TD Canada Belief is certainly one of Canada’s largest and hottest banks, providing a variety of services and products by way of in-person and on-line banking.

On this information, we offer an outline of TD’s checking account and bank card portfolio, with hyperlinks to extra in-depth articles on particular merchandise and different key data.

Chequing and Financial savings Accounts

TD has 4 private chequing accounts and three private financial savings accounts, which we’ll go over on this part.

When contemplating which kind of account to open, it’s essential to consider your banking priorities and preferences, and the way you have a tendency to make use of and entry your account.

TD additionally usually has promotional affords while you join a selected account or a number of accounts collectively that may garner you a money bonus, increased rates of interest on financial savings, and different perks (e.g., merchandise).

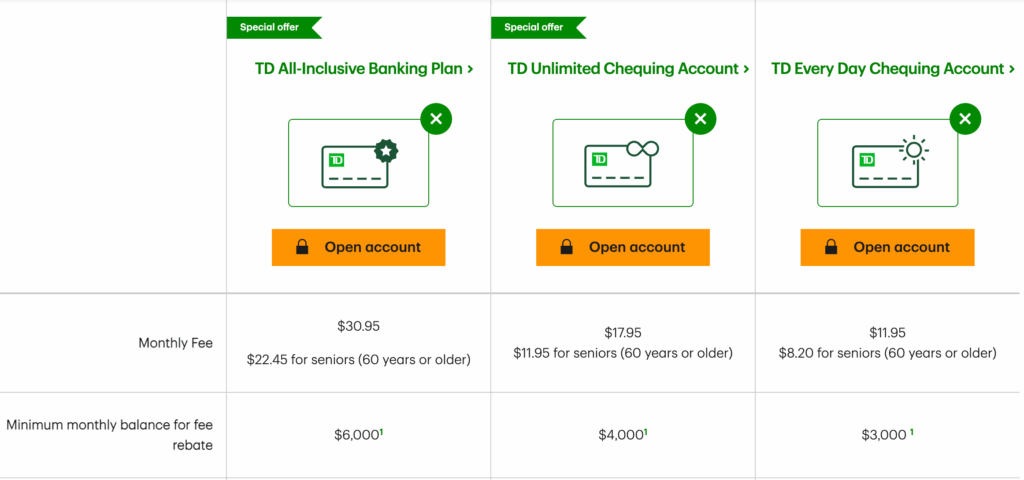

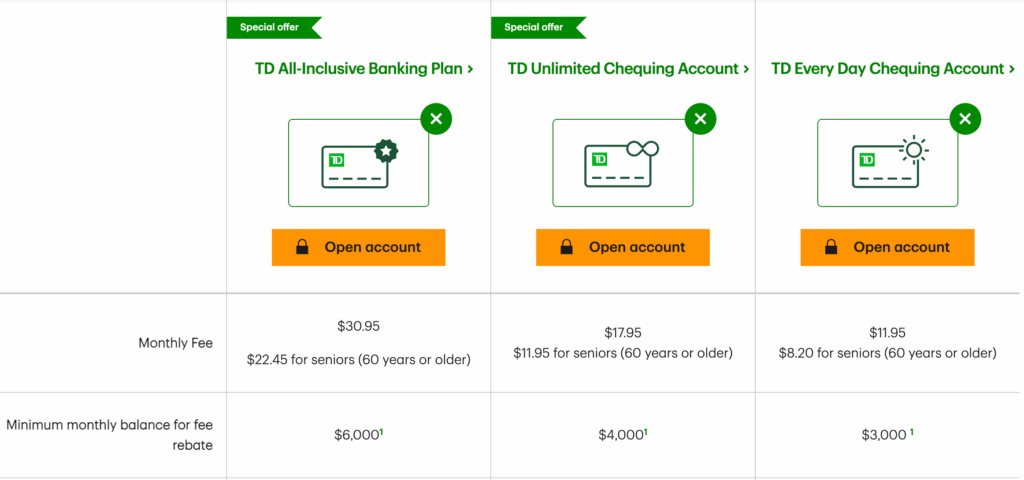

Chequing Accounts

Chequing accounts are one of the best day-to-day account as they have an inclination to supply extra month-to-month transactions and decrease charges in comparison with financial savings accounts. Plus, they usually include perks equivalent to free Interac e-transfers and rebates on bank card annual charges.

To be taught extra, let’s have a look the important thing traits of every of TD’s private chequing accounts from the best to essentially the most complete:

TD Minimal Chequing Account

- Month-to-month charge: $3.95 (waived for seniors receiving the Assured Revenue Complement (GIS) and for Registered Incapacity Financial savings Plan beneficiaries)

- Included transactions: 12 (extra transactions = $1.25/every)

- Interac e-transfers: $0.50/every (for transactions as much as $100) and $1/every (for transactions above $100)

- ATM charges: $2 for non-TD ATMs in Canada, $3 for overseas ATMs within the US and Mexico, and $5 for overseas ATMs in another nation

- Bank card annual charge rebate: None

- Finest for: People with minimal banking wants

TD Each Day Chequing Account

- Month-to-month charge: $11.95 (waived if a $3,000 account steadiness is maintained); $8.20 for seniors over the age of 60

- Included transactions: 25 (extra transactions = $1.25/every)

- Interac e-transfers: Free

- ATM charges: $2 for non-TD ATMs in Canada, $3 for overseas ATMs within the US and Mexico, and $5 for overseas ATMs in another nation

- Bank card annual charge rebate: None

- Finest for: People who make fewer than 25 transactions per thirty days

TD Limitless Chequing Account

- Month-to-month charge: $17.95 (waived if a $4,000 account steadiness is maintained); $11.95 for seniors over the age of 60

- Included transactions: Limitless

- Interac e-transfers: Free

- ATM charges: $0 for all ATMs in Canada, $3 for overseas ATMs within the US and Mexico, and $5 for overseas ATMs in another nation

- Bank card annual charge rebate: First yr annual charge rebate for an eligible TD bank card

- Finest for: People who need the liberty of limitless transactions and who can reap the benefits of the bank card charge rebate

TD All-Inclusive Banking Plan

- Month-to-month charge: $30.95 (waived if a $6,000 account steadiness is maintained); $22.45 for seniors over the age of 60

- Included transactions: Limitless

- Interac e-transfers: Free

- ATM charges: $0 for all ATMs globally

- Bank card annual charge rebate: : Yearly annual charge rebate for an eligible TD bank card

- Extra options: A small security deposit field (topic to availability) and free personalised cheques

- Finest For: People who usually use non-TD ATMs and those that can reap the benefits of the annual bank card charge rebate and the extra product perks

Financial savings Accounts

TD additionally affords three financial savings accounts for purchasers seeking to construct their financial savings whereas nonetheless having quick access to their funds.

Let’s discover these three accounts and what makes every one distinctive.

TD’s financial savings accounts all pay variable curiosity that’s calculated day by day and paid month-to-month. Charges change over time, and a few accounts have steadiness thresholds for incomes increased charges, so make sure to verify TD’s website for the newest numbers earlier than you apply.

TD Each Day Financial savings Account

- Month-to-month charge: $0

- Annual rate of interest: 0.010%

- Included transactions: One (extra transactions = $3/every)

- Transfers: Free to different TD deposit accounts

- ATM charges: $2 for non-TD ATMs in Canada, $3 for overseas ATMs within the US and Mexico, and $5 for overseas ATMs in another nation

- Finest For: People on the lookout for a easy place to start out saving

TD Excessive Curiosity Financial savings Account

- Month-to-month charge: $0

- Annual rate of interest relying in your day by day closing steadiness:

- $0–$4,999: 0.00%

- $5,000–$9,999: 0.50%

- $10,000–$99,999: 1.00%

- $100,000–$499,999: 1.30%

- $500,000 or extra: 1.50%

- Included transactions: Zero (transactions = $5/every, which is waived if a $25,000 account steadiness is maintained)

- Transfers: Free to different TD deposit accounts

- ATM charges: $2 for non-TD ATMs in Canada, $3 for overseas ATMs within the US and Mexico, and $5 for overseas ATMs in another nation

- Finest for: People on the lookout for an easy-to-access financial savings account

TD ePremium Financial savings Account

- Month-to-month charge: $0

- Annual rate of interest relying in your day by day closing steadiness:

- $0–$9,999: 0.000%

- $10,000 or extra: 0.550%

- Included transactions: Zero (transactions = $5/every)

- Transfers: Free to different TD deposit accounts

- ATM charges: $2 for non-TD ATMs in Canada, $3 for overseas ATMs within the US and Mexico, and $5 for overseas ATMs in another nation

- Finest For: People who can preserve an account steadiness of $10,000 or increased

Moreover, for people who’ve newly immigrated to Canada, TD has created a particular provide referred to as the TD New to Canada Banking Bundle.

This provide supplies a wide range of totally different monetary incentives while you open particular chequing and financial savings accounts, plus extra rewards-based incentives while you sign-up for a selected bank card.

Scholar Financial institution Accounts

TD affords one account particularly for youth (below the age of 23) and college students (of any age) who’re enrolled in full-time post-secondary schooling: the TD Scholar Chequing Account.

TD Scholar Chequing Account

- Month-to-month charge: $0

- Included transactions: Limitless

- Interac e-transfers: Free

- ATM charges: $2 for non-TD ATMs in Canada, $3 for overseas ATMs within the US and Mexico, and $5 for overseas ATMs in another nation

- Bank card annual charge rebate: None

- Finest for: People who’re below the age of 23 or who’re enrolled in a full-time post-secondary program

Moreover, TD has created a particular provide for younger college students who’re new to Canada: the Worldwide Scholar Banking Bundle.

Each the New to Canada Banking Bundle and the Worldwide Scholar Banking Bundle frequently include limited-time promos like money bonuses, present playing cards, and rebated TD World Switch charges. The precise combine modifications, so verify TD’s present particular affords web page earlier than you apply.

US Greenback Accounts

TD has two US greenback accounts obtainable: the US Every day Curiosity Chequing Account and the Borderless Account.

These accounts are perfect for individuals who have banking wants in each Canada and the US as they mean you can simply trade funds between the 2 nations at a aggressive charge.

The US Every day Curiosity Chequing Account has no month-to-month charge, making it a superb account if you end up often in want of banking entry within the US.

Comparatively, the Borderless Account has a month-to-month charge of $4.95 (USD) which is waived if the account steadiness is $3,000 (USD).

This account enjoys a most popular trade charge and supplies account holders with free US financial institution drafts and primary cheques. These options make it best for frequent travellers to the US.

Understand that these are Canadian-domiciled accounts, which suggests you gained’t be onboarded into the U.S. banking system. In different phrases, you gained’t get entry to ACH transfers or the flexibility to pay U.S. billers like a real U.S.-based account would enable.

TD Credit score Playing cards

TD affords its purchasers a variety of private bank cards that present the chance to earn money again, Aeroplan factors, and TD Rewards Factors.

Money Again Credit score Playing cards

TD affords two money again bank cards: the TD Money Again Visa Infinite* Card and the TD Money Again Visa* Card.

These bank cards are perfect for individuals who just like the simplicity of money again rewards, which can be utilized to pay down your account at any time with a minimal of $25.

For an entry-level card, the TD Money Again Visa* Card has no annual charge and earns 1% money again grocery, gasoline & electrical car charging, public transit, recurring invoice funds, and streaming, digital gaming & media purchases, and 0.5% on different purchases.†

- Earn $10 money again† on first buy along with your card†.

- Earn an extra $40 money again† while you spend $1,500 within the first 3 months of account opening†.

- Earn 1% money again†on eligible grocery, gasoline, electrical car charging, public transit, recurring invoice funds, streaming, digital gaming, and media purchases†

- Then, earn 0.5% money again† on all different eligible purchases†

- No minimal revenue requirement

- Annual charge: $0

Comparatively, the TD Money Again Visa Infinite* has an annual charge of $139 however affords 3% money again on grocery, gasoline & electrical car charging, public transit, recurring invoice funds, and streaming, digital gaming & media purchases, and 1% on every part else.†

TD Money Again Visa Infinite* Card

- Earn 10% money again† within the first three months, on as much as $3,500 spent on eligible groceries, gasoline, electrical car charging, public transit, recurring payments, streaming, digital gaming, and media purchases†

- Then, earn 3% money again† on eligible groceries, gasoline, electrical car charging, public transit, recurring invoice funds, streaming, digital gaming, and media†

- Free Deluxe TD Auto Membership Membership for roadside help†

- Minimal revenue: $60,000 private or $100,000 family

- Annual charge: $0 for the primary yr†, then $139

- Software have to be accredited on or after April 30, 2025 to obtain this provide

We’ve created particular person in-depth guides to each of those money again bank cards, the place you could find up-to-date affords and enrollment data – simply click on above to be taught extra.

Aeroplan Co-Branded Credit score Playing cards

For people seeking to earn factors with Canada’s hottest and highly effective airline loyalty program, TD affords three private bank cards that earn Aeroplan factors on on a regular basis spending.

The three playing cards are: the TD® Aeroplan® Visa Platinum* Card, TD® Aeroplan® Visa Infinite* Card, and the TD® Aeroplan® Visa Infinite Privilege* Card.

These playing cards are nice selections for Aeroplan members seeking to construct up their factors account steadiness to entry award flights, as every card comes with a welcome bonus and earns Aeroplan factors on on a regular basis spend.

The entry-level member of the TD Aeroplan co-branded card household is the TD Aeroplan Visa Platinum* Card. This card usually incorporates a beneficiant welcome bonus and comes with a number of Air Canada perks.

It is a nice card to think about when you have a extra modest revenue or need to hold prices down whereas nonetheless incomes factors in direction of journey.

TD® Aeroplan® Visa Platinum* Card

- Earn 10,000 Aeroplan factors† upon first buy†

- Plus, earn 5,000 Aeroplan factors† upon spending $1,000 within the first three months

- Earn 1x Aeroplan factors† on eligible gasoline, electrical car charging, groceries, and Air Canada® purchases, together with Air Canada Holidays®†

- Most well-liked pricing on Air Canada® flights by way of Aeroplan†

- Annual charge: $89, rebated within the first yr†

- Provide obtainable for functions accredited on or after September 4, 2025.

The TD® Aeroplan® Visa Infinite* Card is the following degree up in TD’s Aeroplan bank card household.

Very similar to its Platinum counterpart, this card usually comes with a pleasant welcome bonus, and it additionally affords cardholders one free checked bag on Air Canada flights and a charge rebate to your NEXUS utility.†

This card is an efficient alternative for people who journey usually and may reap the benefits of the associated perks.

TD® Aeroplan® Visa Infinite* Card

- Earn 10,000 Aeroplan factors† upon first buy†

- Plus, earn 15,000 Aeroplan factors† upon spending $7,500 within the first 180 days of account opening†

- Plus, earn an extra 20,000 Aeroplan factors† on renewal while you spend $12,000 inside 12 months of account opening†

- Earn 1.5x Aeroplan factors† on eligible gasoline, groceries, and Air Canada® purchases, together with Air Canada Holidays®†

- Most well-liked Aeroplan pricing and free checked bag on Air Canada® flights†

- Minimal revenue: $60,000 private or $100,000 family

- Annual charge: $139 (rebated for the primary yr)

- Provide obtainable for functions accredited on or after September 4, 2025.

The third card within the TD Aeroplan household is the TD® Aeroplan® Visa Infinite Privilege* Card. Of TD’s three Aeroplan bank cards, this one will include the best welcome bonus and essentially the most priceless perks.

This card is good for people who don’t thoughts paying the excessive annual charge and for Air Canada frequent flyers who can maximize the utility of the related journey advantages, together with eUpgrade rollover and limitless Maple Leaf Lounge entry.

TD® Aeroplan® Visa Infinite Privilege* Card

- Earn 20,000 Aeroplan factors† upon first buy

- Plus, earn an extra 35,000 Aeroplan factors† upon spending $12,000 within the first 180 days

- Plus, earn a one-time anniversary bonus of 30,000 Aeroplan factors† upon spending $24,000 inside 12 months of account opening†

- Earn 2x Aeroplan factors† on eligible Air Canada® purchases, together with Air Canada Holidays®†

- Earn 1.5x Aeroplan factors† on eligible gasoline, electrical car charging, groceries, eating, journey, and transit purchases†

- Aeroplan most popular pricing, free checked bag, precedence check-in and boarding on Air Canada flights†

- Limitless Air Canada Maple Leaf Lounge† entry

- Visa Airport Companion Program membership with six free lounge visits per yr

- $100 partial rebate for the NEXUS utility charge each 48 months†

- Minimal revenue: $150,000 private or $200,000 family

- Annual charge: $599

- Provide obtainable for functions accredited on or after September 4, 2025.

Try our in-depth guides for these three Aeroplan playing cards to study up-to-date affords and enrollment data – simply click on the cardboard names above.

TD Rewards Credit score Playing cards

TD affords three bank cards that earn TD Rewards Factors on on a regular basis spending. TD Rewards is the financial institution’s personal rewards program, permitting purchasers to earn factors that can be utilized for journey, assertion credit, and present playing cards.

The three TD Rewards playing cards are the TD Rewards Visa* Card, the TD Platinum Journey Visa* Card, and the TD First Class Journey® Visa Infinite* Card.

TD Rewards Factors are significantly priceless when redeemed for journey booked by way of Expedia® for TD, the financial institution’s on-line journey portal operated in partnership with Expedia®.

The TD Rewards Visa* Card is that this bank card household’s entry-level providing and affords the chance to earn TD Rewards Factors on on a regular basis purchases with zero annual charge.†

It is a nice card for people who’re on the lookout for an easy, low-cost card that lets them earn in direction of versatile future journey.

- Earn 15,152 TD Rewards Factors while you spend $500 inside 90 days of Account opening+†

- Plus, earn 4x TD Rewards Factors† on eligible journey purchases while you e-book by way of Expedia® for TD†

- Use your rewards for any journey bookings obtainable on Expedia® for TD†

- Annual charge: $0

- Software have to be accredited on or after January 7, 2025 to obtain this provide

The TD Platinum Journey Visa* Card is the mid-level card of the TD Rewards bank card household, and new cardholders normally have the chance to earn a welcome bonus within the first few months of card membership.

This card additionally affords elevated TD Rewards Factors incomes charges, making it a superb card for people seeking to construct up their factors steadiness quicker.

TD Platinum Journey Visa* Card

- Earn 15,000 TD Rewards Factors upon first buy†

- Earn 35,000 TD Rewards Factors upon spending $1,000 within the first 90 days†

- Plus, earn 6x TD Rewards Factors† on eligible journey purchases while you e-book by way of Expedia® for TD†

- Earn 4.5x TD Rewards Factors† on eligible grocery, eating, and public transit purchases†

- Use your rewards for any journey bookings obtainable on Expedia® for TD†

- No minimal revenue requirement

- Annual charge: $89, rebated within the first yr†

The TD First Class Journey Visa Infinite* Card is the premium card providing within the TD Rewards bank card household.

This card usually incorporates a beneficiant welcome bonus and a first-year annual charge rebate.

Cardholders can even take pleasure in wonderful incomes charges for TD Rewards Factors and a $100 lodging/trip credit score that can be utilized when reserving not less than $500 price of eligible journey by way of Expedia® for TD.†

This card is an efficient alternative for people who want to rapidly accumulate TD Rewards Factors and who could make use of the $100 lodging/trip credit score.

TD First Class Journey® Visa Infinite* Card

- Earn 20,000 TD Rewards Factors upon making your first buy†

- Earn 145,000 TD Rewards Factors upon spending $7,500 inside 180 days of account opening†

- Plus, earn a Birthday Bonus of as much as 10,000 TD Rewards Factors†

- Plus, earn 8x TD Rewards Factors† on eligible journey purchases while you e-book by way of Expedia® for TD†

- Get an annual TD Journey Credit score† of $100 while you e-book by way of Expedia® for TD†

- Use your rewards for any journey bookings obtainable on Expedia® for TD†

- 4 complimentary lounge visits by way of the Visa Airport Companion Program†

- Minimal revenue: $60,000 private or $100,000 family

- Annual charge: $139, rebated for the primary yr†

- Provide efficient as of September 4, 2025†

Click on on the bank card names above to entry our in-depth guides for the up-to-date affords and enrollment data for the three TD Rewards bank cards.

Low-Fee Credit score Playing cards

TD affords one low-rate bank card within the TD Low Fee Visa* Card.

This card is an efficient alternative for somebody who usually wants to hold a steadiness on their card and would profit from the decrease annual rate of interest of 12.90%.

This card additionally usually affords promotional rates of interest for a set variety of months, permitting new cardholders to increase or surprising purchases with out incurring as a lot curiosity.

TD Banking App

TD has an app obtainable for each Apple iOS and Android.

Throughout the app, you’ll be able to entry their chequing, financial savings, credit score, and funding accounts. You may transfer cash between these accounts, pay payments, and deposit cheques (by taking a photograph of the cheque).

You may as well ship and request cash inside Canada through Interac e-transfer or to 200+ nations utilizing TD World Switch.

Throughout the app, you can even hold their debit and bank cards safe with the flexibility to lock a card whether it is misplaced, misplaced, or stolen. They’ll then simply unlock the cardboard within the app as soon as it has been discovered.

In case you’re new to the app, TD additionally supplies some very useful tutorials on their web site that can assist you be taught all concerning the totally different options.

Conclusion

TD Canada Belief is the second largest financial institution in Canada, with over 1,000 branches throughout the nation.

TD affords a variety of financial institution accounts, bank cards, and extra merchandise designed to swimsuit a myriad of various shopper varieties.

Whether or not you’re a pupil, a newcomer to Canada, or somebody perusing new banking choices, TD’s range of choices are definitely price exploring.