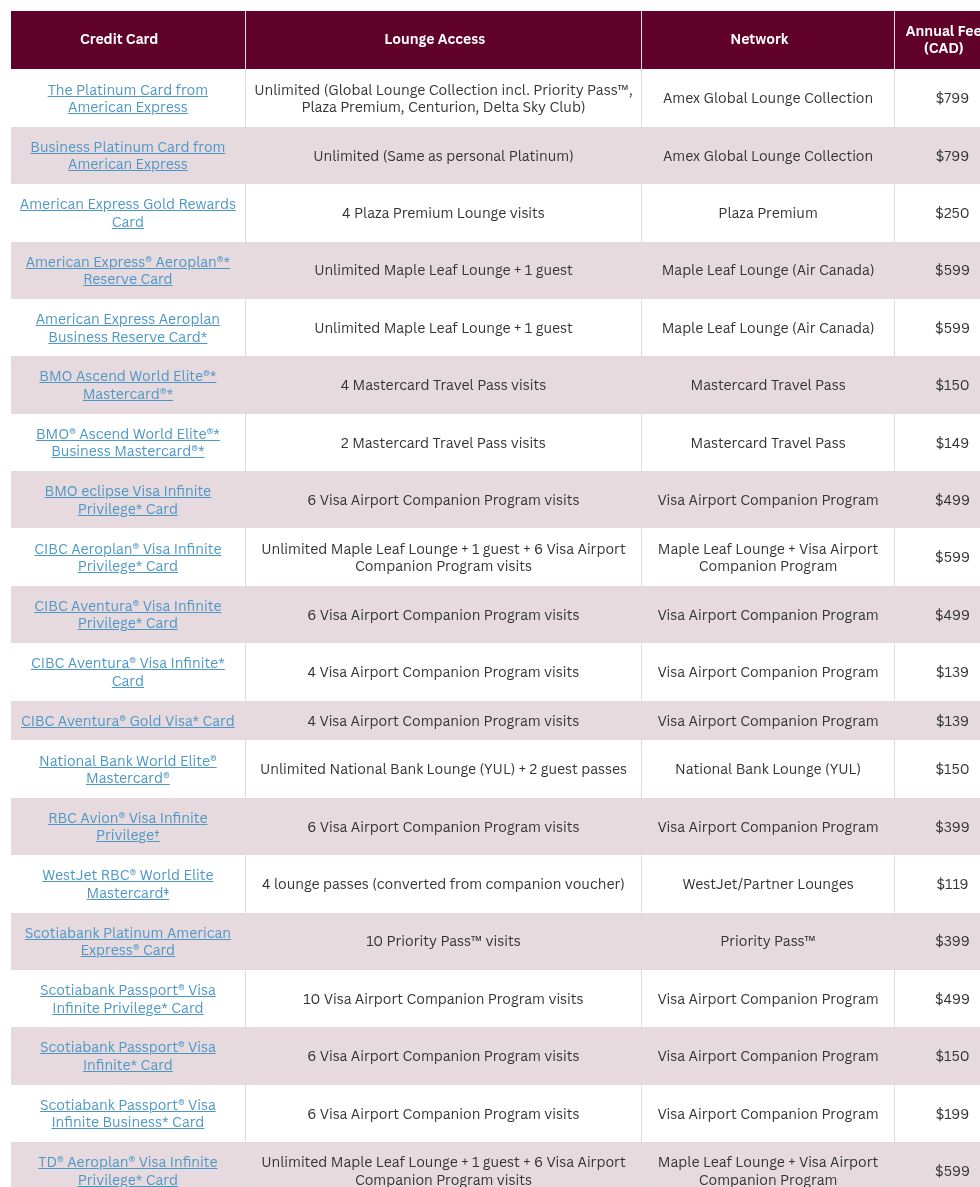

On this information, we break down all of the Canadian bank cards that supply complimentary lounge entry, together with the kind of entry, lounge networks, and what number of passes you get per yr.

All Canadian Credit score Playing cards with Lounge Entry — In a Nutshell

Understanding the Varieties of Airport Lounge Entry

There are 4 several types of lounge networks that include Canadian bank cards.

Relying in your bank card, you would possibly get entry to a worldwide lounge community like Precedence Move, or be restricted to airline-branded lounges. Right here’s a fast breakdown of the primary sorts:

Precedence Move

One of many largest unbiased airport lounge packages on the earth, with entry to over 1,300 lounges throughout 600+ cities. It contains a mixture of contract lounges globally and is particularly helpful when flying economic system or with non-alliance airways.

Visa Airport Companion Program (Powered by DragonPass)

Provided via Visa Infinite and Visa Infinite Privilege playing cards, this program makes use of the DragonPass lounge community, which incorporates many Plaza Premium areas in Canada and lounges around the globe. Some playing cards embody complimentary visits, whereas others require you to pay a reduced entry payment.

Mastercard Journey Move (by DragonPass)

Much like the Visa model however tied to World Elite Mastercard merchandise. Requires enrolment via Mastercard’s Journey Move portal.

Airline-Branded Lounges

These are operated instantly by airways equivalent to Air Canada, WestJet, Air France, and KLM. Entry is often tied to flying with that particular airline, typically on the identical day, and should include visitor privileges relying in your card.

Entry is often restricted to flights operated by the issuing airline (and generally solely when flying in a premium cabin or on a same-day ticket).

Premium Private Playing cards with Lounge Entry

The American Specific Platinum Card

Extensively thought-about essentially the most complete journey card in Canada, the American Specific Platinum Card affords limitless entry to over 1,300 lounges worldwide.

This contains Precedence Move (lounges solely, no eating places), Plaza Premium, Centurion Lounges, and Delta Sky Golf equipment when flying Delta.

Past lounge entry, it comes with a $200 annual journey credit score, a $200 eating credit score, Marriott Bonvoy Gold and Hilton Honors Gold standing, and top-tier journey insurance coverage.

The $799 annual payment isn’t low cost—however for frequent flyers who can take full benefit, it’s simply justifiable.

American Specific Platinum Card

- Earn 70,000 MR factors upon spending $10,000 within the first three months

- Plus, earn 30,000 MR factors upon making a purchase order in months 14–17 as a cardholder

- Earn 2x MR factors on all eating and journey purchases

- Obtain an annual $200 journey credit score

- Obtain an annual $200 eating credit score

- Switch MR factors to Aeroplan and different frequent flyer packages for premium flights

- Limitless airport lounge entry for you and one visitor at Precedence Move, Plaza Premium, Centurion, and different lounges

- Credit and rebates for every day bills all year long with Amex Presents

- Bonus MR factors for referring household and buddies

- Annual payment: $799

Scotiabank Platinum American Specific® Card

The Scotiabank Platinum American Specific® Card features a Precedence Move membership with 10 complimentary lounge visits per yr for the first cardholder, and 4 for a supplementary cardholder. That’s a beneficiant lounge profit for a card at this value level—particularly for those who worth the widespread availability of Precedence Move lounges.

You’ll earn 4 Scene+ factors per greenback spent† on motels, automobile leases, and experiences booked via Scene+ Journey, and a flat 2 Scene+ factors per greenback spent on all different purchases†. Whereas it doesn’t provide the identical excessive class bonuses because the Scotiabank Gold American Specific® Card, its constant 2x earn fee nonetheless outpaces the bottom earn charges on many different premium playing cards.

Extra perks embody no overseas transaction charges, which is a significant win for worldwide travellers, and entry to Amex Presents, which give common assertion credit or bonus factors at standard retailers. With a $399 annual payment, this card delivers wonderful worth via a mixture of lounge entry, versatile rewards, and travel-friendly advantages.

Scotiabank Platinum American Specific® Card

- Earn 60,000 Scene+ factors upon spending $3,000 within the first three months

- Earn an extra 20,000 Scene+ factors upon spending $10,000 within the first 14 months

- Plus, earn 2x Scene+ factors on all purchases

- Precedence Move membership with 10 free lounge visits per yr

- Benefit from the unique advantages of being an American Specific cardholder

- Annual payment: $399

Scotiabank Passport® Visa Infinite Privilege* Card

The Scotiabank Passport® Visa Infinite Privilege* Card affords 10 complimentary lounge visits yearly through the Visa Airport Companion Program, together with no overseas transaction charges—making it particularly enticing for worldwide travellers.

You’ll earn 3 Scene+ factors per greenback spent on journey†—together with flights, motels, and transit—and an additional 3 factors per greenback whenever you e-book via Scene+ Journey.†

Whereas the earn charges exterior of journey classes are modest, the mix of FX financial savings, lounge entry, and robust insurance coverage makes this a really well-rounded premium possibility.

Scotiabank Passport® Visa Infinite Privilege* Card

- Earn 30,000 Scene+ factors upon spending $3,000 within the first three months

- Plus, earn an extra 30,000 Scene+ factors upon spending $20,000 within the first six months

- And, earn an extra 20,000 Scene+ factors whenever you make at the very least one eligible buy throughout the 14th month of account opening

- Earn 3x Scene+ factors on eligible journey purchases

- Earn 2x Scene+ factors on eating and leisure purchases

- Visa Airport Companion membership with 10 free lounge visits per yr

- $250 annual journey credit score

- Redeem factors for an announcement credit score in opposition to any journey expense

- Minimal earnings: $150,000 private or $200,000 family

- Annual payment: $599

CIBC Aventura® Visa Infinite Privilege* Card

This premium CIBC Aventura® Visa Infinite Privilege* Card contains six complimentary lounge visits per yr via the Visa Airport Companion Program. Whereas not limitless, it covers most informal or average journey wants.

You’ll additionally take pleasure in robust journey insurance coverage, airport perks, and versatile Aventura Factors.

CIBC Aventura® Visa Infinite* Card

- Earn 15,000 CIBC Aventura Factors after making your first buy†

- Earn 30,000 CIBC Aventura Factors after spending $3,000 within the first 4 month-to-month assertion intervals†

- Earn 2x CIBC Aventura Factors on all purchases via the CIBC Rewards Centre†

- Earn 1.5x CIBC Aventura Factors on eligible fuel, groceries, EV charging, and drugstore purchases†

- 12-month Skip+ free trial and different unique advantages whenever you hyperlink your CIBC Aventura® Visa Infinite* Card with Skip†

- 4 complimentary lounge visits per yr with the Visa Airport Companion Program†

- Partial NEXUS utility payment credit score†

- Minimal earnings: $60,000 private or $100,000 family†

- Annual payment: $139 (rebated for the primary yr)†

RBC Avion® Visa Infinite Privilege†

You’ll get 6 complimentary lounge visits per yr via the Visa Airport Companion Program with the RBC Avion® Visa Infinite Privilege†, making this a stable premium card for infrequent lounge use.

What units this card aside is its affiliation with the RBC Avion program—the one Canadian financial institution rewards program apart from Amex that means that you can switch factors to airline companions.

You may transfer Avion factors to packages like American Airways AAdvantage, British Airways Government Membership, and Cathay Pacific Asia Miles, making it a wonderful selection for those who’re into reserving premium cabins with factors.

With robust insurance coverage, Visa Infinite Privilege perks, and first rate journey earn charges, it’s a dependable journey companion—particularly for those who’re already banking with RBC.

RBC® Avion Visa Infinite Privilege†

- Earn as much as 35,000 Avion factors upon approval†

- Then, earn 15,000 Avion factors upon spending $5,000 within the first six months†

- Then, earn 20,000 Avion factors as a one-time anniversary bonus upon renewal†

- Plus, earn 1.25x RBC Avion factors† on all qualifying purchases

- Use your rewards for any enterprise class flight with no restrictions on dates, seats, or airways†

- Switch factors to one in all 4 airline companions†

- DragonPass membership with six free lounge visits per yr†

- Minimal earnings: $200,000 private or family†

- Annual payment: $399†

BMO eclipse Visa Infinite Privilege* Card

The BMO eclipse Visa Infinite Privilege* Card contains six complimentary lounge visits per yr via the Visa Airport Companion Program powered by DragonPass.

Whereas it doesn’t provide limitless entry, it’s on par with different Visa Infinite Privilege playing cards and contains the choice to convey visitors.

The place this card actually stands out is its 5x earn fee on eating, groceries, fuel, journey—and drugstore purchases, making it the highest-earning Canadian card for Buyers Drug Mart and Rexall spenders.

It additionally comes with a really versatile $200 annual way of life credit score† to assist offset the $499 annual payment.†

In case you worth lounge entry and wish to maximize rewards on on a regular basis purchases, this is a wonderful all-rounder within the premium area.

BMO eclipse Visa Infinite Privilege* Card

- Earn 50,000 BMO Rewards factors upon spending $6,000 within the first three months

- Plus, earn 30,000 BMO Rewards factors upon spending $30,000 within the first six months

- Plus, earn one other 40,000 BMO Rewards factors upon spending $75,000 within the first yr

- And, earn 5x BMO Rewards factors on groceries, eating, fuel, drugstores, and journey purchases

- Plus, obtain a $200 way of life credit score whenever you attain your first yr anniversary

- Dragon Move membership with six free lounge visits per yr

- Minimal earnings: $150,000 private or $200,000 family

- Annual payment: $599

Mid-Tier Playing cards with Lounge Entry

Scotiabank Passport® Visa Infinite* Card

The Scotiabank Passport® Visa Infinite* Card has lengthy been among the best mid-tier journey playing cards in Canada, providing six complimentary lounge visits per yr via the Visa Airport Companion Program.

It additionally stands out for having no overseas transaction charges, which may prevent 2.5% on each buy made in a overseas forex.

You’ll earn Scene+ factors, with a 2x incomes fee on groceries, eating, leisure, and transit globally,† and 1x on every thing else.†

The cardboard’s $150 annual payment is usually waived within the first yr, making it a fantastic start line for travellers trying to dip their toes into lounge entry with out leaping to premium playing cards.

Scotiabank Passport® Visa Infinite* Card

- Earn 30,000 Scene+ factors upon spending $2,000 within the first three months

- Earn an extra 10,000 Scene+ factors upon spending $40,000 within the first yr

- Earn 2x Scene+ factors on groceries, eating, leisure, and transit

- Plus, earn 3x Scene+ factors on grocery purchases at Sobeys, IGA, Safeway, and FreshCo

- Visa Airport Companion membership with six free lounge visits per yr

- Redeem factors for assertion credit score for any journey expense

- Minimal earnings: $60,000 private or $100,000 family

- Annual payment: $150

Nationwide Financial institution® World Elite® Mastercard®

The Nationwide Financial institution® World Elite® Mastercard® affords limitless entry to the Nationwide Financial institution Lounge at Montréal-Trudeau (YUL) for your self, plus two visitor passes per yr. Whereas it doesn’t embody DragonPass visits, it’s superb for Quebec-based travellers who frequent Montreal’s airport.

One standout characteristic is its versatile journey insurance coverage, which incorporates award journey, because you solely have to cost a portion of your journey (equivalent to taxes and charges) to the cardboard for protection to kick in. That’s uncommon, even amongst premium playing cards, and provides additional peace of thoughts when redeeming factors for flights.

Nationwide Financial institution® World Elite® Mastercard®

- Earn 5x À la carte Rewards factors on grocery and restaurant spend†

- Get journey insurance coverage on award journey, in addition to medical protection on longer journeys for ages as much as 75†

- Obtain $150 in annual credit for airport parking, baggage charges, seat choice charges, lounge entry, and airline ticket upgrades†

- Minimal earnings: $80,000 private or $150,000 family

- Annual payment: $150

CIBC Aventura® Visa Infinite* Card

The CIBC Aventura® Visa Infinite* Card contains 4 complimentary visits per yr via the Visa Airport Companion Program, powered by DragonPass.

You’ll earn Aventura Factors in your every day spending, which could be redeemed via CIBC’s journey portal or for assertion credit, flights, and trip packages.

CIBC Aventura® Visa Infinite* Card

- Earn 15,000 CIBC Aventura Factors after making your first buy†

- Earn 30,000 CIBC Aventura Factors after spending $3,000 within the first 4 month-to-month assertion intervals†

- Earn 2x CIBC Aventura Factors on all purchases via the CIBC Rewards Centre†

- Earn 1.5x CIBC Aventura Factors on eligible fuel, groceries, EV charging, and drugstore purchases†

- 12-month Skip+ free trial and different unique advantages whenever you hyperlink your CIBC Aventura® Visa Infinite* Card with Skip†

- 4 complimentary lounge visits per yr with the Visa Airport Companion Program†

- Partial NEXUS utility payment credit score†

- Minimal earnings: $60,000 private or $100,000 family†

- Annual payment: $139 (rebated for the primary yr)†

CIBC Aventura® Gold Visa* Card

The CIBC Aventura® Gold Visa* Card affords 4 complimentary lounge visits per yr via the Visa Airport Companion Program, powered by DragonPass—similar to its Visa Infinite sibling.

It earns Aventura Factors that may be redeemed via CIBC’s journey portal or for assertion credit, flights, and extra.

What makes this card stand out is its low earnings requirement: you solely want a minimal family earnings of $15,000, making it essentially the most accessible Visa card in Canada that gives lounge entry.

It’s a fantastic entry level for newcomers to journey rewards or those that don’t meet the upper earnings thresholds of Infinite playing cards.

CIBC Aventura® Gold Visa* Card

- Earn 15,000 CIBC Aventura Factors after making your first buy†

- Earn 30,000 CIBC Aventura Factors after spending $3,000 within the first 4 month-to-month assertion intervals†

- Earn 2x CIBC Aventura Factors on all eligible purchases via the CIBC Rewards Centre†

- Earn 1.5x CIBC Aventura Factors on eligible fuel, groceries, and drugstore purchases†

- 4 complimentary lounge visits per yr with the Visa Airport Companion Program†

- Partial NEXUS utility payment credit score†

- 12-month Skip+ free trial and different unique advantages whenever you hyperlink your CIBC Aventura® Gold Visa* Card with Skip†

- Minimal earnings: $15,000 family†

- Annual payment: $139 (rebated for the primary yr)†

TD First Class Journey® Visa Infinite* Card

The TD First Class Journey® Visa Infinite* Card will start providing 4 complimentary lounge visits via the Visa Airport Companion Program beginning April 30, 2025.

Till then, it’s not a lounge card—nevertheless it earns TD Rewards factors and affords versatile redemptions via Expedia for TD or as an announcement credit score.

In case you already maintain this card or wish to get one now, it’s value figuring out that lounge entry is on the horizon—making it a stronger contender within the close to future.

TD First Class Journey® Visa Infinite* Card

- Earn 20,000 TD Rewards Factors upon making your first buy†

- Earn 115,000 TD Rewards Factors upon spending $5,000 inside 180 days of account opening†

- Plus, earn as much as 10,000 TD Rewards Factors again in your birthday†

- Plus, earn 8x TD Rewards Factors† on eligible journey purchases whenever you e-book via Expedia® for TD†

- Get an annual TD Journey Credit score† of $100 whenever you e-book via Expedia® for TD†

- Use your rewards for any journey bookings out there on Expedia® for TD†

- Minimal earnings: $60,000 private or $100,000 family

- Annual payment: $139, rebated for the primary yr†

- Utility should be accredited on or after January 7, 2025 to obtain this provide

BMO Ascend World Elite®* Mastercard®*

The BMO Ascend World Elite®* Mastercard®* affords 4 complimentary visits per yr via Mastercard Journey Move by DragonPass, which is sufficient for a couple of round-trips with lounge entry. Visitor entry is allowed however makes use of up your go to allotment.

You’ll earn BMO Rewards factors and get complete journey insurance coverage, together with emergency medical protection, flight delay, and misplaced baggage safety.

For individuals who desire a Mastercard possibility with robust insurance coverage and a few lounge perks, this card delivers.

BMO Ascend World Elite®* Mastercard®*

- Earn 45,000 BMO Rewards factors upon spending $4,500 within the first three months

- Then, earn 3,750 BMO Rewards factors upon spending $2,500 in every of months 4–15

- Plus, get a DragonPass membership with 4 lounge passes per yr

- Annual payment waived in your first anniversary for major cardholders and approved customers.

Airline Co-Branded Playing cards with Lounge Entry

American Specific Aeroplan Reserve Card

With the American Specific Aeroplan Reserve Card card, you’ll get limitless entry to Maple Leaf Lounges and Air Canada Cafés when flying on Air Canada, however with the added flavour of Amex-exclusive perks.

This premium Aeroplan card provides you limitless entry to Maple Leaf Lounges and Air Canada Café when flying on a same-day Air Canada ticket, and it contains complimentary entry for one visitor as effectively.

You’ll additionally take pleasure in premium airport perks like precedence check-in, boarding, and a free first checked bag.

It affords an industry-leading incomes fee of 3 Aeroplan factors per greenback spent on Air Canada purchases, making it the highest-earning Aeroplan co-branded card when reserving instantly with the airline.

You’ll additionally get most popular pricing on Aeroplan flight rewards, which helps stretch your factors even additional.

In case you’re loyal to Air Canada and wish robust earn charges, elite-style perks, and constant lounge entry for you and a journey companion, this card is a prime contender.

American Specific Aeroplan Reserve Card

- Earn 60,000 Aeroplan factors upon spending $7,500 within the first three months

- Plus, earn 25,000 Aeroplan factors upon spending $2,500 in month 13

- All the time earn 3x Aeroplan factors on Air Canada purchases

- Aeroplan most popular pricing, free checked bag, precedence check-in and boarding on Air Canada flights

- Limitless Air Canada Maple Leaf Lounge entry in North America

- Bonus Aeroplan factors for referring household and buddies

- No minimal earnings requirement

- Annual payment: $599

TD® Aeroplan® Visa Infinite Privilege* Card

The premium TD® Aeroplan® Visa Infinite Privilege* Card provides you limitless entry to Air Canada Maple Leaf Lounges and Air Canada Café areas inside North America when flying on a same-day Air Canada ticket.†

It additionally contains complimentary entry for one visitor,† making it superb for {couples} or companions who journey collectively.

You’ll additionally get six complimentary lounge visits per yr via the Visa Airport Companion Program,† which could be helpful when flying with non-Star Alliance airways.

On prime of lounge entry, you’ll take pleasure in precedence check-in, boarding, and baggage dealing with on Air Canada flights, plus a free first checked bag for you and as much as eight companions on the identical reserving.†

In case you’re loyal to Air Canada and wish an elite-like expertise constructed into your bank card, this one delivers.

TD® Aeroplan® Visa Infinite Privilege* Card

- Earn 20,000 Aeroplan factors† upon first buy

- Plus, earn an extra 35,000 Aeroplan factors† upon spending $12,000 within the first 180 days

- Plus, earn a one-time anniversary bonus of 30,000 Aeroplan factors† upon spending $24,000 inside 12 months of account opening†

- Earn 2x Aeroplan factors† on eligible Air Canada® purchases, together with Air Canada Holidays®†

- Earn 1.5x Aeroplan factors† on eligible fuel, groceries, eating, meals supply, and different journey purchases†

- Aeroplan most popular pricing, free checked bag, precedence check-in and boarding on Air Canada flights†

- Limitless Air Canada Maple Leaf Lounge† entry

- Visa Airport Companion Program membership with six free lounge visits per yr

- Minimal earnings: $150,000 private or $200,000 family

- Annual payment: $599

- Supply out there for functions accredited on or after January 7, 2025.

CIBC Aeroplan® Visa Infinite Privilege* Card

Functionally similar to the TD model, the CIBC Aeroplan® Visa Infinite Privilege* Card gives limitless entry to Maple Leaf Lounges and Air Canada Cafés, together with complimentary entry for one visitor, so long as you’re flying with Air Canada that day

You’ll additionally get six complimentary lounge visits per yr via the Visa Airport Companion Program.

With all the identical journey perks because the TD card—precedence providers, free checked luggage, robust insurance coverage—this one comes down to non-public desire.

In case you financial institution with CIBC or choose their platform, that is your go-to Aeroplan premium card.

CIBC Aeroplan® Visa Infinite Privilege* Card

- Earn 20,000 Aeroplan factors upon first buy†

- Earn 30,000 Aeroplan factors upon spending $15,000 within the first six months†

- Plus, earn an anniversary bonus of 35,000 Aeroplan factors upon renewing the cardboard for a second yr, after having spent at the very least $25,000 within the first yr†

- Earn 2x Aeroplan factors on Air Canada purchases†

- Earn 1.5x Aeroplan factors on fuel, groceries, eating, meals supply, electrical car charging, and different journey purchases†

- Aeroplan most popular pricing, free checked bag, precedence check-in and boarding on Air Canada flights†

- Limitless Air Canada Maple Leaf Lounge entry†

- Visa Airport Companion Program membership with six free lounge visits per yr†

- NEXUS utility credit score†

- Minimal earnings: $150,000 private or $200,000 family

- Annual payment: $599

WestJet RBC® World Elite Mastercard‡

Whereas the WestJet RBC® World Elite Mastercard‡ doesn’t provide lounge entry by default, this card provides you the choice to transform your annual WestJet companion voucher into 4 lounge passes.

These can be utilized at WestJet’s Elevation Lounge in Calgary or at choose associate lounges around the globe.

The cardboard additionally affords free checked luggage on WestJet flights, journey insurance coverage, and earns WestJet {dollars} (quickly to be factors) that may be utilized on to base fares. In case you’re loyal to WestJet and fly via Calgary (YYC) typically, this card is a pure match.

WestJet RBC® World Elite Mastercardǂ

- Earn 250 WestJet {dollars} upon making your first buy†

- Earn 200 WestJet {dollars} upon spending $5,000 within the first three months†

- Plus, obtain an annual companion voucher for discounted journey on WestJet flights, with a co-pay beginning at $119 plus taxes and charges†

- Minimal earnings: $80,000 private or $150,000 family

- Annual payment: $119

Enterprise Credit score Playing cards with Lounge Entry

Enterprise Platinum Card from American Specific

The Enterprise Platinum Card from American Specific affords the identical limitless world lounge entry as the private Platinum Card, making it equally priceless for journey—however with added advantages tailor-made to enterprise house owners.

You’ll earn elevated factors on business-related classes and benefit from the flexibility of Amex Membership Rewards.

Whether or not you’re flying for work or combining enterprise with leisure, this card delivers robust journey worth—plus, you would possibly be capable to expense the payment.

Enterprise Platinum Card from American Specific

- Earn 90,000 MR factors upon spending $15,000 within the first three months

- Plus, earn 40,000 MR factors upon making a purchase order in months 14–17 as a cardholder

- And, earn 1.25x MR factors on all purchases

- Additionally, obtain a $200 annual journey credit score

- Switch MR factors to Aeroplan and different frequent flyer packages for premium flights

- Limitless airport lounge entry for you and one visitor at Precedence Move, Plaza Premium, Centurion, and different lounges

- Credit and rebates for enterprise bills all year long with Amex Presents

- Bonus MR factors for referring household and buddies

- Qualify for the cardboard as a sole proprietor

- Annual payment: $799

American Specific Aeroplan Enterprise Reserve Card

The American Specific Aeroplan Enterprise Reserve Card affords limitless entry to Maple Leaf Lounges and Air Canada Cafés when flying on a same-day Air Canada ticket—plus one complimentary visitor.

It additionally earns 3 Aeroplan factors per greenback spent on Air Canada purchases and contains most popular pricing on Aeroplan flight rewards.

Enterprise house owners will respect added perks like worker card controls and enhanced reporting.

In case you personal a enterprise and often fly with Air Canada, this card affords a powerful mixture of lounge entry, excessive earn potential, and journey perks underneath one roof.

American Specific Aeroplan Enterprise Reserve Card

- Earn 65,000 Aeroplan factors upon spending $10,500 within the first three months

- Plus, earn 25,000 Aeroplan factors upon spending $3,500 in month 13

- Additionally, earn 3x Aeroplan factors on Air Canada purchases

- Aeroplan most popular pricing, free checked bag, precedence check-in and boarding on Air Canada flights

- Limitless Air Canada Maple Leaf Lounge entry

- Bonus Aeroplan factors for referring household and buddies

- Qualify for the cardboard as a sole proprietor

- Annual payment: $599

Scotiabank Passport® Visa Infinite Enterprise* Card

The Scotiabank Passport® Visa Infinite Enterprise* Card affords six complimentary lounge visits per yr via the Visa Airport Companion Program.

It additionally carries the identical no overseas transaction charges profit, making it superb for entrepreneurs who journey internationally and wish to save on FX expenses.

The cardboard earns Scene+ factors and contains robust journey insurance coverage, buy safety, and entry to Visa Infinite Enterprise perks.

At a $199 annual payment, it’s a compelling mid-range possibility for enterprise house owners trying to take pleasure in a couple of premium perks.

Scotiabank Passport® Visa Infinite Enterprise* Card

- Earn 30,000 Scene+ factors upon spending $5,000 within the first three months

- Earn 10,000 Scene+ factors upon spending $60,000 within the first 12 months

- Plus, earn 1.5x Scene+ factors on all purchases

- Visa Airport Companion Program membership with six free lounge visits per yr

- No overseas transaction charges

- Qualify on the idea of your enterprise financials

- $199 annual payment

BMO® Ascend World Elite®* Enterprise Mastercard®*

With two lounge visits per yr through Mastercard Journey Move, the BMO® Ascend World Elite®* Enterprise Mastercard®* provides a layer of consolation to your enterprise journey—with no premium price ticket.

You’ll additionally earn BMO Rewards factors, which could be redeemed for journey or used to pay down your stability.

The $149 annual payment is comparatively low for a enterprise journey card, and it comes with first rate insurance coverage protection, together with flight delay, journey cancellation, and rental automobile safety.

A sensible choose for small enterprise house owners or freelancers who need occasional lounge entry on the go.

BMO® Ascend World Elite®* Enterprise Mastercard®*

- 20,000 BMO Rewards factors whenever you make your first buy

- Earn as much as 8,000 BMO Reward Factors per thirty days whenever you spend at the very least $3,000 per thirty days inside months 3 – 12

- Earn

1.54 factors per greenback spent on fuel, workplace provides, and telecommunications payments - Rise up to 7 cents off per litre on all Shell®± gas*

- Get 5 free digital healthcare visits per yr with Maple

- DragonPass membership with two free visits per yr

- Qualify for the cardboard with a registered enterprise and minimal private or enterprise earnings

- Annual payment: $0 for the primary yr, then $149

Honourable Mentions

American Specific Gold Rewards Card

Whereas it’s not a premium card, the Amex Gold Rewards Card quietly affords 4 complimentary Plaza Premium lounge visits per yr. That’s a uncommon perk and with no dependency on DragonPass or Precedence Move networks, entry is extra simple at main Canadian airports.

You’ll earn 2x Membership Rewards factors on journey, fuel, groceries, and eating places, and the factors could be transferred to airline and lodge companions. In case you’re on the lookout for a mid-range card that earns effectively and comes with a style of lounge luxurious, this is among the best-kept secrets and techniques in Amex Canada’s lineup.

American Specific Gold Rewards Card

- Earn 10,000 MR factors upon spending $4,000 within the first three months

- Plus, earn an extra 5,000 MR factors upon spending $1,000 in every of the primary 12 months, as much as 60,000 MR factors

- Additionally, obtain an annual $100 journey credit score and a $50 NEXUS credit score

- Switch MR factors to Aeroplan and different frequent flyer packages for premium flights

- Plaza Premium membership with 4 annual lounge passes

- Credit and rebates for every day bills all year long with Amex Presents

- Bonus MR factors for referring household and buddies

- Annual payment: $250

Conclusion

Lounge entry is among the most tangible methods to enhance your journey expertise—and the correct bank card can unlock it with out the necessity for elite standing or costly premium tickets.

Whether or not you’re a frequent flyer who needs limitless entry, or an occasional traveller who simply needs a quiet place to chill out earlier than a flight, there’s a Canadian bank card that matches your wants and price range.

From ultra-premium playing cards with limitless visits to mid-tier choices providing a couple of complimentary passes, this information has you coated with essentially the most up-to-date lineup of each card in the marketplace.

Select based mostly on how typically you journey, which airports you frequent, and which rewards program suits your way of life. And the subsequent time you’re caught with a delay or early check-in, at the very least you’ll have someplace higher to attend than a plastic seat by the gate.

† Phrases and situations apply. Please seek advice from the cardboard issuer’s web site for up-to-date data. Affordable efforts are made to make sure content material accuracy.