On this version of Head-to-Head, we’ll evaluate two bank cards from Marriott Bonvoy, one of many largest lodge applications for Canadians: the Marriott Bonvoy American Specific Card and the Marriott Bonvoy Enterprise American Specific Card.

Marriott Bonvoy is at the moment the one main lodge chain with a co-branded bank card in Canada. Each bank cards provide strong worth propositions with fairly low annual charges, in addition to some very fascinating perks and advantages.

For those who’ve received your eye on considered one of these playing cards, learn on to search out out which one is finest for you.

Marriott Bonvoy American Specific Card vs. Marriott Bonvoy Enterprise American Specific Card

Card Fundamentals

We’ll start with among the playing cards’ key traits: the bonuses, charges, and incomes charges.

1. Annual Charge

Each playing cards have very affordable annual charges, particularly when you think about the perks and advantages that come together with them, which we’ll describe intimately beneath.

The Marriott Bonvoy American Specific Card has an annual charge of $120, whereas the Marriott Bonvoy Enterprise American Specific Card has an annual charge of $150.

Verdict: The distinction of $30 makes the non-public Amex Bonvoy Card the winner right here.

2. Welcome Bonus

At present, the non-public Marriott Bonvoy American Specific Card affords as much as 55,000 Bonvoy factors while you apply through a refer-a-friend hyperlink.

Then again, the Marriott Bonvoy Enterprise American Specific Card affords as much as 60,000 Bonvoy factors.

Traditionally, the minimal spending requirement for the non-public model of the cardboard has hovered round $3,000, with a welcome bonus of between 50,000–70,000 Bonvoy factors, as much as a historic excessive of 105,000 factors.

For the enterprise model of the cardboard, the spending requirement has fluctuated from a low of $1,500 to a excessive of $5,000, with a while in between at $3,000. Just like the non-public card, the welcome bonus has ranged between 50,000–80,000 Bonvoy factors, as much as a excessive of 105,000 Bonvoy factors.

Verdict: The Bonvoy Enterprise Card tends to have a barely bigger welcome bonus than the non-public variant, giving it a slight edge on this measure.

3. Incomes Charges

Each bank cards have a wonderful incomes fee of 5 Bonvoy factors per greenback spent at Marriott inns, together with room prices, meals and beverage, and incidentals.

Moreover, each playing cards earn 2 Bonvoy factors per greenback spent on all different purchases.

Nonetheless, the Bonvoy Enterprise Card has one benefit that we don’t see with the non-public Bonvoy card, because it earns 3 Bonvoy factors per greenback spent on gasoline, eating, and journey.

Verdict: The extra incomes fee for the Bonvoy Enterprise Card makes it the clear winner. Gasoline, eating, and journey purchases could make up a major quantity of on a regular basis spending (particularly for enterprise house owners), unlocking the opportunity of incomes loads extra factors with the Bonvoy Enterprise Card.

Perks and Advantages

Typically, a journey bank card’s ongoing perks and advantages assist to justify its annual charge 12 months after 12 months. As you’ll see, the non-public and enterprise Bonvoy playing cards are largely comparable on this criterion.

1. Elite Qualifying Nights

15 elite qualifying nights are rewarded to cardholders of each merchandise, mechanically qualifying members for Silver Elite standing. This standing earns extra advantages corresponding to 10% bonus factors on stays and precedence late check-out.

Elite qualifying nights are helpful within the pursuit of extra significant ranges of standing, corresponding to Marriott Platinum Elite or Titanium Elite standing.

Upon reaching these tiers at 50 and 75 elite qualifying nights respectively, you’ll get pleasure from a set of perks when staying at inns underneath the Marriott umbrella, together with free breakfast, complimentary suite upgrades, and 4pm late check-out.

The 15 elite qualifying nights rewarded from each playing cards drop the necessities right down to 35 and 60 nights for Platinum and Titanium, respectively. Sadly, not like the US-issued variations of those playing cards, holding each the non-public and enterprise playing cards received’t stack to 30 elite qualifying nights.

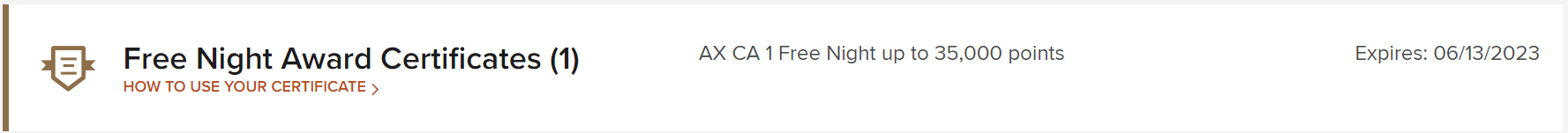

2. Anniversary Free Evening Award

Cardholders will obtain an annual Free Evening Award every anniversary date, valued at 35,000 Bonvoy factors.

Based mostly on our present valuation, we’d worth 35,000 Bonvoy factors at $280 (CAD), far outweighing each playing cards’ annual charges. This makes it fairly compelling so as to add each playing cards to your “keeper card” portfolio, to be stored and held for the Free Evening Award 12 months after 12 months.

For those who’re tactical in planning your award redemption, you may simply redeem the Free Evening Award for a lodge evening that may in any other case value greater than $315.

Moreover, you may top-up the Free Evening Award with an an extra 15,000 factors, for a redemption of as much as 50,000 factors. This needs to be sufficient to attain a really engaging upscale lodge at a major low cost.

Verdict: Since each playing cards provide the very same perks and advantages, they continue to be deadlocked on this class of comparability.

Different Components

Past the essential card options and ongoing advantages, what else units these two Marriott Bonvoy bank cards aside?

1. Ease of Getting Accepted

Fortuitously, neither card has a minimal revenue requirement for approval. As well as, approval for the Amex Bonvoy Enterprise Card is extra easy than you might suppose.

There’s no requirement to be a registered enterprise when making use of for the enterprise model; these working as sole proprietors or doing enterprise underneath their title can qualify.

2. Insurance coverage

Each the non-public and enterprise playing cards provide virtually similar insurance coverage advantages.

Each playing cards provide a reasonably primary package deal flight and baggage delay insurance coverage, lodge housebreaking insurance coverage, misplaced or stolen baggage insurance coverage, automotive rental theft and harm insurance coverage, and $500,000 in Journey Accident Insurance coverage.

Extra sturdy insurance coverage varieties like emergency medical protection, journey cancellation, and journey interruption or not discovered on both card.

As a product geared in direction of enterprise house owners, the Bonvoy Enterprise Card additionally affords protection of as much as $10,000 in case of everlasting complete incapacity as a sole proprietor as a consequence of unintended damage.

Verdict: This extra business-oriented insurance coverage protection provides the Bonvoy Enterprise Card a slight edge, though neither card ranks among the many finest decisions for journey insurance coverage available in the market.

3. Supplementary Playing cards

The private Bonvoy card affords free supplementary playing cards, as much as a most of 9 per account.

In the meantime, the enterprise model prices $50 per supplementary card, additionally permitting as much as a most of 9 playing cards per account.

Verdict: The private card wins on this class, with no extra prices for supplementary playing cards.

4. Referral Bonus

The Marriott Bonvoy Enterprise American Specific Card earns 15,000 Bonvoy factors per referral, as much as a most of 150,000 Bonvoy factors per calendar 12 months.

Then again, the non-public Marriott Bonvoy American Specific Card earns 10,000 Bonvoy factors per referral, as much as a most of 150,000 Bonvoy factors per calendar 12 months – though some cardholders are often focused for the next referral bonus of 15,000 Bonvoy factors.

Verdict: The Marriott Bonvoy Enterprise American Specific Card is the winner on this class, providing the superior referral bonus on an ongoing foundation.

[screenshot]

5. Visible Look

Each playing cards are similar with a clear, gray, and modern design, that includes Marriott Bonvoy’s brand within the top-right nook.

Conclusion

Total, it’s a reasonably shut race between Marriott Bonvoy‘s two co-branded bank cards within the Canadian market.

The Marriott Bonvoy Enterprise American Specific Card the next incomes fee of three Bonvoy factors per greenback earned on gasoline, eating, and journey, in addition to a superior referral bonus construction. In change, nevertheless, there’s the next annual charge of $150 in comparison with the non-public card’s $120.

Finally, each the non-public and enterprise bank cards are price making use of for and holding in the long term, given their robust ongoing advantages within the type of 15 elite qualifying nights and an anniversary Free Evening Award that outweighs the annual charge yearly.

For those who needed to choose one card, I’d advocate the enterprise model for a slight edge or the non-public model to avoid wasting on annual charges. Nonetheless, in case you’re trying to actually maximize Bonvoy factors, then choosing up each playing cards could be the wisest transfer.