In the case of journey rewards, airline and resort loyalty applications typically steal the highlight.

However what about fixed-value factors applications?

These lesser-known factors applications may not promise flashy First Class redemptions or overwater villas, however they provide constant worth and ease that enchantment to many travellers.

For these trying to save on journey bills with out diving into the complexities of loyalty applications, fixed-value factors applications is usually a highly effective instrument.

On this information, we’ll discover fixed-value factors applications in Canada and how one can profit from them.

What Are Mounted-Worth Factors Packages?

Mounted-value factors applications are precisely what they sound like: the factors you earn have a set redemption worth when redeemed. Not like applications like Aeroplan or American Airways AAdvantage, the place factors values can range primarily based on redemption decisions, fixed-value factors sometimes ship constant worth – say, 1 cent per level.

Whereas the primary advantage of this easy system is the benefit of redeeming factors at a assured worth, applications like RBC Avion and CIBC Aventura can typically exceed 1 cent per level–when you’re keen to place in a bit further effort to know how they work.

Let’s examine two approaches to redeeming Scene+ factors, a fixed-value factors program, and Aeroplan factors for an Air Canada flight from Toronto (YYZ) to St. John’s (YYT) in Economic system Normal fare.

On Air Canada’s web site, an Economic system Normal flight for this route is priced at $219.74 (all figures CAD)

The very same flight is obtainable by means of the Scene+ journey portal for a similar value at $219.74, with the choice to redeem 21,974 Scene+ factors — equal to 1 cent per level.

Now let’s study the identical flight utilizing Aeroplan factors. This flight may be booked for 10,100 Aeroplan factors plus $51 in taxes and charges. This redemption yields a worth of 1.67 cents per level, providing higher worth than redeeming Scene+ factors.

Nevertheless, utilizing Aeroplan factors typically requires extra data about fare guidelines, baggage necessities, and maximizing redemption worth. And not using a respectable understanding of the Aeroplan program, it’s doable to redeem factors at a charge decrease than 1 cent per level, which diminishes their worth.

Alternatively, Scene+ factors present a hassle-free expertise for somebody new to factors applications, with a assured redemption charge of 1 cent per level. Whereas this mounted worth may not provide the aspirational redemptions that enchantment to skilled travellers, it additionally protects learners from by chance redeeming their factors at poor worth.

In Canada, a number of the most notable fixed-value applications embody:

Whereas transferable factors currencies like American Specific Membership Rewards and RBC Avion may also be redeemed at mounted values, you may typically unlock better worth by transferring them to airline and resort companions, as proven within the instance above.

I like to recommend saving these for large bills like flights and luxurious resorts, and fixed-value factors currencies for different journey bills like transportation and tour packages.

That stated, some fixed-value applications additionally provide flight redemption charts that unlock increased worth, such because the CIBC Aventura Flight Rewards Chart, RBC Air Journey Redemption Schedule, and American Specific Mounted Factors Journey Program. So it’s value exploring these choices for maximizing your factors.

Which Mounted-Worth Factors Packages Are the Finest?

With so many fixed-value factors applications obtainable in Canada, it may be fairly difficult to level out which one is the very best on your journey wants.

Beneath, I’ll break down the professionals, cons, and the highest bank cards for incomes factors with a number of the hottest applications, serving to you select the precise match on your objectives.

AIR MILES®

- Execs: Wonderful for expertise, together with Disneyland bookings

- Cons: Restricted flight choices and resort footprints on the devoted journey portal

- Redemption worth on journey: 10.53 cents per Mile (95 Miles = $10)

- Finest bank card to earn: BMO AIR MILES®† World Elite®*Mastercard®*

BMO Rewards

- Execs: Versatile redemption choices for journey and assertion credit

- Cons: Decrease redemption charge than different applications

- Redemption worth on journey: 0.67 cents per level

- Finest bank card to earn: BMO eclipse Visa Infinite Privilege* Card

CIBC Aventura Factors

- Execs: Potential outsized worth with the CIBC Aventura Airline Reward Charts

- Cons: Excessive worth redemptions require an intensive understanding of this system

- Redemption worth on journey: 1 cent per level (as much as 2 cents per level by means of CIBC Aventura Airways Chart)

- Finest bank card to earn: CIBC Aventura® Visa Infinite Privilege* Card

MBNA Rewards

- Execs: Straightforward to earn

- Cons: Restricted flight choices and resort foot prints on the devoted journey portal

- Redemption worth on journey: 1 cent per level

- Finest bank card to earn:MBNA Rewards World Elite® Mastercard®

Nationwide Financial institution À la carte Rewards

Scotiabank Scene+

TD Rewards Factors

- Execs: Numerous methods to redeem together with Amazon.ca purchases

- Cons: Restricted to Expedia4TD for optimum worth

- Redemption worth on journey: 0.5. cents per level by means of Expedia® for TD, 0.4 cents per level by means of Guide Any Approach journey

- Finest bank card to earn: TD First Class Journey® Visa Infinite* Card

For my part, Scotiabank Scene+ stands out as probably the greatest fixed-value factors applications. It affords a beneficiant incomes charge of 5–6x factors on on a regular basis purchases like groceries and eating with the Scotiabank Gold American Specific® Card, making it simple to build up factors rapidly. However what really makes this card compelling is the benefit of redemption.

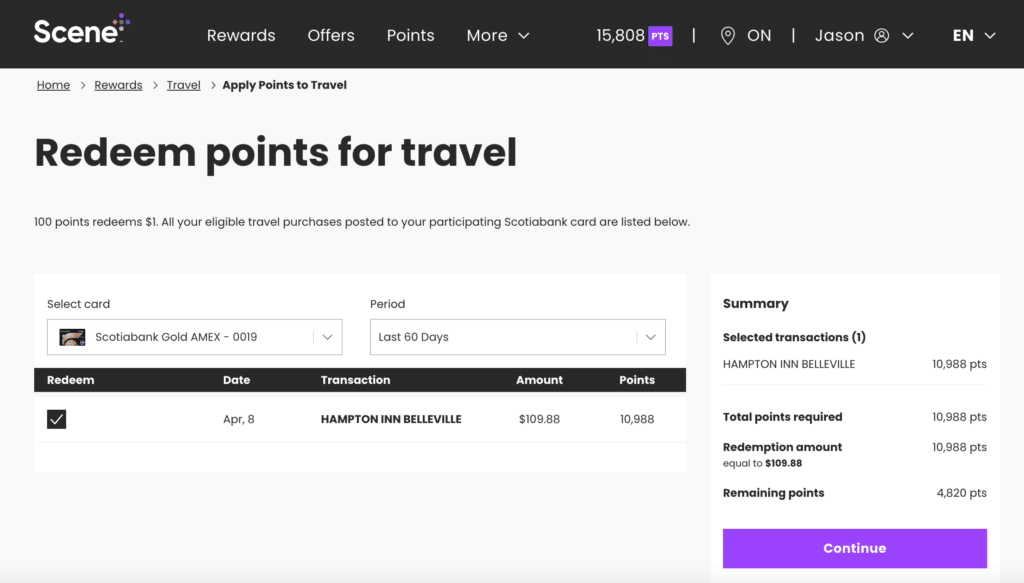

Not like different applications the place it requires you to e book journey by means of their devoted portal to maximise redemption worth, this isn’t the case for Scene+ factors. Whereas Scene+ does have its personal journey portal, you’re not locked into utilizing it.

As a substitute, you may merely cost your journey purchases to your Scene+ points-earning card and apply factors towards that buy afterward.

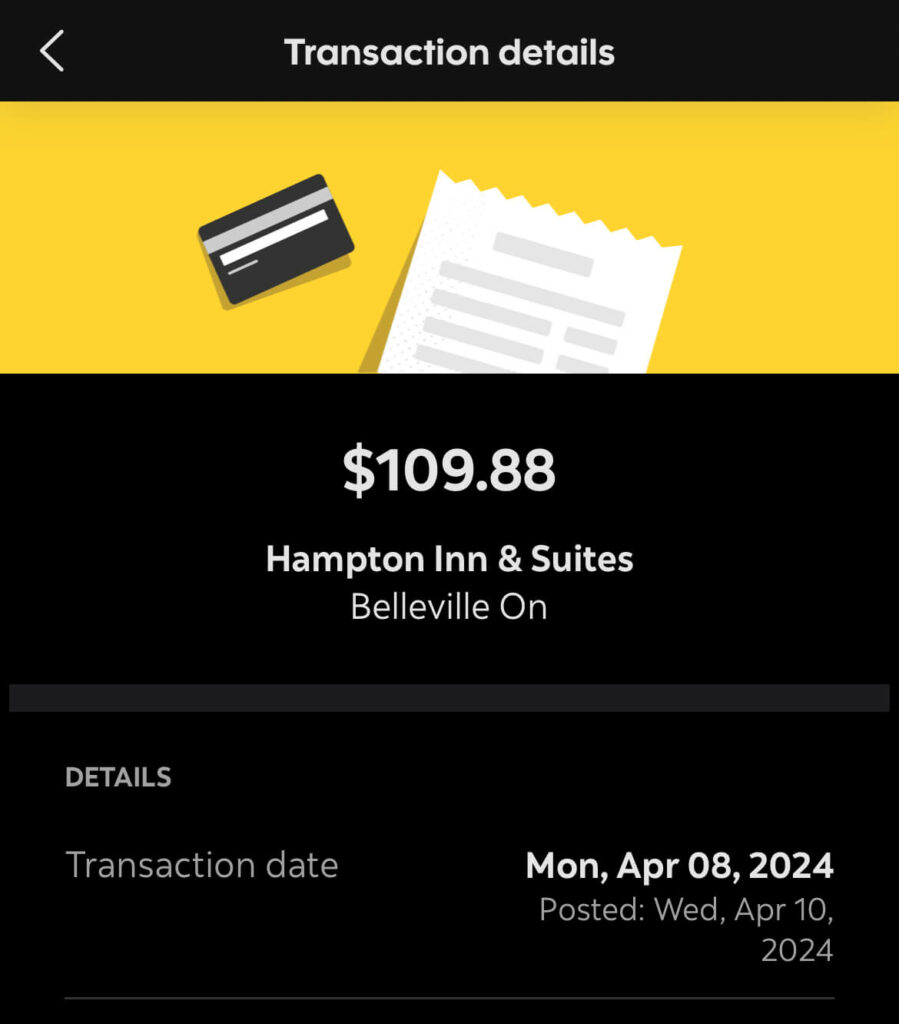

For instance, you may make a resort reserving with a Scotiabank Gold American Specific® Card.

As soon as the transaction is posted, you may merely head over to the Scene+ portal to use factors in direction of the acquisition.

Plus, the factors may even be utilized in direction of different journey associated bills like transportation and excursions, making it very stretchable.

For these causes, the Scene+ program is a very compelling alternative for a lot of travellers no matter their experience within the factors journey world.

Scotiabank Gold American Specific® Card

- Earn 30,000 Scene+ factors upon spending $2,000 within the first three months

- Plus, earn an extra 20,000 Scene+ factors upon spending $7,500 within the first 12 months

- Earn 6x Scene+ factors at Sobeys, IGA, Safeway, FreshCo, and extra

- Plus, earn 5x Scene+ factors on groceries, eating, and leisure

- Additionally, earn 3x Scene+ factors on gasoline, transit, and choose streaming companies

- Redeem factors for an announcement credit score for any journey expense

- No overseas transaction charges

- Benefit from the unique advantages of being an American Specific cardholder

- Annual charge: $120 (waived for the primary 12 months)

Tips on how to Leverage Mounted-Worth Factors Packages

Different journey bills

Whereas loyalty applications shine for flights and resorts, fixed-value factors are good for overlaying prices like:

- Unbiased resorts not linked to any resort loyalty applications

- Tour guides, airport pickups, and excursions

- Cruises, automobile leases, and short-term leases

For instance, when you’re travelling in a metropolis with tight time however wish to slot in all of the sights to your schedule, you may think about reserving a guided tour bundle on platforms like Viator and apply Scene+ factors in direction of the acquisition.

Positioning flights

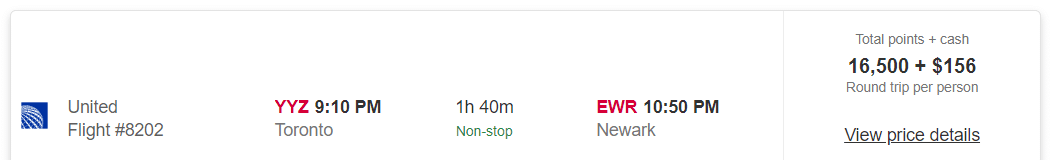

Superior factors travellers typically e book positioning flights to entry higher award availability or particular aircrafts that function solely in main hubs. Mounted-value factors are a wonderful possibility for these quick flights. For instance, CIBC Aventura factors can unlock important financial savings when used with their Airline Rewards Chart.

Let’s say you’re a Torontonian trying to expertise Lufthansa First Class. This luxury cabin is barely obtainable on choose plane departing from main U.S. hub airports in North America. On this case, you’d have to e book a positioning flight to Newark to start your First Class cabin journey.

Whereas quick, these flights can typically develop into unexpectedly costly, particularly when demand is excessive. That is the place CIBC Aventura Factors come in useful, permitting you to redeem 10,000–20,000 factors for a base fare of as much as $400. This redemption can yield a worth of as much as 2 cents per level, making it a strategic and cost-effective option to cowl positioning flights.

Conserving it easy

Not everybody has the time or curiosity to grasp the complexities of loyalty applications. Mounted-value factors applications are a incredible possibility for travellers who merely wish to decrease out-of-pocket bills, quite than making an attempt to maximise the factors to go on aspirational journeys.

With playing cards just like the Scotiabank Gold American Specific®, you may rack up factors rapidly by means of on a regular basis spending. For instance, spending $500 month-to-month on groceries, gasoline, and eating might earn you sufficient Scene+ factors in a 12 months to cowl as much as $600 in any type of journey bills.

Nevertheless, when you’ve got the need to study the ins and outs of loyalty applications, I extremely encourage diving into frequent flyer applications like Aeroplan, the place the potential for outsized worth on premium journey experiences is unmatched.

Conclusion

Mounted-value factors applications might not have the glamour of premium cabins or luxurious resorts, however they’re a wonderful instrument for saving cash on journey with out an excessive amount of effort.

Whether or not you’re offsetting smaller bills, reserving positioning flights, or overlaying tour guides and excursions, these applications have a spot in any traveller’s toolkit.

They’re particularly helpful for protecting issues easy: no attempting to find award house, no timing switch bonuses, and no worrying whether or not you bought “good worth” — simply easy financial savings each time you journey.