Tangerine has elevated welcome bonuses for its duo of money again bank cards: the Tangerine Cash-Again Mastercard and the Tangerine® Cash-Again World Mastercard®*.

This time, you may earn as much as $120 money again on the Tangerine® Cash-Again World Mastercard®*, and as much as $100 money again on the Tangerine Cash-Again Mastercard.

These presents can be found via to January 30, 2026, so let’s see what’s at stake this time round.

Tangerine® Cash-Again World Mastercard®*: $120 Money Again

The Tangerine® Cash-Again World Mastercard®* is presently providing $120 money again upon spending $1,500 within the first three months.

Importantly, this cash-back increase comes along with the money again you earn in your spending.

For a card with no annual payment and a really cheap minimal spending requirement, that is definitely a stable provide within the money again world of Canadian bank cards.

This card was previously referred to as the Tangerine World Mastercard.

In the event you’re , this provide runs via to January 30, 2026, leaving loads of time to use.

Tangerine® Cash-Again World Mastercard®*

- Earn $120 money again upon spending $1,500 within the first three months

- Then, earn 2% money again on two classes of your alternative

- Plus, get an additional bonus class whenever you redeem your rewards right into a Tangerine Financial savings account

- In your bonus rewards, select from groceries, furnishings, eating places, resort/motel, fuel, recurring invoice funds, drugstores, house enchancment, leisure, public transportation & parking, e-games, health & sports activities golf equipment, and international foreign money spend

- Cell system insurance coverage whenever you purchase your telephone with the cardboard

- Minimal earnings: $50,000 private or $80,000 family

- Annual payment: $0

Tangerine Cash-Again Mastercard: 10% Money Again within the First Two Months

In the meantime, the Tangerine Cash-Again Mastercard is providing 10% money again on the primary $1,000 spent within the first two months, equal to $100 money again.

That’s all there’s to it, with no requirement to spend in any specific classes or to carry the cardboard for any specified size of time.

The ten% money again provide has been prolonged as soon as once more, this time via to January 30, 2026.

That is decrease than the very best 15% money again welcome provide that Tangerine has put out previously few years; nevertheless, with no annual payment and a low minimal spending requirement to maximise the provide, it falls squarely within the class of low-hanging fruit.

Tangerine Cash-Again Mastercard

- Earn 10% money again within the first two months on as much as $1,000 spent

- Then, earn 2% money again on as much as three classes of your alternative

- Plus, earn 0.5% money again on all different purchases

- In your bonus rewards, select from groceries, furnishings, eating places, resort/motel, fuel, recurring invoice funds, drugstores, house enchancment, leisure, public transportation & parking, e-games, health & sports activities golf equipment, and international foreign money spend

- No minimal earnings requirement

- Annual payment: $0

What’s Distinctive Concerning the Tangerine Credit cards?

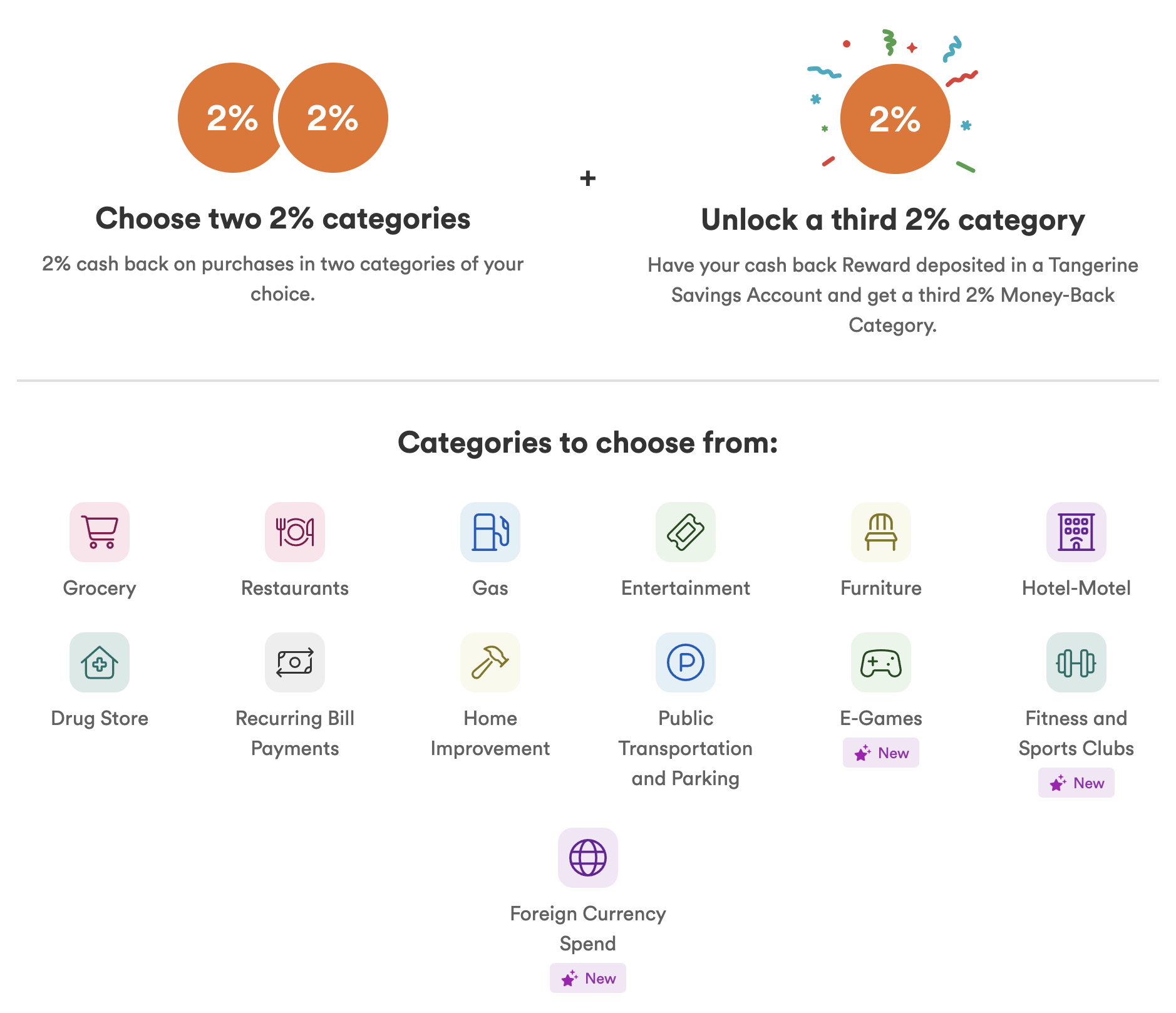

Tangerine is thought for providing a “select your personal journey” strategy to bonus incomes classes: you’ll obtain 2% money again on as much as three classes of your alternative.

That is similar throughout each the Tangerine® Cash-Again World Mastercard®* and the Tangerine Cash-Again Credit score Card.

This makes both a superb long-term “keeper card” for nearly anybody, since you may merely select the classes that you just mostly spend in, after which use it as your common card for ongoing purchases in these classes.

The 13 classes out there for choice are as follows:

- Groceries

- Furnishings

- Eating places

- Lodge/Motel

- Gasoline

- Recurring invoice funds

- Drugstore

- Residence enchancment

- Leisure

- Public transportation & parking

- E-games

- Health & sports activities golf equipment

- International foreign money spend

Cardholders who solely maintain the bank card get to decide on two classes, whereas those that have a Tangerine Financial savings account can select a 3rd class.

Even when you use extra highly effective bank cards for a number of the extra commonplace spending classes (like groceries and eating), Tangerine presents an elevated 2% return on choose classes that no different bank card matches, reminiscent of furnishings and residential enchancment.

In all different classes, each Tangerine playing cards earn a flat 0.5% money again, so it wouldn’t essentially be the only option for normal uncategorized purchases.

In the event you’re deciding between the Tangerine® Cash-Again World Mastercard®* and the Tangerine Cash-Again Credit score Card, observe that they’ve similar incomes buildings and each don’t have any annual payment.

We’d advocate these with a respective private or family annual earnings of a minimum of $50,000 or $80,000 to use for the Tangerine® Cash-Again World Mastercard®*, because it presents a beefier insurance coverage bundle together with automobile leases and cellular system safety.

Conclusion

Tangerine elevated welcome presents for each the Tangerine® Cash-Again World Mastercard®* and the Tangerine Cash-Again Mastercard.

Now is a good time to use for anybody eyeing the Tangerine bank cards for his or her “select your personal journey” bonus construction.

The present presents can be found till January 30, 2026.