Renting a automotive ought to be easy, however anybody who’s stood on the counter is aware of how briskly the prices pile up. That “economic system automotive for $39 a day” turns into $75+ when you add collision injury waivers, charges, and people sneaky “improve” solutions.

The worst half? Many Canadians have already got the protection they’re being offered — they simply don’t notice their bank card contains it.

With the precise bank card, it can save you on insurance coverage, unlock automotive rental reductions, and even take pleasure in elite perks like upgrades or skipping the road.

It’s not nearly saving cash — it’s about making the rental course of smoother with peace of thoughts.

Let’s discover what to search for, the right way to use these advantages correctly, and which playing cards stand out from the remainder.

What Makes a Nice Credit score Card for Automotive Leases?

There’s extra to renting a automotive than getting behind the wheel. A stable bank card shouldn’t solely cowl the fundamentals but additionally step in when issues go fallacious — and ideally, make the method smoother.

On the core of rental advantages is protection for injury or theft of the car — generally known as Collision Injury Waiver (CDW) or Loss Injury Waiver (LDW).

Let’s be clear: CDW/LDW isn’t technically insurance coverage. It’s a contractual waiver that protects you from paying for injury to the rental automotive — together with theft, vandalism, and generally related charges like loss-of-use or towing.

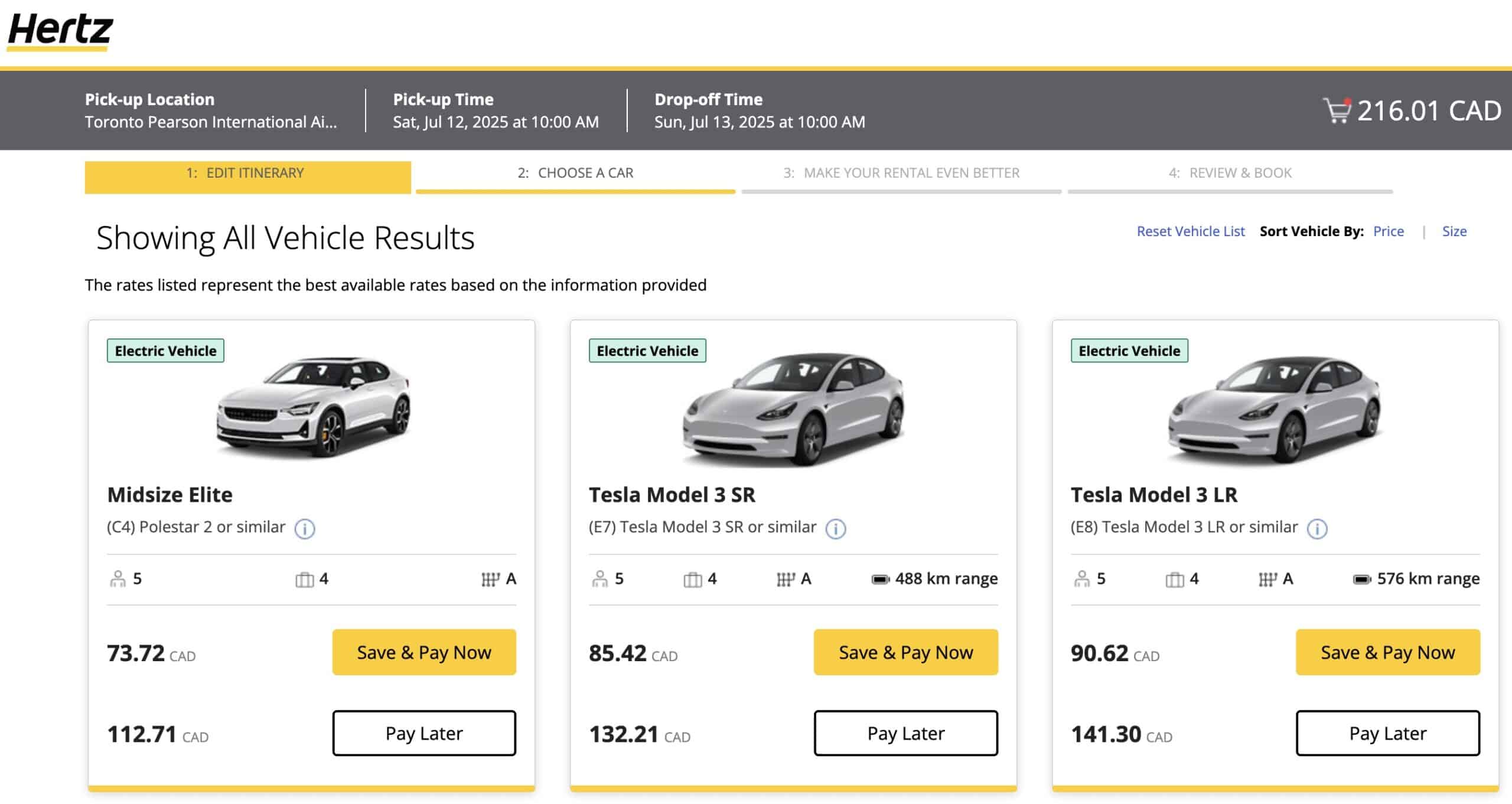

Most Canadian rental businesses cost $30–40/day for this waiver if you happen to don’t have already got it, however many premium bank cards present this protection at no additional value — so long as you pay in full with the cardboard and decline the rental firm’s personal CDW.

Nonetheless, this doesn’t imply you’re totally protected. Bank card CDW/LDW protection doesn’t embody third-party legal responsibility (injury to different autos, property, or folks), nor does it cowl medical payments or private accidents.

Some premium playing cards provide journey emergency medical or accident insurance coverage, which could present some safety for you — however not in your passengers or anybody else concerned.

And even then, protection will depend on your age, province, and eligibility. I sincerely hope you by no means have to seek out out the place that boundary lies.

Protection alone isn’t sufficient to be thought-about an amazing bank card. Some playing cards additionally grant elite standing with Hertz, Avis, or Nationwide.

This allows you to skip the counter and generally will get you upgraded to one thing higher than the bottom mannequin you booked. Others provide unique low cost codes or company charges that scale back every day rental prices and waive some additional charges.

And whereas uncommon, there’s even a card that gives roadside help, which is usually a lifesaver in case your automotive received’t begin otherwise you get locked out.

Prime Credit score Playing cards for Automotive Leases in Canada

Earlier than we get into particular suggestions, right here’s a fast overview of how a number of Canadian playing cards stack up for automotive leases. Most embody CDW/LDW with related limits, however protection length and car worth limits can fluctuate.

The Platinum Card® from American Specific

This is among the few playing cards that covers autos with an MSRP as much as $85,000 CAD. In case you’re reserving a luxurious SUV or one thing fancier than typical, that additional protection headroom actually issues.

The cardboard additionally grants you elite standing with Hertz and Avis, which may imply free upgrades, a further driver at no additional value, precedence service, and skipping the counter altogether.

You’ll additionally profit from Amex Platinum unique charges, which occur to be round 20% cheaper than retail primarily based on my expertise.

However that’s not all.

Amex Platinum bookings embody a complimentary 4-hour grace interval, letting you come back your rental later than the official time with out getting hit with an additional day’s cost.

Say you’re happening a one-night journey and begin your rental at 9 a.m. for a tenting getaway three hours away. To keep away from one other day cost, you’d need to get up at 6 a.m. and return it by 9 a.m. Not very best if you happen to’re not a morning particular person.

With the prolonged return window, you may carry it again by 1 p.m. stress-free.

Nonetheless with the extra 4 hour window you may return your vehical by 1pm with out getting hit with any charges.

The one draw back is that this card comes with a excessive annual payment of $799, so it’s solely worthwhile if you happen to journey regularly — or if you’d like the complete suite of Platinum perks to associate with your rental automotive advantages.

American Specific Platinum Card

- Earn 100,000 MR factors upon spending $10,000 within the first three months

- Plus, earn 50,000 MR factors upon spending $50,000 within the first yr

- Plus, earn 30,000 MR factors upon making a purchase order in months 15–17 as a cardholder

- Earn 2x MR factors on all eating and journey purchases

- Obtain an annual $200 journey credit score

- Obtain an annual $200 eating credit score

- Switch MR factors to Aeroplan and different frequent flyer applications for premium flights

- Limitless airport lounge entry for you and one visitor at Precedence Go, Plaza Premium, Centurion, and different lounges

- Credit and rebates for every day bills all year long with Amex Presents

- Bonus MR factors for referring household and buddies

- Annual payment: $799

Scotiabank Gold American Specific® Card

Whereas it doesn’t include rental automotive elite standing or charge codes, this card nonetheless packs a punch.

It covers leases as much as $65,000 CAD for as much as 48 days, and contains protection for loss-of-use, admin, and towing charges — which many playing cards overlook.

One of many largest perks is that it’s one of many few Canadian playing cards that fees no international transaction charges. In case you’re renting a automotive overseas, this will prevent a stunning quantity.

It additionally earns 6x Scene+ factors on Empire groceries, and 5x on different groceries and eating — making it a wonderful all-around spending card.

It’s been my go-to card for reserving automotive leases over the previous few years, and it nonetheless holds a high spot in my pockets.

Whereas it doesn’t provide most popular charges or loyalty perks, automotive rental reductions do pop up sometimes through Amex Presents — giving it a slight edge over most Canadian Visas and Credit cards.

Scotiabank Gold American Specific® Card

- Earn 20,000 Scene+ factors upon spending $2,000 within the first three months

- Plus, earn an further 20,000 Scene+ factors upon spending $7,500 within the first yr

- Earn 6x Scene+ factors at Sobeys, IGA, Safeway, FreshCo, and extra

- Plus, earn 5x Scene+ factors on groceries, eating, and leisure

- Additionally, earn 3x Scene+ factors on gasoline, transit, and choose streaming providers

- Redeem factors for an announcement credit score for any journey expense

- No international transaction charges

- Benefit from the unique advantages of being an American Specific cardholder

- Annual payment: $120

RBC® Avion Visa Infinite†

This well-known journey card contains CDW/LDW protection for leases as much as $65,000 CAD and 48 days.

What makes it additional helpful is entry to Hertz low cost codes, normally providing round 20% off. That low cost alone can rapidly add up over a couple of leases.

Whereas it lacks loyalty standing perks with automotive rental firms, its robust redemption flexibility and airline switch companions make it a gorgeous journey companion, whether or not you’re driving or flying.

RBC® Avion Visa Infinite†

- Earn 35,000 RBC Avion factors† upon approval†

- Earn 1.25x RBC Avion factors† on qualifying journey purchases

- Switch RBC Avion factors to British Airways Govt Membership and different frequent flyer applications for premium flights†

- Redeem Avion factors for flights with the RBC Air Journey Redemption Schedule†

- Minimal earnings: $60,000 private or $100,000 family

- Annual payment: $120†

- Supplementary card payment: $50

Triangle™ World Elite Mastercard®

This card shines domestically. Whereas the rental protection maxes out at 31 days and doesn’t provide any elite standing or charge codes, it contains one of many strongest roadside help packages of any Canadian bank card.

That features 5 service calls per yr, 250 km towing, and assist with lockouts or lifeless batteries — a uncommon perk for a no-fee card.

In case you’ve chosen the Member Plan, the protection applies no matter which car you’re driving or a passenger of — or the way you’ve paid for the rental automotive.

This makes it the proper companion card to make use of alongside one of many others. Use your important card for LDW/CDW protection, and the Triangle™ World Elite Mastercard® for peace of thoughts on the highway — all at no additional value.

Canadian Tire Triangle World Elite Mastercard

- Earn 4% money again at Canadian Tire, Sport Chek, Marks, and extra

- Plus, earn 3% money again at grocery shops

- And, earn as much as 7 cents per litre in Canadian Tire cash on eligible gas purchases

- Free Canadian Tire Roadside Help Gold Plan

- No payment, no curiosity buy financing at taking part retailers

- Annual payment: $0

Utilizing Credit score Card Insurance coverage Correctly

Having insurance coverage in your bank card is nice — but it surely solely works if you happen to use it correctly.

To be eligible, you have to decline the rental company’s CDW or LDW, and cost the complete value of the rental to your eligible bank card.

Most bank card insurance policies cowl you for as much as 48 consecutive days, although some, just like the Triangle™ World Elite Mastercard®, restrict it to 31 days. Protection normally excludes sure car sorts — like cargo vans, unique sports activities vehicles, or something with greater than eight seats.

One other widespread mistake? Not preserving documentation. If there’s an incident, your bank card issuer will count on you to submit proof of fee, injury stories, rental agreements, and presumably a police report — particularly for theft or vital injury.

And keep in mind, bank card CDW/LDW solely protects the rental car. It doesn’t cowl injury you trigger to others or their property, and it doesn’t cowl medical payments or stolen private gadgets.

Some playing cards provide separate journey accident insurance coverage, however this normally applies solely to you, the cardholder, and varies primarily based on age and province.

In case you’re uncertain or driving in unfamiliar circumstances, it might be price contemplating further protection from the rental firm — significantly Private Accident Insurance coverage (PAI) or legal responsibility safety.

Is It Straightforward to File a Credit score Card Insurance coverage Declare?

Sure, however provided that you’ve executed every part proper from the beginning.

Most bank cards require you to pay the rental firm first, then submit a reimbursement declare. That mentioned, in some instances — like a small windshield crack — the rental firm might deal with the paperwork immediately with the insurer. (Been there in Edmonton!)

To remain on the protected facet, be sure you hold all of the paperwork: your rental settlement, proof of fee with the cardboard, injury stories, restore invoices, and generally a police report.

The secret is performing quick and following the steps. Many insurers require you to inform them inside 48 hours, and also you’ll normally have 30–60 days to file your declare with all supporting paperwork.

Every card has its personal guidelines, timelines, and wonderful print, and lacking only one requirement can result in a denied declare.

I’ll cowl the complete declare course of in a future publish, however for now, learn your card’s insurance coverage booklet earlier than your journey, and hold each receipt and report useful in case one thing goes fallacious.

Conclusion

The perfect bank cards for automotive leases in Canada do extra than simply cowl you for scratches and dents. They aid you keep away from overpriced upsells, unlock loyalty perks, and even present peace of thoughts with perks like roadside help — all whereas saving you actual cash.

Whether or not you’re heading out for a fast weekend escape or an extended highway journey, selecting the best bank card could make your entire expertise smoother, cheaper, and rather a lot much less irritating.

And the following time the rental agent asks, “Would you want so as to add our injury waiver for peace of thoughts?”

you may smile and say, “No thanks. I’ve already received it.”