The Cathay World Elite® Mastercard® – powered by Neo is at present providing a historic excessive welcome bonus, making it a compelling selection for Cathay Pacific loyalists and Asia Miles collectors.

With this supply, you’ll be able to earn as much as 40,000 Asia Miles and get 15% off Cathay Pacific flights when paying with the cardboard and utilizing a particular promo code.

In the event you’re in search of a approach to increase your Asia Miles steadiness whereas securing a reduction on flights, now’s one of the best time to use.

Let’s take a more in-depth have a look at what this card affords.

New Historic Excessive Supply: As much as 40,000 Asia Miles + 15% Flight Low cost

The present supply on the Cathay World Elite® Mastercard® – powered by Neo is the strongest we’ve seen on this card since its launch.

Right here’s what you’ll be able to earn:

- Earn 20,000 Asia Miles upon activating the cardboard†

- Earn 20,000 Asia Miles upon spending $5,000 within the first three months†

- 15% low cost on Cathay Pacific flights when utilizing the promo code CXNEO15OFF (legitimate till December 31, 2025)

In the event you often e-book Cathay Pacific flights, this low cost alone may result in important financial savings, after which you should utilize the Asia Miles for redemptions with Cathay Pacific and different Oneworld airline companions.

Cathay World Elite® Mastercard® – powered by Neo

- Earn 20,000 Asia Miles upon card activation†

- Plus, earn 20,000 Asia Miles upon spending $5,000 within the first three months†

- Then, earn 2 Asia Miles per greenback spent on Cathay Pacific flights† and overseas transactions†.

- And, earn extra Asia Miles at Neo’s companions†

- As much as 15% low cost on Cathay Pacific flights†

- Minimal revenue: $80,000 (private), $150,000 (family)

- Annual payment: $180

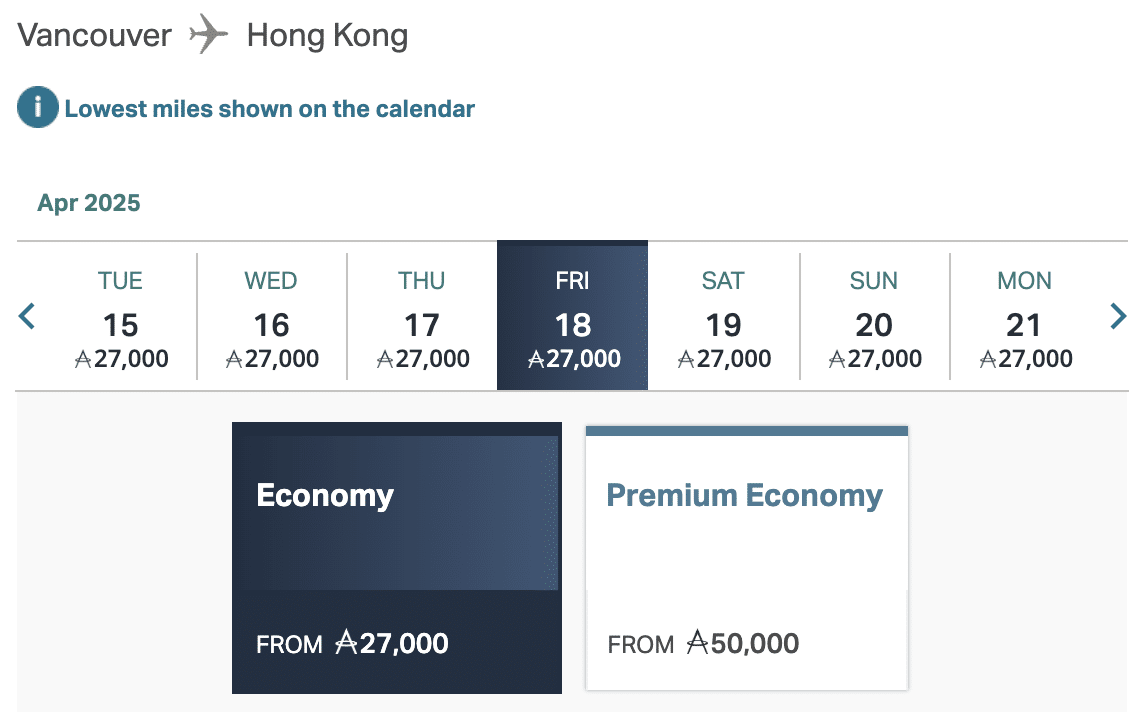

The welcome bonus of as much as 40,000 Asia Miles is sufficient to cowl a one-way financial system ticket from Toronto to Hong Kong, which begins at 38,000 Asia Miles.

For Vancouver-based travellers, a one-way financial system ticket from Vancouver to Hong Kong begins at 27,000 Asia Miles, leaving you with sufficient miles to place towards your subsequent redemption.

Asia Miles may also be redeemed for flights with Oneworld companions resembling Japan Airways, Qatar Airways, and American Airways, offering further flexibility.

In the event you’re planning to redeem Asia Miles for long-haul flights in premium cabins, this bonus may assist offset an excellent chunk of the associated fee, too.

- Vancouver to Hong Kong: 84,000 Asia Miles in enterprise class

- Toronto to Hong Kong: 110,000 Asia Miles in enterprise class

Whilst you’ll nonetheless have to high up your steadiness for enterprise class awards, this welcome bonus offers you a powerful head begin. Plus, Asia Miles affords the one significant pathway to premium cabin redemptions with Cathay Pacific today, as different packages don’t have entry to the identical award stock.

Incomes Charges & On a regular basis Spending

Past the welcome bonus, the Cathay World Elite® Mastercard® – powered by Neo affords the next incomes construction:

- Earn 2 Asia Miles per greenback spent on Cathay Pacific flights†

- Earn 2 Asia Miles per greenback spent in foreign currency echange†

- Earn 1 Asia Mile per greenback spent elsewhere†

- Bonus incomes alternatives with Neo companions†

Whereas the 2x earnings on Cathay Pacific flights is a pleasant perk, the 2.5% overseas transaction payment diminishes the worth of incomes 2x Asia Miles on overseas purchases.

In the event you often spend in foreign currency echange, a really perfect technique is to pair this card with a no overseas transaction payment bank card, such because the Scotiabank Passport® Visa Infinite Card*, to make sure you’re maximizing rewards whereas avoiding pointless charges.

Moreover, the Neo accomplice community gives elevated incomes charges at choose retailers, although the precise charges fluctuate and are solely seen to cardholders. In the event you store repeatedly at Neo’s accomplice retailers, this function may assist increase your Asia Miles earnings.

Redeeming Your Asia Miles

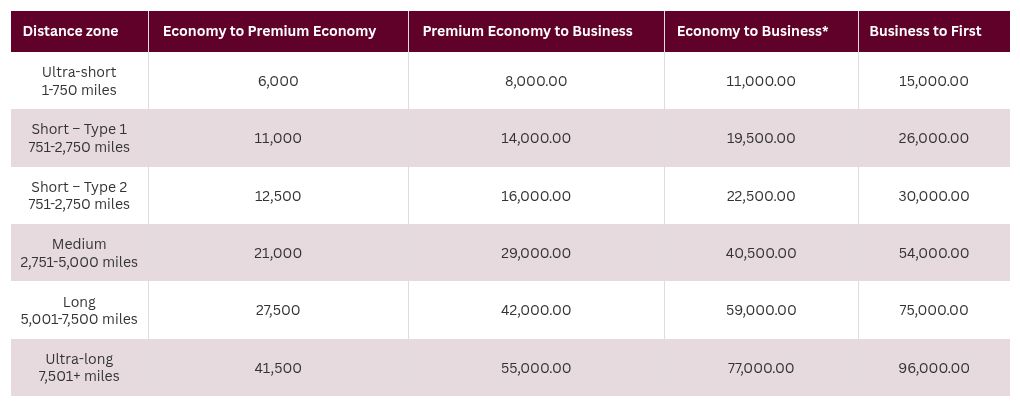

Asia Miles is a distance-based rewards program, which means the variety of miles required for a flight is dependent upon how far you’re flying.

For normal Cathay Pacific, accomplice, mixed-carrier, and Oneworld multi-carrier awards, there’s no formally printed award chart.

As an alternative, you’ll want to go to the Redeem Flight Awards web page to search for mileage necessities manually for every route.

To assist fill that hole, I’ve created an unofficial chart for Cathay Pacific flights primarily based on private analysis and stay award searches.

Whereas it’s not formally endorsed by Asia Miles, it ought to function a dependable reference level when planning your redemptions.

The very best redemptions usually embody:

- Cathay Pacific long-haul flights

- Brief-haul flights inside Asia

- Transatlantic flights on Oneworld companions

For travellers primarily based in Canada, long-haul and ultra-long-haul Cathay Pacific flights from Toronto (YYZ) and Vancouver (YVR) are among the many most dear makes use of of Asia Miles.

Asia Miles may also be used for flight upgrades, lodge stays, and different journey perks, however one of the best worth is usually present in flight redemptions.

In the event you’re new to Asia Miles, take a look at our information to discover ways to maximize your redemptions.

Extra Advantages

Along with incomes Asia Miles, the Cathay World Elite® Mastercard® comes with a couple of journey perks:

- 15% off Cathay Pacific flights (legitimate till December 31, 2025)

- Digital card upon approval for instant use

- Mastercard Journey Cross (DragonPass) lounge entry ($32 USD per go to)

Nevertheless, the perks are underwhelming given the $180 annual payment. In contrast to different airline co-branded playing cards, this card doesn’t supply free checked luggage, precedence boarding, or airport lounge passes—advantages that many travellers count on.

One other main draw back is that the Mastercard Journey Cross doesn’t include any complimentary visits, which is disappointing for a card with a reasonably substantial annual payment.

In distinction, bank cards with decrease annual charges—such because the CIBC Aventura® Visa Infinite Card* and Scotiabank Passport® Visa Infinite Card*—supply 4 and 6 complimentary lounge visits per 12 months, respectively.

In the event you journey often and wish to take pleasure in extra airport advantages, supplementing this card with the Scotiabank Passport® Visa Infinite Card* may very well be a wise transfer.

Not solely does it supply no overseas transaction charges, however it additionally gives six complimentary Visa Airport Companion Cross lounge visits per 12 months, making your general journey expertise smoother and extra rewarding.

Insurance coverage Protection

The Cathay World Elite® Mastercard® – powered by Neo gives average journey insurance coverage advantages, together with:

- Emergency medical insurance coverage (as much as $1 million for journeys as much as 14 days, for these 60 and youthful)

- Journey cancellation & interruption insurance coverage (as much as $1,000 per individual, as much as $5,000 per journey)

- Flight delay insurance coverage (as much as $500)

- Misplaced/delayed baggage insurance coverage (as much as $1,000)

- Rental automotive collision/harm insurance coverage (as much as 48 consecutive days)

- Resort/motel housebreaking insurance coverage (as much as $1,000)

One main downside with reference to the insurance coverage supplied by the cathay grasp card is that the protection doesn’t apply to award bookings.

This can be a shocking omission, as most different airline co-branded bank cards present insurance coverage protection on award tickets, so long as the taxes and charges are charged to the cardboard.

In the event you plan to e-book an award flight with Asia Miles, it’s possible you’ll wish to use a bank card that provides insurance coverage on award journey, such because the Nationwide Financial institution® World Elite® Mastercard®, which gives full protection on award redemptions.

Nationwide Financial institution® World Elite® Mastercard®

- Earn 5x À la carte Rewards factors on grocery and restaurant spend†

- Get journey insurance coverage on award journey, in addition to medical protection on longer journeys for ages as much as 75†

- Obtain $150 in annual credit for airport parking, baggage charges, seat choice charges, lounge entry, and airline ticket upgrades†

- Minimal revenue: $80,000 private or $150,000 family

- Annual payment: $150

Ought to You Get the Cathay World Elite® Mastercard®?

Whereas the welcome bonus of as much as 40,000 Asia Miles is kind of sturdy, the continued worth of this card is proscribed.

The incomes charges aren’t significantly aggressive, with solely 2 Asia Miles per greenback on Cathay Pacific flights and overseas purchases—with the latter being diminished by the two.5% overseas transaction payment.

The cardboard additionally doesn’t embody complimentary lounge entry, and its journey insurance coverage doesn’t even cowl award bookings with Asia Miles, a uncommon omission in comparison with different airline co-branded playing cards.

Is It Nonetheless Price Getting?

Given the present financial local weather and the growing problem of incomes miles, the welcome bonus alone could make this card price signing up for. Even in the event you don’t maintain it long-term, 40,000 Asia Miles for $5,000 in spending is a stable return.

In the event you often e-book Cathay Pacific flights with money, the 15% low cost is one other good perk.

Higher Methods for Incomes Asia Miles

If incomes Asia Miles is your high precedence, there are simpler methods to rack up miles quicker—each via welcome bonuses and every day spending.

1. Get Extra Asia Miles with RBC Avion® Visa Infinite Card*

As an alternative of incomes Asia Miles immediately, RBC Avion® factors switch 1:1 to Asia Miles, permitting for a a lot stronger incomes technique.

For instance, the RBC Avion® Visa Infinite Card* is at present providing as much as 55,000 Avion factors, which might be transferred into 55,000 Asia Miles—15,000 greater than the Cathay World Elite® Mastercard® – powered by Neo for a similar $5,000 spending requirement.

RBC® Avion Visa Infinite†

- Earn 35,000 RBC Avion factors† upon approval†

- Earn an extra 20,000 RBC Avion factors† once you spend $5,000 in your first 6 months†

- Earn 1.25x RBC Avion factors† on qualifying journey purchases

- Switch RBC Avion factors to British Airways Government Membership and different frequent flyer packages for premium flights†

- Redeem Avion factors for flights with the RBC Air Journey Redemption Schedule†

- Minimal revenue: $60,000 private or $100,000 family

- Annual payment: $120†

- Supplementary card payment: $50

Whereas the Avion card doesn’t supply a 15% low cost on Cathay Pacific flights, the additional Asia Miles earned can greater than make up for it when redeemed for premium cabin flights.

Moreover, Avion factors are extra versatile, as they may also be transferred to British Airways Avios or American Airways Aadvantage miles, providing you with extra redemption choices past Cathay Pacific flights.

2. Earn Extra Miles on Your On a regular basis Spending

Past welcome bonuses, the best way you earn factors from every day spending additionally issues.

A a lot stronger long-term incomes technique could be to pair the RBC ION+™ Visa Card with an Avion Elite factors incomes bank card.

RBC Avion Elite Credit score Playing cards

| Credit score Card | Greatest Supply | Worth | |

|---|---|---|---|

|

55,000 RBC Avion factors† $120 annual payment |

55,000 RBC Avion factors† | $1,080 |

Apply Now |

|

55,000 RBC Avion factors† $120 annual payment |

55,000 RBC Avion factors† | $1,080 |

Apply Now |

|

As much as 70,000 RBC Avion factors† $399 annual payment |

As much as 70,000 RBC Avion factors† | $801 |

Apply Now |

|

35,000 RBC Avion factors $175 annual payment |

35,000 RBC Avion factors | $700 |

Apply Now |

|

35,000 RBC Avion factors $120 annual payment |

35,000 RBC Avion factors | $580 |

Apply Now |

The RBC ION+™ Visa Card earns 3 Avion Premium factors per greenback on:

- Groceries

- Eating & meals supply

- Fuel & EV charging

- Rideshare & public transit

- Streaming providers

Since these classes make up the majority of most individuals’s month-to-month spending, this implies you’d successfully be incomes 3 factors per greenback on a majority of your on a regular basis purchases.

Whereas Avion Premium factors don’t switch on to Asia Miles, they are often mixed with Avion Elite factors in the event you maintain an eligible RBC Avion® Elite factors incomes bank card. As soon as mixed, you’ll be able to convert them to Asia Miles at a 1:1 ratio.

In different phrases, this setup successfully earns you 3 Asia Miles per greenback on most of your month-to-month necessities—far outperforming the Cathay World Elite® Mastercard® – powered by Neo’s flat 1 Asia Mile per greenback on on a regular basis spending.

Conclusion

The Cathay World Elite® Mastercard® – powered by Neo at present has its best-ever public supply, with as much as 40,000 Asia Miles and 15% off Cathay Pacific flights. In the event you often fly with Cathay Pacific, this card may very well be a helpful addition to your pockets.

Nevertheless, if you need larger incomes charges, no overseas transaction charges, or stronger journey perks, there are higher options to contemplate.

If this deal pursuits you, apply quickly—limited-time affords can change at any time!