The Wealthsimple Pay as you go Mastercard quietly grew to become one in all my go-to journey playing cards, not due to factors or perks, however as a result of it solves a really particular journey downside.

When it first launched, this was simply one other pay as you go fintech card with a bit of money again and a few early hype. Helpful, certain, however hardly one thing you’d plan a visit round.

Quick ahead to at the moment, and the worth proposition has shifted. Between the dearth of international change charges and dependable entry to international ATMs, the Wealthsimple Pay as you go Mastercard has advanced into some of the sensible instruments Canadians can carry overseas, particularly in locations the place money nonetheless guidelines.

It’s not glamorous, and it received’t substitute your major factors card. However as a no-FX, low-friction solution to entry money abroad, it now does one job very properly — and that’s precisely why it’s earned a everlasting spot in my pockets.

A Primer on Wealthsimple

Wealthsimple is a Toronto-based fintech firm that provides a rising suite of monetary merchandise, largely geared towards millennials and first-time buyers.

The corporate began with Wealthsimple Make investments, its robo-advisor investing platform, and has since expanded into Wealthsimple Commerce, Wealthsimple chequing account, Wealthsimple bank cards, and different app-based monetary instruments.

I personally use Wealthsimple Commerce infrequently to dabble within the inventory market and Wealthsimple Visa Infinite throughout my travels.

Wealthsimple additionally presents Crypto buying and selling, which lowers the barrier to entry for purchasing property like Bitcoin. Simply remember the fact that you’re buying crypto by way of a regulated platform, that means you don’t management the non-public keys.

For travellers, this broader ecosystem issues as a result of the Wealthsimple Pay as you go Mastercard is absolutely built-in into the identical app, making it comparatively straightforward to fund, handle, and entry cash whereas on the street.

The Wealthsimple App

All Wealthsimple merchandise now reside inside a single app, which mixes investing, funds, and spending in a single place.

Throughout the app, customers can ship and obtain cash immediately with different Wealthsimple customers, request funds, and break up bills with pals. Transfers are quick and easy, with out ready for Interac e-transfers to clear.

Whereas none of that is groundbreaking, the app’s actual worth exhibits up when paired with the Wealthsimple Pay as you go Mastercard, particularly when travelling and needing fast entry to funds for ATM withdrawals overseas.

Wealthsimple Pay as you go Mastercard

The Wealthsimple Pay as you go Mastercard is tied on to your chequing account inside the Wealthsimple app. There’s no credit score examine and no revolving credit score line — only a pay as you go steadiness you management.

The place this card really stands out at the moment is in the way it handles international spending and money withdrawals.

No FX Charges and Overseas ATM Withdrawals

The Wealthsimple Pay as you go Mastercard fees no international change charges on both purchases or ATM withdrawals. Transactions are processed on the Mastercard change price, with out the standard 2.5% markup that the majority Canadian playing cards quietly tack on.

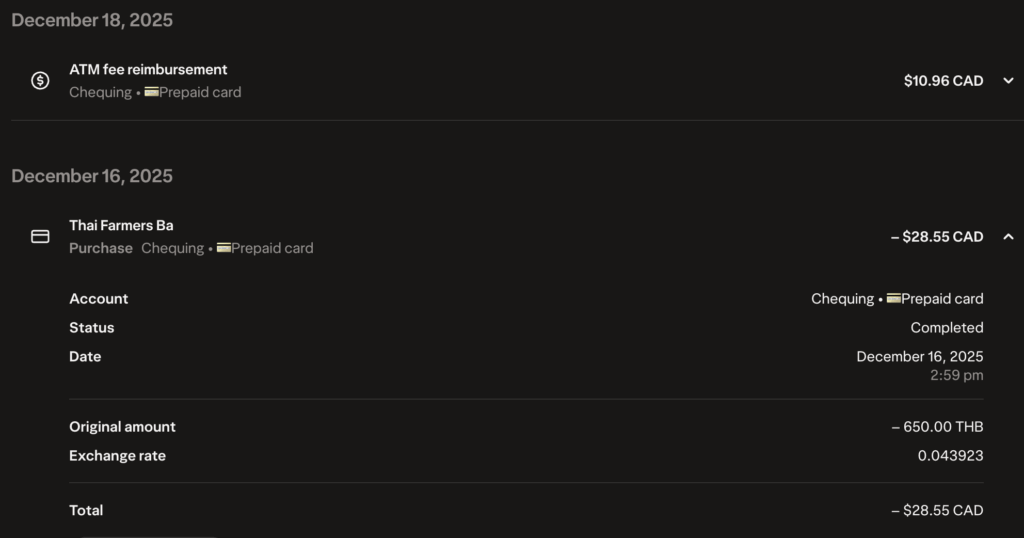

However right here’s the half that basically issues for travellers: ATM charges charged by the machine itself are reimbursed by Wealthsimple.

In lots of nations, native ATMs will cost a flat withdrawal price, usually within the $2–$5 vary. With most Canadian playing cards, you’d pay that price plus a international change markup on prime.

With the Wealthsimple Pay as you go Mastercard, these ATM charges are refunded, which considerably lowers the true value of accessing money overseas.

I’ve been utilizing the cardboard in Thailand, the place ATM withdrawals usually include a 250 THB price (roughly $11 CAD) per transaction. Every time I withdrew money, the ATM price posted to my account and was later reimbursed by Wealthsimple.

Mixed with no FX markup, that made these withdrawals far cheaper than alternate options just like the EQ Financial institution Mastercard or Smart card for ATM withdrawals.

For locations the place money continues to be extensively used — assume Southeast Asia, Africa, or smaller cities in Europe — this makes the Wealthsimple Pay as you go Mastercard some of the cost-effective methods for Canadians to entry money whereas travelling.

Between no FX charges and reimbursed ATM fees, the Wealthsimple Pay as you go Mastercard covers two of the largest ache factors Canadian travellers face when coping with money overseas.

Not a Spending Card (And That’s High quality)

The Wealthsimple Pay as you go Mastercard just lately phased out their 1% money again rewards and doesn’t earn any rewards presently.

In sensible phrases, there’s no purpose to make use of this card for on a regular basis purchases.

Due to this fact, this card is finest handled as a cash-access software, not a spending card. Use it to withdraw cash from ATMs overseas, then change again to a correct no-FX bank card for purchases.

Ideally, you’d need to pair it with playing cards just like the Scotiabank Passport™ Visa Infinite* Card, which earns factors on purchases whereas avoiding international transaction charges.

Wealthsimple additionally presents its personal premium product, the Wealthsimple Visa Infinite* Card, which might be a pure companion for spending overseas. Sadly, that card stays underneath a ready listing and isn’t but open to most of the people.

Till then, pairing the Wealthsimple Pay as you go Mastercard for money withdrawals with a robust no-FX bank card for purchases stays the simplest technique.

Worldwide Transfers

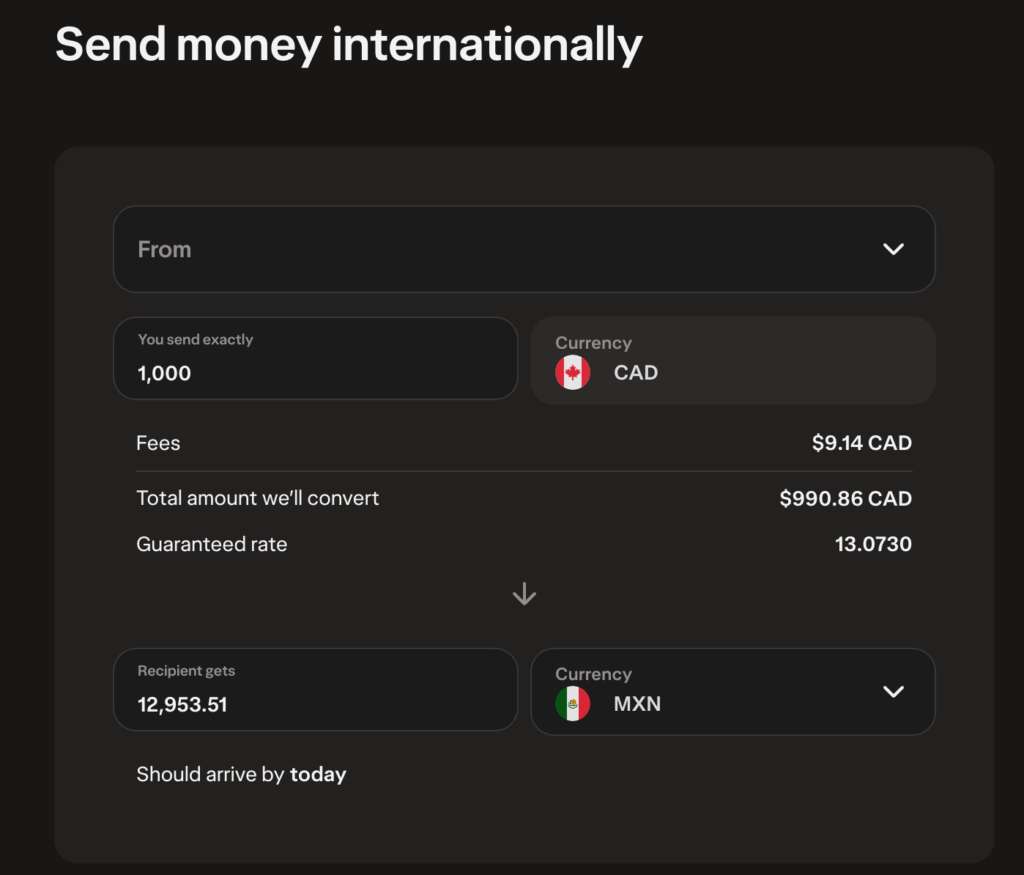

Past money withdrawals, Wealthsimple has quietly constructed out a world cash switch characteristic immediately inside its app.

In the mean time, Wealthsimple helps worldwide transfers in 10 currencies, masking lots of the mostly used corridors. Whereas it’s not attempting to compete on sheer breadth, the supported currencies shall be greater than ample for many travellers, digital nomads, and anybody transferring cash between main markets.

The place this characteristic will get attention-grabbing is pricing. Trade charges are fairly aggressive, usually touchdown in the identical ballpark as devoted companies like Smart. You received’t see the eye-watering FX spreads that conventional banks nonetheless appear pleased with, and charges are usually clear and simple to grasp earlier than you hit ship.

For infrequent worldwide transfers — paying hire overseas, sending cash to household, or transferring funds forward of an extended keep — this is usually a very handy choice. Every thing occurs inside the identical app that already holds your spending steadiness, investments, and pay as you go card, which cuts down on friction and account sprawl.

That mentioned, this nonetheless isn’t a full substitute for Smart should you often transfer cash throughout a variety of currencies or depend on much less frequent switch corridors. Protection is extra restricted, and energy customers should choose a devoted platform for extra advanced wants.

Nonetheless, having worldwide transfers, a no-FX pay as you go card, and reimbursed ATM withdrawals all dwelling underneath one roof is genuinely helpful. For a lot of Canadians, Wealthsimple now covers most cross-border cash wants with out forcing you to juggle a number of apps and logins.

Conclusion

The Wealthsimple Pay as you go Mastercard is a type of uncommon journey instruments that really feels full.

No FX charges. Reimbursed ATM fees. Aggressive world cash transfers throughout 10 currencies. All of it wrapped right into a single app that doesn’t attempt to upsell you each 5 seconds. For travellers, expats, and anybody who nonetheless wants money overseas (which is most of us, whether or not we admit it or not), this setup removes plenty of the standard friction.

Extra importantly, it really works in real-world journey situations. Whereas different travellers hesitate at international ATMs , scanning price disclosures and debating whether or not a 250 THB cost is price it, it’s reassuring to withdraw money, transfer on, and know the price shall be reimbursed. That small however tangible benefit is commonly sufficient to win individuals over.

I actually hope Wealthsimple retains this product precisely as it’s. As a result of when a card presents no FX charges, ATM price reimbursement, and world transfers at aggressive charges, it stops being a distinct segment fintech perk and begins feeling like a quiet journey privilege — one I’m more than pleased to maintain flexing.