The TD First Class Journey® Visa Infinite* Card presents a stable welcome bonus, beneficiant incomes charges, and robust journey insurance coverage.

This card earns versatile TD Rewards Factors, which could be redeemed in quite a few methods however are most beneficial when redeemed for journey booked by way of Expedia® for TD.

On this assessment, we’ll discover what’s on supply with this card that can assist you decide if it may be value including to your pockets as a part of your general Miles & Factors technique.

At a Look

- Annual Price: $139

- Supplementary cardholders: $50 (for first card), $0 (for all further playing cards)

- Minimal annual revenue: $60,000 (private, $100,000 (family)

- Estimated credit score rating: Good to Wonderful

- Ranking: 4/5

What we love: airport lounge entry, good journey insurance coverage, and versatile factors redemptions

What we’d change: take away international transaction charges to make it a stronger journey bank card selection

Rotating Sturdy Welcome Bonus

In the previous couple of years, the TD First Class Journey® Visa Infinite* Card has supplied a welcome bonus that ranges from 75,000–165,000 TD Rewards Factors, which are value round $375–675 (all figures in CAD) in worth relying on the way you select to redeem the factors.

The welcome bonus is usually supplied in a few chunks, with a small share being earned upon your first buy and the remainder being earned after you meet a single minimal spending requirement.

As at all times, with a minimal spending requirement, you’ll wish to be conscientious when making use of for the cardboard to be sure to have sufficient upcoming bills to earn the total welcome bonus. Pleasantly, the minimal spending requirement for the TD First Class Journey® Visa Infinite* Card has traditionally been very cheap, requiring round $5,000-7,500 in spending over a 180-day interval.

With the cardboard additionally typically waiving the annual charge for the primary yr, it is a very robust welcome supply that may add some actual worth to your Miles & Factors portfolio.

TD First Class Journey® Visa Infinite* Card

- Earn 20,000 TD Rewards Factors upon making your first buy†

- Earn 145,000 TD Rewards Factors upon spending $7,500 inside 180 days of account opening†

- Plus, earn a Birthday Bonus of as much as 10,000 TD Rewards Factors†

- Plus, earn 8x TD Rewards Factors† on eligible journey purchases whenever you e-book by way of Expedia® for TD†

- Get an annual TD Journey Credit score† of $100 whenever you e-book by way of Expedia® for TD†

- Use your rewards for any journey bookings obtainable on Expedia® for TD†

- 4 complimentary lounge visits by way of the Visa Airport Companion Program†

- Minimal revenue: $60,000 private or $100,000 family

- Annual charge: $139, rebated for the primary yr†

- Provide efficient as of September 4, 2025†

Sturdy Incomes Charges

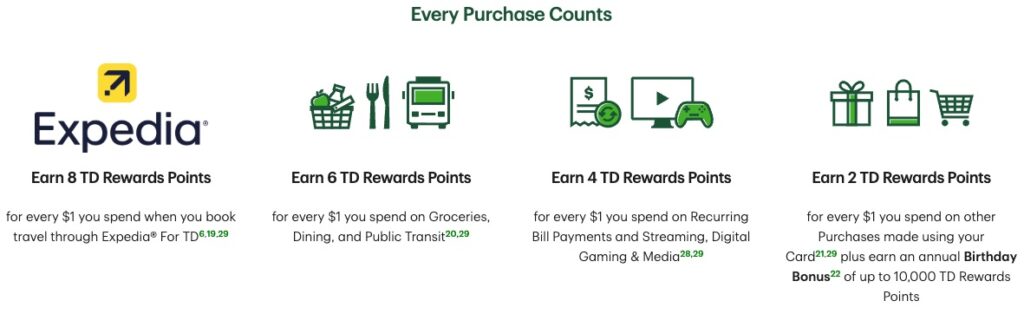

The TD First Class Journey® Visa Infinite* Card earns TD Rewards Factors in a tiered construction, as follows:

- Earn 8 TD Rewards Factors per greenback spent on eligible journey booked by way of Expedia® for TD †

- Earn 6 TD Rewards Factors per greenback spent on eligible groceries and eating places †

- Earn 4 TD Rewards Factors per greenback spent on eligible recurring invoice funds, streaming, digital gaming and media purchases †

- Earn 2 TD Rewards Factors per greenback spent on all different eligible purchases †

These charges are equal to a 4%, 3%, 2%, and 1% return, respectively, in the event you select to redeem your factors for his or her most worth of 0.5 cents per level, obtainable on journey booked by way of Expedia® for TD.

In the event you typically e-book your journey by way of Expedia (otherwise you’re prepared to begin doing so), these are some notably beneficiant incomes charges.

Plus, incomes as much as 3% in return worth on groceries and eating places and as much as 2% again on recurring invoice funds is fairly good by any measure, albeit not the very best in Canada.

It’s value noting that there’s a $25,000 annual spending cap for every of the elevated classes. When you’ve reached it, your incomes price will drop right down to the baseline price of two TD Rewards Factors per greenback spent.†

Versatile Rewards Forex

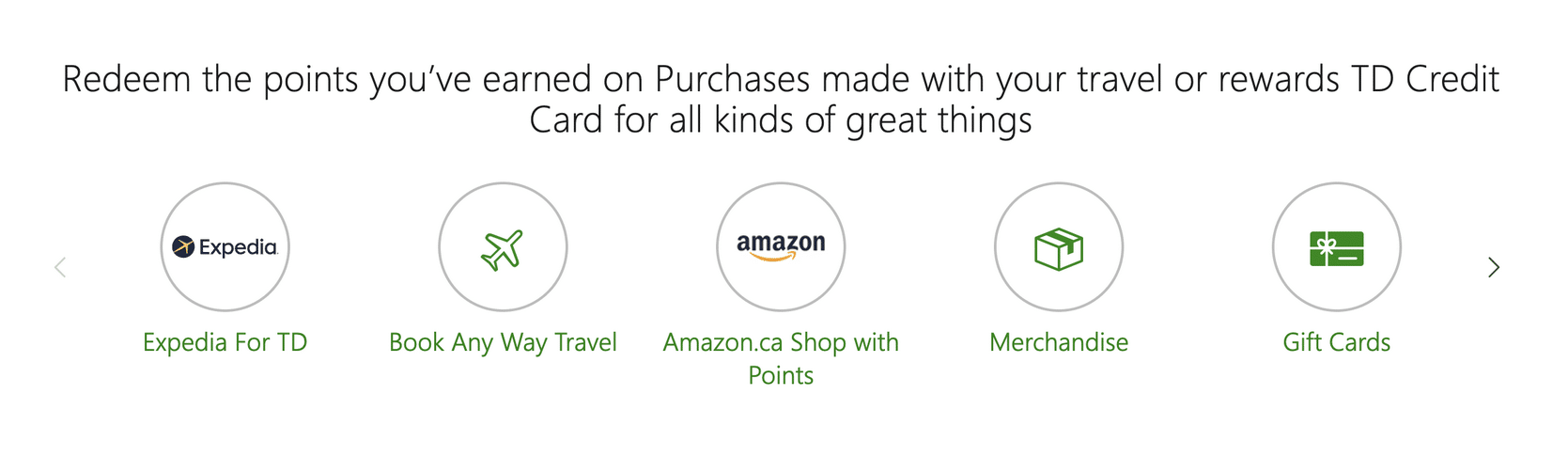

As we talked about above, the TD First Class Journey® Visa Infinite* Card earns TD Rewards Factors. These versatile factors could be redeemed in many various methods, together with for merchandise, reward playing cards, assertion credit, and journey.

Though TD Rewards Factors can’t be transferred to any exterior airline or lodge loyalty applications, you possibly can nonetheless redeem them for flights, motels, and different journey bills by both reserving by way of Expedia® for TD or instantly with any vendor.

These two choices are probably the most worthwhile methods to redeem your TD Rewards factors, permitting you to take pleasure in a price of 0.5 cents per level when redeeming by way of Expedia® for TD and 0.4 cents per level when reserving your individual journey instantly with distributors.

Because of their flexibility, TD Rewards Factors could be very useful to have round since they can assist cowl journey bills that may’t be booked by way of different loyalty applications, like cruises, excursions, and Disney tickets, saving you a good amount of cash in your subsequent journey.

Moreover, with the E book Any Manner characteristic, you possibly can e-book an Airbnb or instantly with a smaller boutique lodge after which apply your TD Rewards Factors as a press release credit score to offset the associated fee.

Additionally, in the event you redeem your TD Rewards Factors in opposition to bigger E book Any Manner journey bills, you’ll achieve entry to an improved redemption price of 0.5 cents per level for any quantity over $1,200.†

You may learn extra about these versatile factors and the way to maximize their worth in our TD Rewards information.

Further Perks & Advantages

When it comes to perks and advantages, the TD First Class Journey® Visa Infinite* Card presents a $100 journey credit score in your first eligible lodge or trip package deal bookings over $500 made by way of Expedia® for TD,† and the cardboard additionally presents reductions on automobile leases by way of Avis and Price range.†

The cardboard additionally comes with 4 complimentary annual lounge passes by way of the Visa Airport Companion Program. With these passes, you possibly can entry collaborating lounges worldwide, which provides consolation and comfort to your travels.†

Moreover, you’ll obtain a Birthday Bonus of factors in your card’s yearly anniversary which is the same as 10% of the overall variety of factors you earned all through the previous 12 months, as much as 10,000 factors.

What Else Does the Card Provide?

Along with the robust incomes charges, versatile factors, and the perks listed above, the TD First Class Journey® Visa Infinite* Card additionally presents robust and diversified journey insurance coverage, together with journey medical insurance coverage, flight/journey delay insurance coverage, journey cancellation/journey interruption insurance coverage, automobile rental insurance coverage, and extra.

In reality, this card was voted because the winner of the 2023 Prince of Journey Awards for Greatest Credit score Card for Journey Insurance coverage!

The total breakdown of the insurance coverage supplied on this card is as follows:

- Widespread provider journey accident insurance coverage: As much as $500,000†

- Journey medical insurance coverage: as much as $2 million for 21 days (aged 64 and youthful) or 4 days (aged 65 and older)†

- Flight/journey delay insurance coverage: As much as $500 for delays of 4 hours or extra†

- Journey cancellation insurance coverage: as much as $1,500 per particular person ($5,000 most)†

- Journey interruption insurance coverage: as much as $5,000 per particular person ($25,000 most)†

- Delayed and misplaced baggage insurance coverage: As much as $1,000 for delays of six hours or extra†

- Auto rental collision/loss harm insurance coverage: As much as 48 consecutive days†

- Resort/motel housebreaking insurance coverage: As much as $2,500†

As a cardholder, you’ll additionally take pleasure in entry to product safety and prolonged guarantee protection, plus cellular machine insurance coverage, all of which may prevent a ton of cash in case your new cellular machine or product will get unintentionally broken or stolen.

What We Want It Provided

Whereas the TD First Class Journey® Visa Infinite* Card is powerful general, there are a number of areas that might be improved to make it a top-tier journey card.

First, the two.5% international transaction charge makes it much less interesting for purchases overseas. A terrific journey card ought to be the one you depend on each at dwelling and whereas travelling.

Many motels require fee upon check-in, which regularly means a international foreign money cost in the event you’re outdoors Canada. Add eating, transportation, and day-to-day bills to the combination and all of the sudden you’re paying an additional 2.5% on virtually every part. That’s removed from superb.

One other limitation is the shortage of switch companions. TD Rewards Factors are versatile for fixed-value redemptions, however not like applications reminiscent of American Specific Membership Rewards, they’ll’t be transformed into airline or lodge loyalty currencies. That limits your upside in the event you’re chasing premium flights or luxurious lodge stays.

Lastly, redemptions outdoors of Expedia for TD solely fetch 0.4 cents per level. It will be a significant enchancment if TD supplied a flat 0.5 cents per level throughout all journey bookings, much like how Scene+ factors at all times redeem at 1 cent per level for any journey buy.

This could be particularly helpful since platforms like Reserving.com or Agoda typically value motels extra competitively in areas reminiscent of Asia.

Conclusion

The TD First Class Journey® Visa Infinite* Card is a superb card for offsetting journey bills due to its beneficiant incomes charges and constantly robust welcome bonus.

Incomes TD Rewards Factors, this card is especially good at serving to you cowl journey bills which might be in any other case troublesome to entry with loyalty applications, reminiscent of Disney tickets, boutique motels, and actions/excursions.

Plus, with its stable journey insurance coverage protection, this card can help your adventures in additional methods than one and is definitely value contemplating in the event you’re in a position to benefit from its many options and advantages.

† Phrases and circumstances apply. Please confer with the TD web site for probably the most up-to-date product info.