In case you’re a fan of maximizing your rewards, travelling for much less, or getting a little bit additional out of your funding technique, this can be a promotion price noting.

From Might 1 to July 31, 2025, TD Direct Investing is giving new and present shoppers the possibility to earn as much as 1,000,000 Aeroplan factors once you switch exterior belongings right into a TD Direct Investing account.1

Whether or not you’re investing for retirement, a house, or your subsequent journey, this supply is an distinctive alternative to earn invaluable factors whereas consolidating your funds.

Let’s take a more in-depth have a look at how this supply works, why TD Direct Investing is a best choice for self-directed traders, and easy methods to take full benefit of the rewards.

How the TD Direct Investing Aeroplan Take Flight Supply Works

The promotion rewards shoppers with tiered Aeroplan factors based mostly on the full worth of exterior belongings transferred into an eligible TD Direct Investing account.1

It’s essential to register for the supply utilizing the promo code AEROPLAN2025 by July 31, 2025, and provoke a switch of $10,000 or extra inside 30 days of registering for the supply.

The tiers begin at $10,000 for 10,000 Aeroplan factors and go all the best way as much as 1,000,000 factors for transfers of $2 million or extra.

Bonus factors are paid out in three instalments so long as your stability is maintained:

- 25% by November 30, 2025

- 25% by April 30, 2026

- 50% by August 31, 2026

For instance, If register for the promotion earlier than July 31, 2025 and switch $250,000 inside 30 days, you’ll obtain 37,500 Aeroplan factors by November 30, 2025, one other 37,500 factors by April 30, 2026, and the remaining 75,000 by August 31, 2026.

It’s essential to preserve the complete worth of your qualifying belongings in your account(s) all through the whole holding interval. In case you withdraw greater than 5% of your stability, you’ll forfeit any remaining factors.

Qualifying belongings should come from an exterior monetary establishment that’s not a part of TD Financial institution Group. Transfers from TD Canada Belief, TD Wealth, or TD Direct Investing accounts usually are not eligible for this supply.

Additionally, belongings which have beforehand acquired bonuses from different TD promotions are excluded.

Why Aeroplan Factors Are So Beneficial

Aeroplan is among the most versatile and rewarding loyalty packages in Canada, with flight redemptions out there on Air Canada and over 45 airline companions.

Whether or not you’re trying to fly short-haul in financial system or get pleasure from lie-flat seats in worldwide enterprise class, Aeroplan gives large worth, particularly when used strategically.

For instance, a one-way enterprise class flight on ANA from Vancouver to Tokyo can value as little as 55,000 Aeroplan factors. With the very best tier on this supply, that’s sufficient for over 9 spherical journey enterprise class flights to Japan, a dream journey for any Asia-bound traveller.

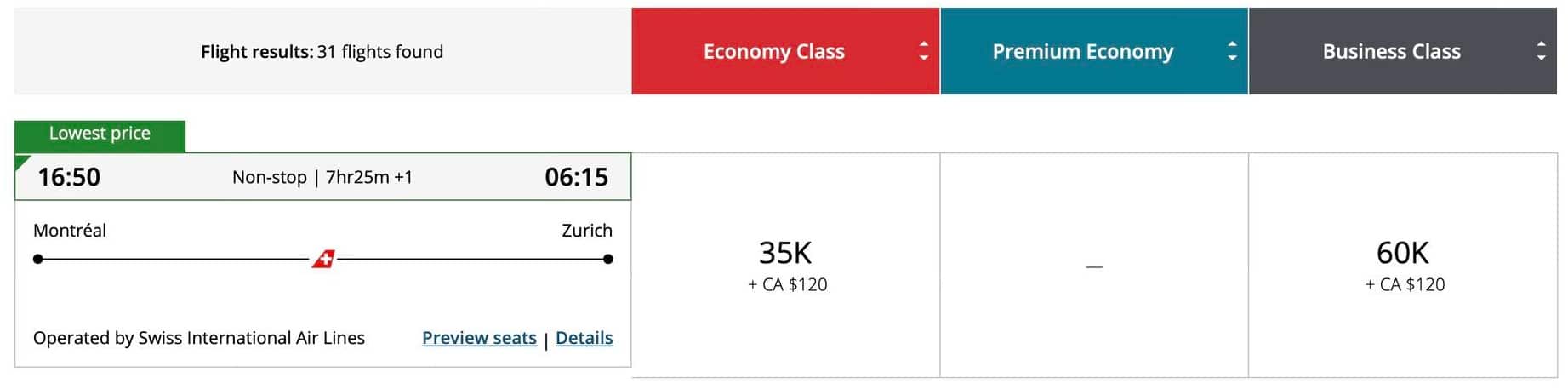

And it’s not simply restricted to ANA. If Europe is looking, a one-way enterprise class flight from Montreal to Zurich on SWISS can go for as little as 60,000 Aeroplan factors.

And with Aeroplan’s huge community of 45+ airline companions and stopovers for simply 5,000 additional factors, you may stretch your factors additional than virtually some other program in Canada.

Whether or not you’re planning to fly in model or stretch your factors on a number of financial system redemptions, this supply might be your probability to spice up your stability considerably—and begin reserving the sorts of journeys you didn’t assume have been doable.

Eligible Accounts and Transfers

This supply applies to a broad choice of account sorts, together with private and company funding accounts:

- Money (single or joint account holder)

- Margin (single or joint account holder)

- Tax-Free Financial savings Account (single account holder) (TFSA)1

- Registered Retirement Financial savings Plan (single account holder) (RRSP)1

- Registered Training Financial savings Plan (single account holder) (RESP)2

- Self-Directed Locked-In Retirement Accounts (LIRA)1

- Self-Directed Locked-In Retirement Financial savings Plan (LRSP)3

- Company Account

Account(s) not eligible for the supply embody:

- Any non-personal accounts apart from company

- Retirement Revenue Fund (RIF)1

- Life Revenue Fund (LIF)1

- Registered Incapacity Financial savings Plan (RDSP)1

- First House Financial savings Account (FHSA)1

You’ll have to switch web new belongings from outdoors the TD ecosystem. That features shares, ETFs, GICs, mutual funds, and money. Transfers from one other TD account, comparable to TD Wealth or TD Direct Investing, aren’t eligible.

Credit score Card Requirement: Which Playing cards Qualify

With a view to take part, you’ll additionally want to carry an eligible TD Aeroplan bank card in good standing as of July 31, 2025, and preserve it energetic till August 31, 2026.

The checklist of eligible TD Aeroplan bank cards consists of the next:

However this isn’t only a technical requirement. It’s additionally an effective way to speed up your Aeroplan incomes technique.

TD Aeroplan playing cards are among the many most rewarding co-branded playing cards in Canada, providing beneficiant welcome bonuses, excessive earn charges on on a regular basis purchases, and built-in journey advantages that improve your Aeroplan membership.

TD® Aeroplan® Credit score Playing cards

Relying on the cardboard, you would earn as much as 85,000 Aeroplan factors as a welcome bonus, factors that stack completely with the Direct Investing bonus.

You’ll additionally earn as much as 1.5–2x Aeroplan factors on eligible purchases like groceries, fuel, and journey, permitting you to continue to grow your stability even after the funding bonus pays out.

On prime of that, TD Aeroplan playing cards unlock most well-liked pricing on Aeroplan redemptions for Air Canada flights, and a few playing cards even include free first checked baggage, Maple Leaf Lounge entry, or Precedence Airport Advantages when flying with Air Canada.

In different phrases, holding a TD Aeroplan card isn’t nearly ticking a field. It’s about unlocking much more worth from the factors you earn by this investing promotion. In case you don’t already maintain one, now’s the proper time to use and double-dip on rewards.

What Makes TD Direct Investing a Sturdy Platform?

For anybody trying to handle their very own portfolio, TD Direct Investing is a self-directed investing brokerage platform operated by TD Waterhouse Canada Inc., a subsidiary of The Toronto-Dominion Financial institution.

Purchasers can entry markets utilizing WebBroker, TD’s desktop buying and selling device, or use the cell app to handle their account on the go. There’s additionally an Superior Dashboard for energetic merchants, full with real-time quotes, customizable layouts, and streaming information.

You’ll even have entry to a broad vary of funding choices. TD Direct Investing helps buying and selling in Canadian and U.S. shares, ETFs, mutual funds, bonds, and GICs. IPO participation is accessible too, as are instruments for managing registered and non-registered accounts.

Price Concerns

Whereas TD Direct Investing isn’t the most affordable platform in the marketplace, it’s aggressive—particularly once you issue within the measurement of the Aeroplan bonus.

Inventory trades value $9.99 every for many customers, and drop to $7.00 if you happen to commerce no less than 150 instances per quarter. Choices contracts value a further $1.25 per contract.

Mutual fund purchases are commission-free, and account upkeep charges are waived in case your family holds no less than $15,000 in belongings throughout eligible TD Direct Investing accounts.

One factor to remember is the $150 transfer-out charge per account if you happen to select to maneuver your belongings elsewhere afterward.

That stated, with a possible 1,000,000 Aeroplan factors on the desk, the upfront worth far outweighs that value for many shoppers.

Easy methods to Qualify and Optimize the Supply

To profit from the TD Direct Investing Aeroplan supply, timing and technique matter.

Begin by registering for the supply utilizing the promo code AEROPLAN2025 by July 31, 2025. You’ll have 30 days from registration to provoke your switch, and 60 days to finish it.

Extra contributions might be made up till August 31, 2025, and can depend towards your qualifying whole.

To obtain your full bonus, preserve your Aeroplan-eligible bank card and preserve your account stability intact till August 31, 2026. Keep away from withdrawing greater than 5% of your transferred belongings otherwise you’ll threat forfeiting remaining factors.

In case you’re simply shy of a better tier, think about topping up your account or consolidating throughout a number of TD accounts (together with household-linked accounts) to succeed in a much bigger bonus.

Conclusion

The TD Direct Investing 2025 Aeroplan Take Flight Supply is among the most rewarding brokerage promotions we’ve seen in Canada.

With the possibility to earn as much as 1,000,000 Aeroplan factors, it bridges the hole between monetary technique and journey rewards in a means that’s laborious to disregard.

In case you’ve been occupied with consolidating your investments or switching platforms, this supply makes it properly price doing so. Add within the capacity to pair the promotion with a TD Aeroplan bank card, and also you’re taking a look at an extremely highly effective combo for rising your factors stability.

Whether or not you’re chasing a bucket-list journey or simply need a smarter method to make investments, this promotion provides you a singular method to obtain each targets directly.

Disclaimer

All emblems are the property of their respective homeowners.

®Aeroplan is a registered trademark of Aeroplan Inc., used below license.

®The Air Canada maple leaf brand is a registered trademark of Air Canada, used below license.

*Trademark of Visa Worldwide Service Affiliation and used below license.

TD Direct Investing, TD Wealth Monetary Planning and TD Wealth Personal Funding Recommendation are divisions of TD Waterhouse Canada Inc., a subsidiary of The Toronto-Dominion Financial institution.

TD Simple Commerce™ is a service of TD Direct Investing, a division of TD Waterhouse Canada Inc., a subsidiary of The Toronto-Dominion Financial institution.

TD Wealth Monetary Planning Direct is a service providing from TD Wealth Monetary Planning, a division of TD Waterhouse Canada Inc., a subsidiary of The Toronto-Dominion Financial institution.

TD Wealth Personal Funding Counsel represents the services provided by TD Waterhouse Personal Funding Counsel Inc., a subsidiary of The Toronto-Dominion Financial institution.

TD Wealth Personal Banking companies are provided by The Toronto-Dominion Financial institution.

TD Wealth Personal Belief companies are provided by The Canada Belief Firm.

TD Financial institution Group means The Toronto-Dominion Financial institution and its associates, who present deposit, funding, mortgage, securities, belief, insurance coverage and different services or products.