On this version of Head-to-Head, we’ll evaluate the 2 Mastercard merchandise issued by Rogers Financial institution: the Rogers Pink Mastercard® (previously the Rogers Connections Mastercard) and the Rogers Pink World Elite® Mastercard.

Each playing cards provide money again on purchases, no annual charges, and helpful perks which might be particularly helpful for many who use Rogers services.

Let’s put the playing cards up towards one another to assist determine which is greatest in your pockets.

Rogers Mastercard vs. Rogers World Elite® Mastercard

Card Fundamentals

We’ll kick issues off with a have a look at the necessities provided by each playing cards: the welcome bonus, the annual charge, and the incomes charges.

1. Welcome Bonus

Presently, neither the Rogers Pink Mastercard® nor the Rogers Pink World Elite® Mastercard is providing a welcome bonus.

Verdict: A tie. No additional upfront worth on both card proper now.

2. Annual Charge

The Rogers Pink Mastercard and the Rogers Pink World Elite® Mastercard each have no annual charges,† placing them squarely on even floor on this class.

Verdict: It is a clear tie, since neither card requires an annual charge.

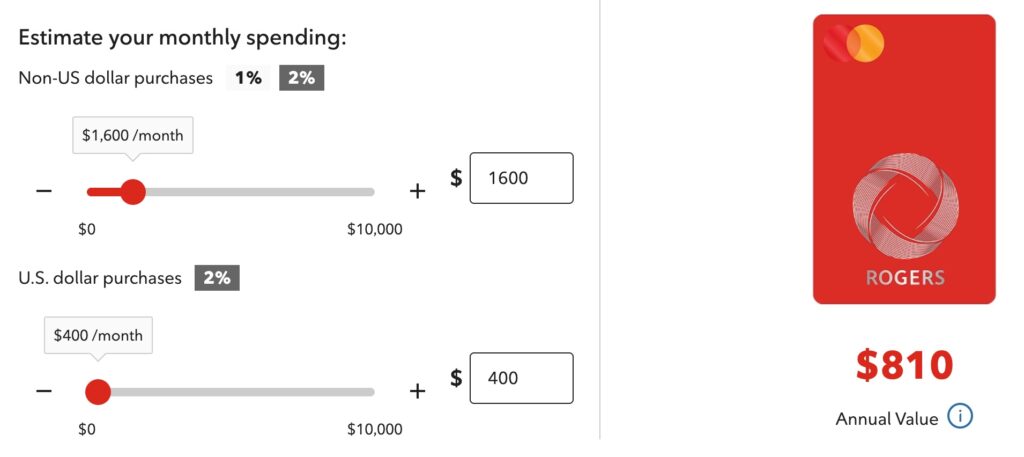

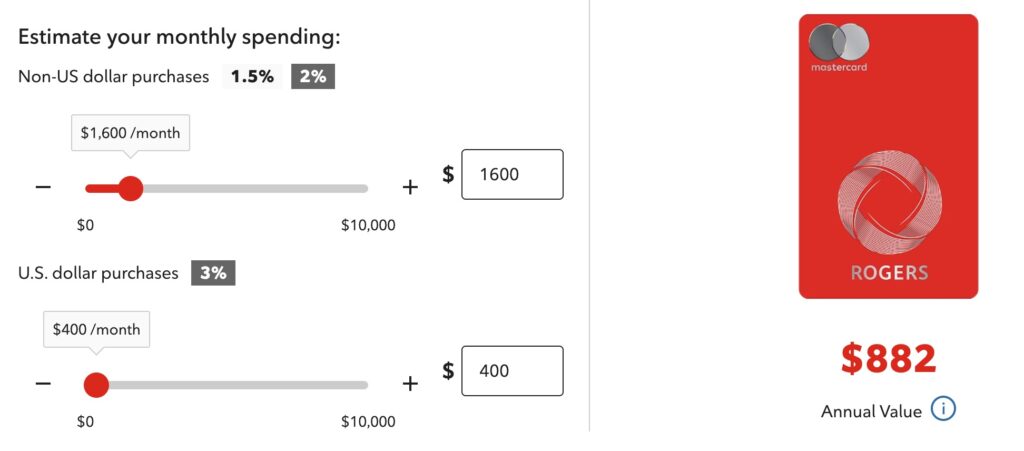

3. Incomes Charges

Each the Rogers Pink Mastercard and the Rogers Pink World Elite® Mastercard provide alternatives to earn money again on eligible purchases.

With the Rogers Mastercard, you possibly can earn money again on the following charges:

- 2% limitless money again on all eligible purchases in US {dollars}

- 2% limitless money again on non-US greenback purchases if in case you have a qualifying service with Rogers, Fido, or Shaw†

- In any other case 1% money again on all different eligible non- US greenback purchases†

Comparatively, the Rogers Pink World Elite® Mastercard gives the next barely elevated incomes charges:

- 3% limitless money again on eligible US greenback purchases†

- 2% limitless money again on eligible non-US greenback purchases if in case you have a qualifying service with Rogers, Fido, or Shaw†

- In any other case, 1.5% limitless money again on all different eligible non-US greenback purchases†

It’s price noting that the class incomes price for US greenback purchases on each playing cards is offset by a 2.5% international transaction charge levied by each playing cards. When you’ve got a excessive quantity of spending in US {dollars}, it’s possible you’ll need to contemplate a card with true no international transaction charges as an alternative.

Verdict: In the event you’re not a Rogers/Fido/Shaw buyer, the Rogers Pink World Elite® Mastercard wins (1.5% vs. 1%). If you’re a buyer, each playing cards earn 2% on non US greenback purchases, whereas World Elite nonetheless leads on USD purchases (3% vs. 2%). Nonetheless, each playing cards cost a 2.5% international transaction charge, so if a big share of your spending is in US {dollars}, these aren’t perfect decisions. Contemplate a no-FX card as an alternative.

Perks and Advantages

Typically, the incremental perks and advantages provided by bank cards can tip the scales in a single course over one other. Let’s check out the additional options on the Rogers Mastercard and the Rogers Pink World Elite® Mastercard.

1. Redeeming

With most money again bank cards, there usually aren’t fascinating methods to redeem your rewards past a press release credit score, and certainly, that is the case with each the Rogers Pink Mastercard® and the Rogers Pink World Elite® Mastercard.

Each playing cards earn money again that may be redeemed towards any buy made on the cardboard within the final 90 days.

To redeem your money again, you’ll want a minimal of $10 accessible in your account. Then, you’ll merely signal into your Rogers Checking account, and select which buy you’d wish to redeem towards.

Redeeming towards eligible Rogers, Fido, or Shaw purchases provides 50% extra cash again. That successfully makes a 2% earn behave like 3% while you funnel redemptions to these payments.

For instance, when you redeem $10 money again to pay for a Rogers, Fido, or Shaw invoice, it’ll get become a $15 assertion credit score.†

Now, when you had been to completely use the money again earned towards Rogers, Fido, or Shaw payments, the efficient baseline incomes price bumps as much as 3% money again.†

In different phrases, for each $100 you spend on the cardboard, you’ll earn the equal of $3 money again when it’s redeemed for an eligible Rogers, Fido, or Shaw invoice.

Verdict: Tie. The 50% redemption increase applies to each playing cards.

2. Further Options

Provided that each playing cards don’t have any annual charges, it’s not shocking that they each even have pretty restricted perks and advantages in comparison with bank cards with larger annual charges.

Of the advantages, one which the 2 playing cards have in widespread is the chance to buy a brand new telephone with a 0% rate of interest via the Equal Cost Plan.†

To make the most of this perk, you’ll have to pay for a brand new machine that prices at the least $250 utilizing your Rogers bank card at a Rogers, Shaw, or Fido retailer, and afterwards, you’ll have the ability to arrange financing for a 36-or 48-month time period.†

In the event you aren’t in a position to pay for a telephone outright, then this perk will be significantly helpful, because you received’t incur any curiosity or further charges, so long as you make your month-to-month funds.†

Past this perk, the 2 merchandise every provide a few card-specific advantages that could be of worth.

Each playing cards additionally provide 5 Roam Like Dwelling days for Rogers cell phone plans, which helps you to get pleasure from your telephone plan even whilst you’re overseas without charge.† Relying on the place you’re travelling, this profit may have a price of as much as $90.†

Uniquely, the Rogers Pink World Elite® Mastercard supplies cardholders with a complimentary membership to Mastercard Journey Go offered by DragonPass.† As a member, you’ll have entry to over 1,300 airport lounges worldwide.†

It’s essential to notice, nonetheless, that this profit doesn’t cowl the price of entry. To make the most of the collaborating airport lounges and their facilities, you’ll have to pay $32 (USD) per go to.†

Verdict: It’s troublesome to choose a winner on this class, however finally, we could should facet with the Rogers Pink World Elite® Mastercard for the incremental lounge entry membership.†

Nonetheless, there are many different playing cards that provide complimentary entry to airport lounges.

Different Elements

1. Insurance coverage

With regards to insurance coverage, the Rogers Pink Mastercard® doesn’t provide any protection, whereas its World Elite® counterpart does provide some fundamental protection while you use the cardboard to make eligible purchases and bookings.

By reserving your journey with the Rogers Pink World Elite® Mastercard, you possibly can make the most of the emergency medical protection, in addition to the journey cancellation, interruption, and delay insurance coverage for brief out-of-province and out-of-country journeys.†

Moreover, while you reserve and pay for a automobile rental utilizing the World Elite® card, you’re supplied with some protection for theft of and harm to the car.†

Lastly, the World Elite® card additionally supplies buy safety and prolonged guarantee protection, which will be useful when you run into points with an eligible merchandise not too long ago bought on the cardboard.†

Verdict: On this class, the World Elite card is the clear winner, because it supplies some restricted insurance coverage protection in comparison with the zero protection provided by the Rogers Mastercard.

2. Ease of Approval

To be eligible for the Rogers Pink World Elite® Mastercard, it’s essential have a minimal private annual earnings of at the least $80,000, or a family earnings of at the least $150,000.†

Then again, the Rogers Pink Mastercard® has no minimal earnings requirement, and also you’re simply topic to credit score approval.†

Verdict: With no minimal earnings required, the Rogers Pink Mastercard® is extra accessible, and comes out forward on this class.

3. Supplementary Cardholders

Each the Rogers Pink Mastercard® and the Rogers Pink World Elite® Mastercard can help you add as much as 9 supplementary cardholders for no further charge.

Verdict: It’s a tie right here, since there’s no price both means.

4. Visible Look

Each playing cards use an identical vertical design with the Rogers brand; beauty variations shouldn’t drive your choice.

Conclusion

With no welcome bonus on both card, the selection comes right down to the way you spend and what you want. In the event you’re a Rogers/Fido/Shaw buyer who redeems to these payments, each playing cards successfully flip 2% earn into 3% because of the 50% redemption increase. In the event you’re not a buyer, the Rogers Pink World Elite® Mastercard pulls forward with 1.5% on non-USD purchases (vs. 1% on Pink) and three% on USD (vs. 2% on Pink).

In the event you’re a frequent traveller and also you care about safety, the World Elite’s insurance coverage suite and DragonPass membership (pay-per-visit) make it the extra full package deal—offered you meet the $80k/$150k earnings requirement.

Lastly, Each playing cards cost a 2.5% international transaction charge, so if an enormous chunk of your spending is in US {dollars}, seize a real no international transaction charge card as an alternative.

In any other case, with no annual charge on both product, you possibly can strive the one that matches your scenario immediately—and your pockets received’t complain.

†Phrases and circumstances apply. Consult with the cardboard issuer’s web site for full, up-to-date info.