Beginning March 3, 2026 in Alberta and Could 26, 2026 throughout the remainder of Canada, you’ll earn and redeem Scene+ factors at collaborating Shell gasoline stations on gas, automobile washes, and eligible comfort purchases.

AIR MILES incomes and redemption at Shell will finish the day earlier than these dates, with no conversion of miles to Scene+ factors.

This shift lands on the identical week BMO introduced that AIR MILES will transition to its new Blue Rewards program in summer time 2026, holding balances intact however retiring the AIR MILES model.

Let’s stroll by what this implies on the pump, how the earn charges work, and which playing cards you may need to use going ahead.

Incomes Scene+ factors at Shell

As soon as the partnership goes dwell, Shell will award Scene+ factors on virtually every part you’d anticipate at a gasoline station. You’ll earn:

- 1 Scene+ level per litre on all grades of gas

- 1 Scene+ level for each greenback you spend on automobile washes and eligible comfort objects at collaborating stations

You’ll be able to earn by scanning your Scene+ card on the pump or inside the shop, by paying by the Shell app after linking your Scene+ account, or by paying with an eligible Scotiabank card that’s related to Scene+ and Shell Go+.

On high of the bottom earn, Shell provides a bonus layer whenever you hyperlink your Scene+ account to Shell Go+. In that setup, you earn 10% extra Scene+ bonus factors on gas, automobile washes, and eligible comfort purchases, and also you earn an extra multiplier whenever you purchase Shell V-Energy NiTRO+ Premium Gasoline.

I’m fairly glad that there aren’t any minimal necessities just like the AIR MILES construction at Shell, with 1 mile per 10 litres of premium, 1 mile per 20 litres of normal, and 1 mile per $5 in-store. The Scene+ mannequin ought to really feel much less fussy.

What Financial savings Can You Get on the Pump?

Beforehand, BMO cardholders had been capable of get 2 cents per litre off all Shell fuels and an excellent richer low cost on V-Energy when their BMO card was linked to their AIR MILES profile.

Surprisingly, you didn’t really must pay with a BMO card to get the low cost, so long as it was correctly linked within the background.

Within the new world, Scotiabank and Tangerine step into that function. Shell has confirmed that eligible Scotiabank credit score and debit playing cards, in addition to eligible Tangerine bank cards, will unlock instantaneous financial savings on the pump as soon as they’re linked in Shell Go+.

If you pay with the linked card, or its token in your cellular pockets, the low cost is utilized proper on the pump whilst you additionally earn Scene+ factors and Shell Go+ bonuses.

On high of that, CAA members can save 3 cents per litre at collaborating Shell stations, and this CAA low cost may be stacked with Scene+ incomes, Shell Go+ bonuses, and eligible Scotiabank or Tangerine instantaneous financial savings when every part is ready up accurately.

The exact cents-per-litre low cost from Scotiabank and Tangerine has not been printed but, so we can not say whether or not it will likely be higher, worse, or roughly equal to the previous BMO setup.

For now, it’s most secure to think about it as a pleasant rebate layered on high of the roughly 1% return you get from Scene+ factors, with the ultimate verdict reserved for when Shell and the banks publish precise numbers.

Which Credit score Card Ought to You Use at Shell?

There are actually two inquiries to reply right here: which playing cards unlock Shell’s official financial savings, and which playing cards provide the greatest return on the spending itself.

If you wish to hold issues clear and “on script,” an eligible Scotiabank Scene+ card paired with Shell Go+ will seemingly be the flagship combo.

A card such because the Scotiabank® Gold American Specific®* Card, which earns 3 Scene+ factors per greenback spent on gasoline, allows you to earn from three instructions without delay.

You get base Scene+ factors from Shell on the litres and in-store purchases, you get the Shell Go+ bonus on high of that, and then you definitely earn your regular bank card Scene+ factors on the total transaction quantity, all whereas triggering instantaneous pump financial savings as soon as these go dwell.

Scotiabank Gold American Specific® Card

- Earn 25,000 Scene+ factors upon spending $2,000 within the first three months

- Plus, earn an further 20,000 Scene+ factors upon spending $7,500 within the first 12 months

- Earn 6x Scene+ factors at Sobeys, IGA, Safeway, FreshCo, and extra

- Plus, earn 5x Scene+ factors on groceries, eating, and leisure

- Additionally, earn 3x Scene+ factors on gasoline, transit, and choose streaming companies

- Redeem factors for an announcement credit score for any journey expense

- No international transaction charges

- Benefit from the unique advantages of being an American Specific cardholder

- Annual charge: $120 (waived for the primary 12 months)

For a lot of drivers, that degree of stacking is greater than sufficient. You refill, faucet one card or cellphone, and stroll away realizing you will have squeezed an honest quantity of worth out of an in any other case boring expense.

If you’re extra aggressive about card technique, chances are you’ll have a look at this and quietly ponder whether you’ll be able to nonetheless play the identical recreation that existed beneath BMO: linking one card to set off a reduction, then paying with a distinct, increased worth foreign money incomes card.

Beneath the previous association, you could possibly have a BMO card linked to Shell for the worth break, however nonetheless pay with one thing like an RBC® ION+™ Visa‡ Card to earn 3 Avion factors per greenback spent on gasoline.

- Earn 7,000 Avion factors upon approval^

- Earn 14,000 Avion factors upon spending $1,500 within the first six months^

- Earn 3x factors† on qualifying grocery, eating, meals supply, gasoline, rideshare, day by day public transit, electrical automobile charging, streaming, digital gaming and digital subscriptions†

- Earn 1 additional Moi Rewards level for each two {dollars} spent at Metro, Meals Fundamentals, Tremendous C, Jean Coutu, Brunet and Première Moisson whenever you scan your Moi card and pay together with your linked RBC Card (minimal buy required).¹¹

- Cell gadget insurance coverage†

- Annual charge: $48†

We don’t but know whether or not Shell’s new Scotiabank and Tangerine setup will permit the identical form of separation between “linked card for reductions” and “fee card for factors.”

The FAQ language leans within the path of needing to pay with the linked card or its digital pockets model to set off the moment financial savings and computerized earn and redeem behaviour.

If that’s the way it really works on the pump, then the optimum play will probably be to choose the Scotiabank or Tangerine product that most closely fits your general technique and easily use that at Shell.

If, nevertheless, the implementation finally ends up letting you hyperlink a card for the low cost however cost the transaction to a distinct card, then alternatives open up once more.

In that situation, you may effectively hyperlink a Scotiabank or Tangerine card purely to unlock the low cost and automation, however nonetheless route the precise cost to a card like RBC® ION+™ Visa‡ Card on the terminal to earn 3 Avion factors per greenback on gasoline. It’s value holding that concept in your again pocket, however it’s not one thing it is best to depend on till the brand new system is totally dwell and examined.

Both means, Shell Go+ is the management centre. Whether or not you might be leaning into Scotiabank’s personal playing cards, testing Tangerine, or eyeing hybrid setups, every part runs by that app and the hyperlinks you arrange inside it.

How Can You Redeem Scene+ Factors at Shell?

Redeeming at Shell follows the usual Scene+ components you may already know from grocery shops or Cineplex.

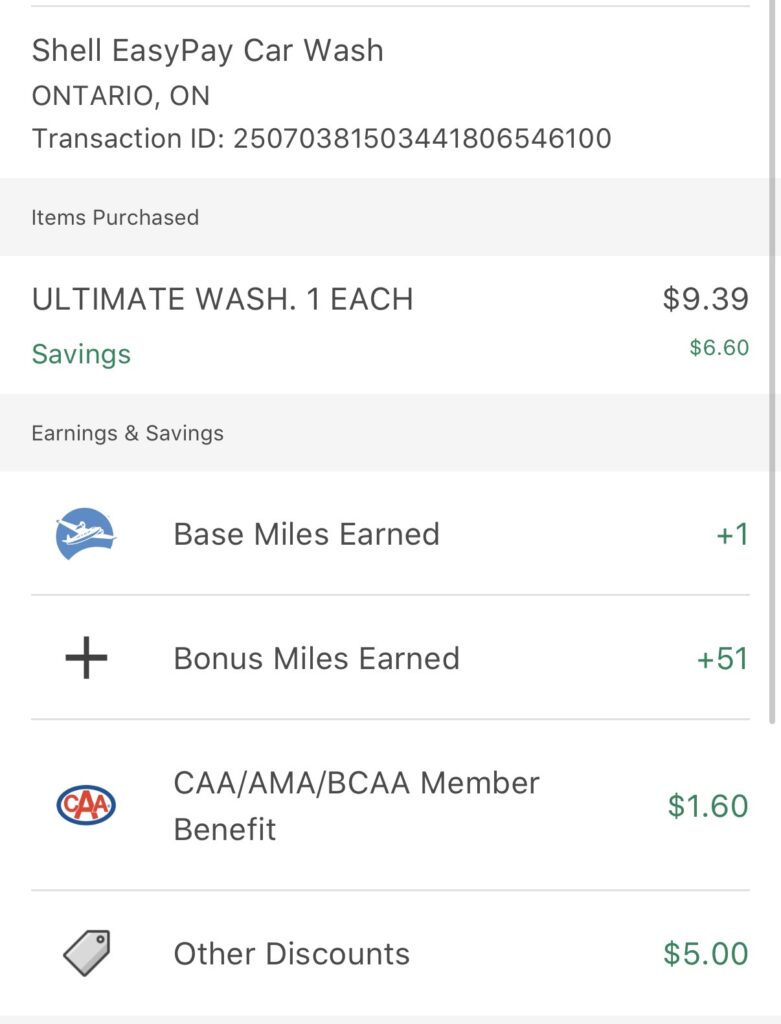

You redeem in increments of 1,000 Scene+ factors, and every block of 1,000 factors wipes $10 off your Shell transaction.

You’ll be able to apply that low cost to gas, automobile washes, or eligible in-store purchases, after which pay the remaining quantity with money, debit, or credit score.

The good half is that you simply proceed to earn Scene+ factors on the total pre-redemption worth of your eligible buy. Should you use 2,000 factors to take $20 off a $60 fill-up, you earn Scene+ as if you happen to had paid the total $60, not simply the $40 that really leaves your checking account.

Should you’re an eligible Scene+ member, you’ll be able to redeem factors in increments of 1,000 for $10 off your buy of gas, automobile wash, or eligible comfort objects at collaborating Shell areas.

You select what number of factors to make use of (at the very least 1,000 per transaction and in increments of 1,000 factors except in any other case permitted) and pay the remaining stability with money, debit or credit score. You’ll proceed to earn factors on the total worth of your eligible buy.

You do want a correctly registered Scene+ account to redeem. Should you choose up a bodily Scene+ card at Shell and by no means full the registration on-line or within the Scene+ app, you’ll be able to nonetheless earn factors on eligible purchases, however you won’t be able to burn them on the pump or entry focused provides till your account is confirmed.

As a result of Shell makes use of the identical 1,000 equals 10 construction as the remainder of Scene+, you should not have to fret about getting worse worth on the gasoline station than you’d get on the grocery retailer. Should you want to decrease your gas invoice as an alternative of your meals invoice one month, you’ll be able to. The mathematics doesn’t punish you for it.

When Does It Start?

The timing of the transition will depend on the place you reside. In Alberta, Shell begins providing Scene+ on March 3, 2026, and March 2, 2026 is the final day you’ll be able to earn or redeem AIR MILES at Shell.

In the remainder of Canada, the cutover occurs later within the spring. You’ll be able to proceed to make use of AIR MILES at Shell by Could 25, 2026, with Scene+ taking on on Could 26, 2026.

There is no such thing as a conversion of AIR MILES into Scene+ factors as a part of this variation. Your AIR MILES stability stays contained in the AIR MILES ecosystem and can later be moved into BMO’s Blue Rewards program on a one-to-one foundation.

Meaning it is best to consider Shell as merely leaving the AIR MILES orbit and becoming a member of Scene+, relatively than any form of merger between the 2 applications.

When you’ve got been within the behavior of utilizing AIR MILES Money for Shell gas, it’s value planning a couple of redemptions earlier than your area’s deadline so you aren’t left wishing you had emptied your stability on the pump whilst you nonetheless might.

After that, you can be taking a look at a clear cut up: gas rewards at Shell come from Scene+, whereas your historic AIR MILES stability continues its life beneath Blue Rewards with different companions.

How do I personally have a look at Shell and Scene+?

On a private be aware, this partnership ticks a variety of bins for me. Shell is already my favorite gasoline station, primarily as a result of the app is so effectively developed.

I can pull right into a bay, choose the pump within the app, pay on my cellphone, and begin fuelling with out talking to anybody and even taking my pockets out.

The identical goes for automobile washes. With the ability to run the entire course of from my cellphone, together with utilizing Apple Pay contained in the Shell app, makes the expertise really feel so much smoother than trying to find a card on the until.

Scene+ can also be my favorite fixed-value factors foreign money in Canada. I like that I can use factors in opposition to so many various kinds of journey purchases, and that I can typically redeem immediately with the journey supplier as an alternative of being locked right into a single portal or a unusual reward chart.

If I’ve a pile of Scene+ factors, I do know I can level them at a grocery invoice, a film night time, or a random resort reserving and get the identical worth.

Placing these two collectively, I’m genuinely excited for this partnership. My regular behavior of fuelling up by the Shell app now has the potential to feed a factors stability that’s really helpful for the form of journey redemptions I prefer to make.

Conclusion

Shell Canada becoming a member of Scene+ is a significant shift within the loyalty panorama. Your gas, automobile washes, and comfort purchases at Shell will now construct the identical factors stability chances are you’ll already be rising on the grocery retailer, the films, or on journey, with Shell Go+ and eligible Scotiabank or Tangerine playing cards including additional juice.

For AIR MILES collectors, shedding Shell as an earn-and-burn companion could sting, even when balances are preserved beneath Blue Rewards.

For Scene+ followers, it’s a clear win. In any case, 2026 is the 12 months to double-check the place you refill, which card you faucet, and which program your litres are feeding, so your gasoline invoice quietly pulls its weight in your general factors technique.