Think about logging into your airline account, excited to ebook that dream journey, solely to seek out out that your factors have expired.

It’s a irritating state of affairs that occurs extra usually than you suppose, as the truth is that many people don’t understand that factors can expire if we’re not utilizing or incomes them recurrently.

As we wrap up the yr 2025, it’s a superb time to tackle a easy however essential activity: reviewing your loyalty accounts.

An annual verify for factors vulnerable to expiring is a fast behavior that may save your hard-earned rewards and preserve them prepared for future adventures.

The excellent news is, preserving your factors alive is less complicated than you suppose.

On this submit, we’ll cowl the expiration insurance policies for main airline loyalty packages and share methods to maintain your factors lively with out an excessive amount of effort.

Let’s dive into the easy steps to make sure your miles don’t expire.

1. Know The Guidelines of Your Loyalty Program

Most loyalty packages require you to have interaction in some type of qualifying exercise at common intervals to maintain your airline factors from expiring.

Nevertheless, every airline program has its personal algorithm. Some think about each incomes and redeeming factors as qualifying actions, whereas others solely rely incomes.

Moreover, there are some packages whose factors by no means expire, whereas others have factors that can expire after a sure interval of inactivity. In some packages, your factors expire after a set time frame, regardless of how a lot exercise there’s been.

Figuring out the specifics of your loyalty program is step one to safeguarding your factors balances.

Listed below are the expiration insurance policies for some fashionable airline loyalty packages for North Individuals:

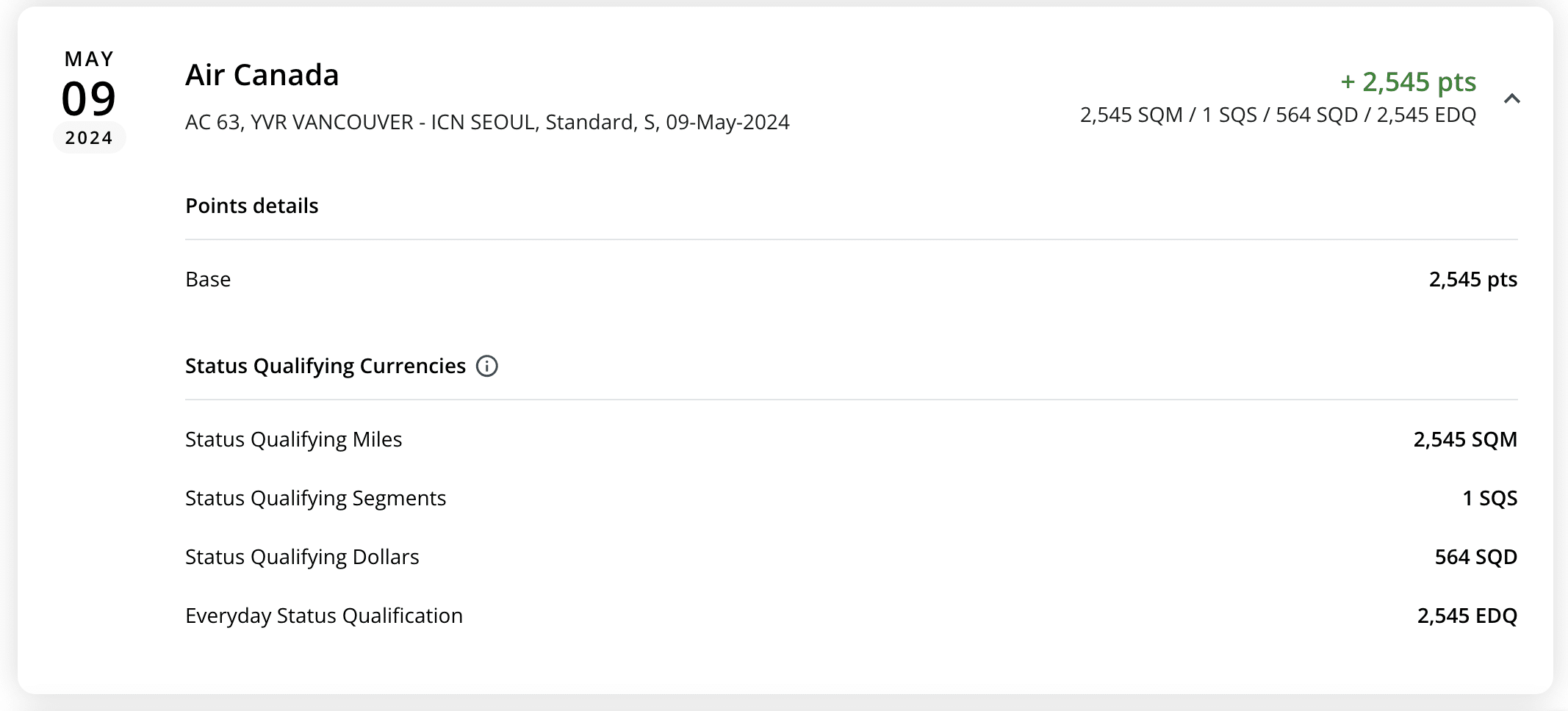

- Air Canada Aeroplan: Factors usually expire after 18 months of account inactivity; nonetheless, factors expiry is paused till November 30, 2026. After that date, the 18-month inactivity rule will apply once more.

- WestJet Rewards: WestJet factors don’t expire; nonetheless, your account should have at the very least one incomes, redeeming, transferring, or changing exercise each 24 months to remain lively. Sure promotional rewards might have their very own expiry dates.

- Air France KLM Flying Blue: Miles can expire for those who go 24 months with none qualifying flight or eligible co-branded bank card exercise. A qualifying flight or eligible card buy usually resets the clock in your steadiness.

- Atmos Rewards: Technically, miles don’t expire, however your account could also be deactivated after 24 months of inactivity. (You then have 12 months to reactivate your account.)

- American Airways AAdvantage: Miles expire after 24 months of account inactivity.

- Avianca LifeMiles: Miles expire after 12 months with none factors accrual exercise.

- The British Airways Membership: Avios expire after 36 months of account inactivity.

- Cathay Pacific Asia Miles: Miles expire after 18 months of account inactivity.

- Delta SkyMiles: SkyMiles by no means expire.

- Korean Air SKYPASS: Miles expire 10 years after they’re earned. (Miles earned on or earlier than June 30, 2008 don’t expire and are legitimate for the member’s lifetime)

- Singapore Airways KrisFlyer: Miles expire 36 months after they’re earned.

- United MileagePlus: Miles by no means expire.

- Virgin Atlantic Flying Membership: Factors by no means expire.

2. Earn Factors from Co-Branded Credit score Playing cards

One of many best methods to maintain your airline factors from expiring is by utilizing co-branded bank cards. These playing cards permit you to earn factors on on a regular basis purchases like groceries, eating, and gasoline.

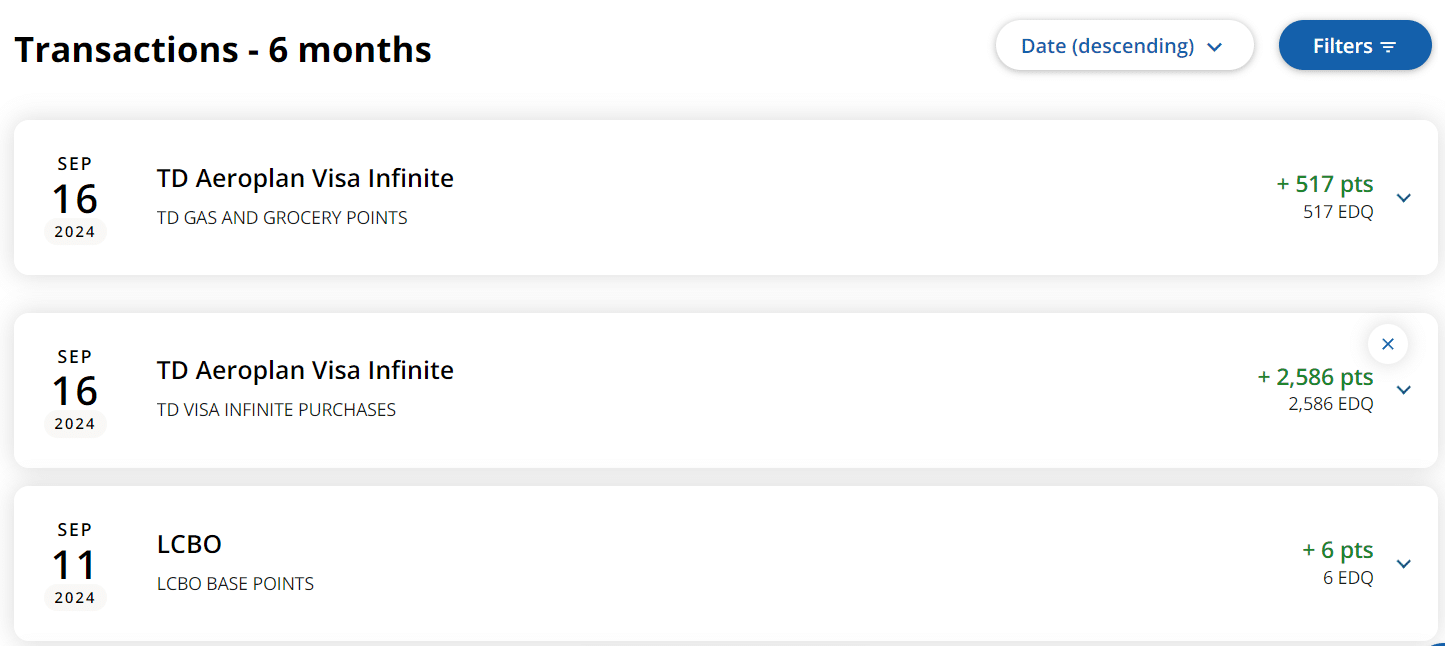

For instance, for those who maintain a TD® Aeroplan® Visa Infinite* Card, each time you make a purchase order, you’re not solely incomes Aeroplan factors from these purchases, however you’re additionally extending your factors steadiness expiration date by 18 months.

Should you don’t have already got one, verify in case your airline gives a co-branded bank card.

Many airways associate with main banks to offer playing cards that provide beneficiant welcome bonuses, journey perks, and most significantly, the power to earn the rewards foreign money of your alternative and assist preserve your factors from expiring.

TD® Aeroplan® Visa Infinite* Card

- Earn 10,000 Aeroplan factors† upon first buy†

- Plus, earn 15,000 Aeroplan factors† upon spending $7,500 within the first 180 days of account opening†

- Plus, earn a further 20,000 Aeroplan factors† on renewal while you spend $12,000 inside 12 months of account opening†

- Earn 1.5x Aeroplan factors† on eligible gasoline, groceries, and Air Canada® purchases, together with Air Canada Holidays®†

- Most popular Aeroplan pricing and free checked bag on Air Canada® flights†

- Minimal revenue: $60,000 private or $100,000 family

- Annual payment: $139 (rebated for the primary yr)

- Supply out there for purposes authorised on or after September 4, 2025.

Switch Factors from Financial institution Packages

If a co-branded bank card isn’t out there for the airline you take into consideration, or if the product isn’t provided in your nation, think about one other handy choice: transferring factors from a versatile foreign money program.

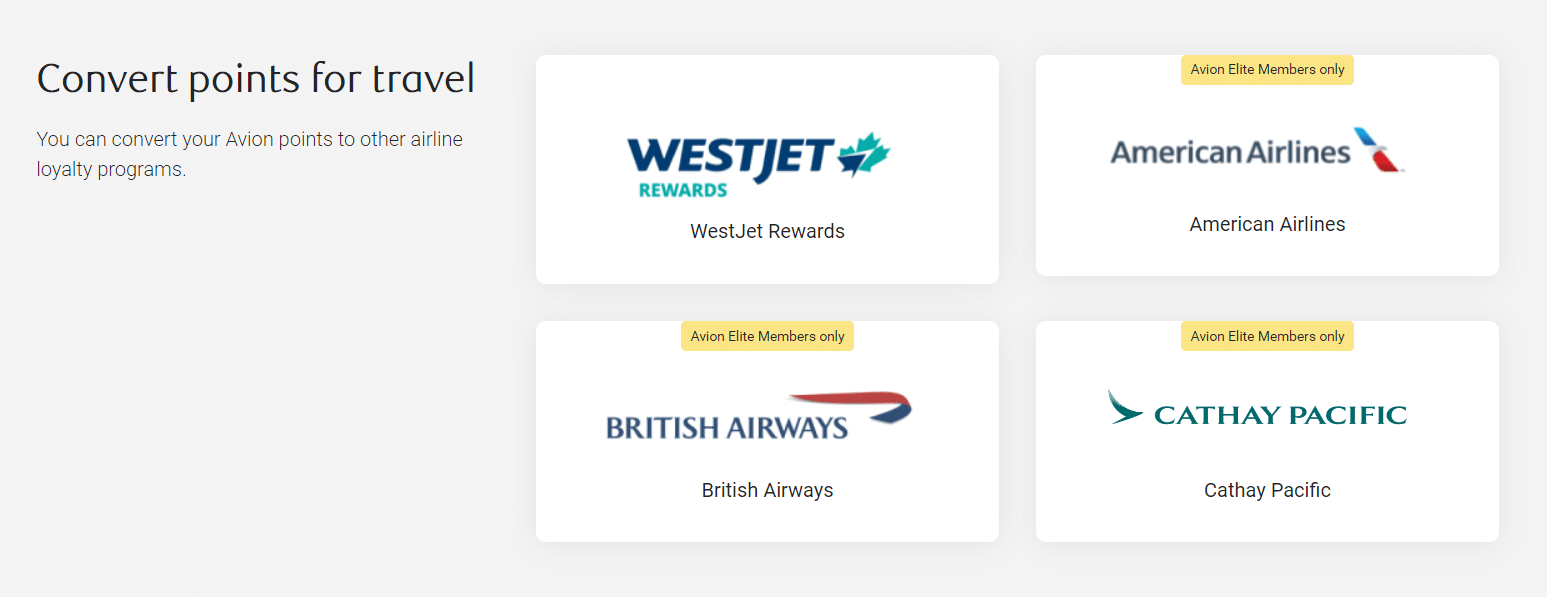

In Canada, there are two factors currencies that may be transformed into numerous airline and resort companions: American Specific Membership Rewards and RBC Avion Rewards.

In the USA, there are various extra packages out there. Among the hottest ones embrace American Specific US Membership Rewards, Bilt Rewards, Capital One Miles, Citi ThankYou Rewards, and Chase Final Rewards.

By transferring factors from one program into your airline’s loyalty program, you may add qualifying exercise and lengthen the lifetime of your factors or miles. That is particularly helpful in case you have a steadiness with an airline that you just don’t fly with regularly, however you’d nonetheless prefer to preserve your factors lively.

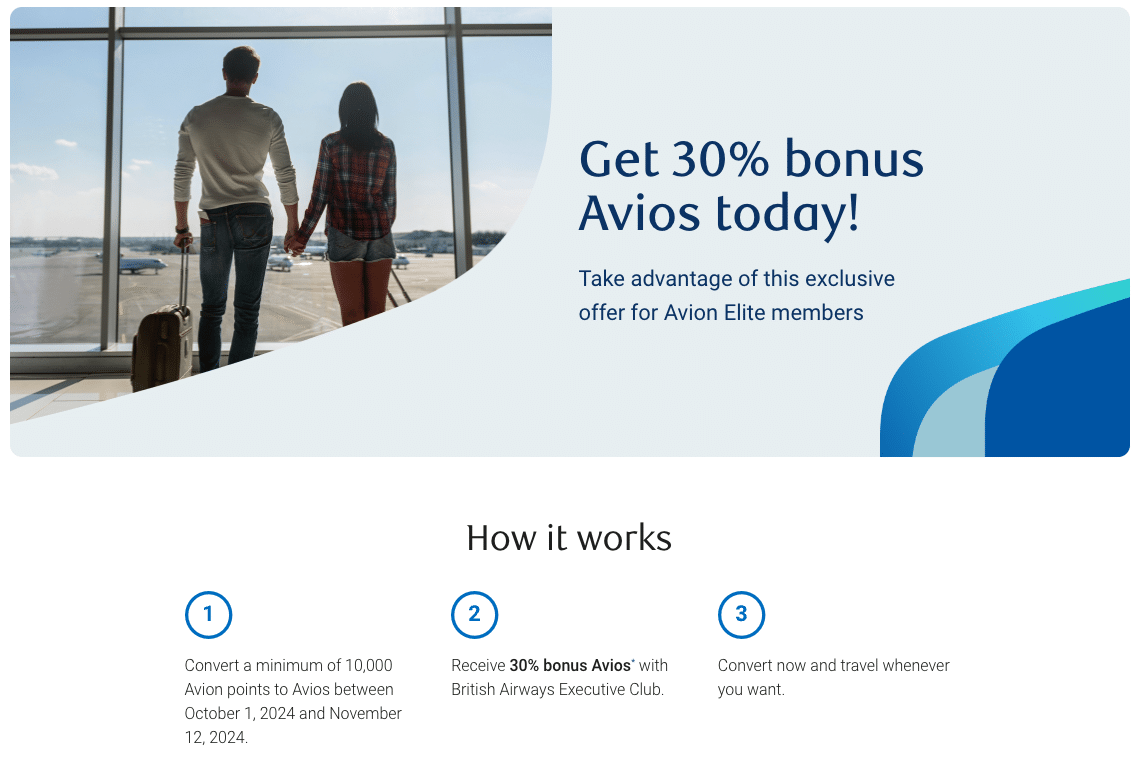

For instance, changing RBC Avion factors into British Airways Avios counts as a qualifying exercise inside your British Airways account, thus extending the expiry date of your Avios by one other three years.

Should you’re pondering of going this route, understand that relying on which program you’re transferring from there stands out as the occasional switch bonus promotions that allow you to get pleasure from 10–50% extra factors while you switch.

For instance, RBC Avion Rewards pretty recurrently runs switch bonus promotions from their in-house Avion factors to British Airways Govt Membership, permitting you to get extra worth out of your Avion factors.

Given this, except you’re in a rush to stop your factors from expiring, it’s sensible to attend for these gives.

3. Earn from Flying Exercise

It could sound apparent, however flying with the airline is a surefire method to preserve your factors from expiring in virtually all instances. Any time you ebook a flight and earn miles, your account exercise is refreshed, extending the expiration date of your factors.

The exceptions to this rule are packages like Korean Air SKYPASS and Singapore Airways KrisFlyer as your factors have an unchangeable and unextendable expiration date in relation to once they have been earned.

Redeeming factors for flights can even rely as qualifying exercise in most packages, making it one other nice method to preserve your factors lively whereas having fun with the rewards you’ve earned.

Nevertheless, understand that there are some packages, like Avianca LifeMiles, that DO NOT rely redeeming factors as qualifying exercise, so all the time double-check the factors expiration coverage of your airline to make sure.

4. Earn from Non-Flying Exercise

Should you’re not flying anytime quickly, don’t fear.

There are quite a few different methods to earn factors with out flying, serving to you to proceed to stop your factors from expiring.

E-book lodges, automotive leases, and actions by way of an affiliated reserving portal

Many airways have affiliated reserving portals the place you may earn factors by reserving lodges, automotive leases, and even actions. Transactions made by way of these portals rely as qualifying incomes exercise and assist lengthen your factors’ expiration.

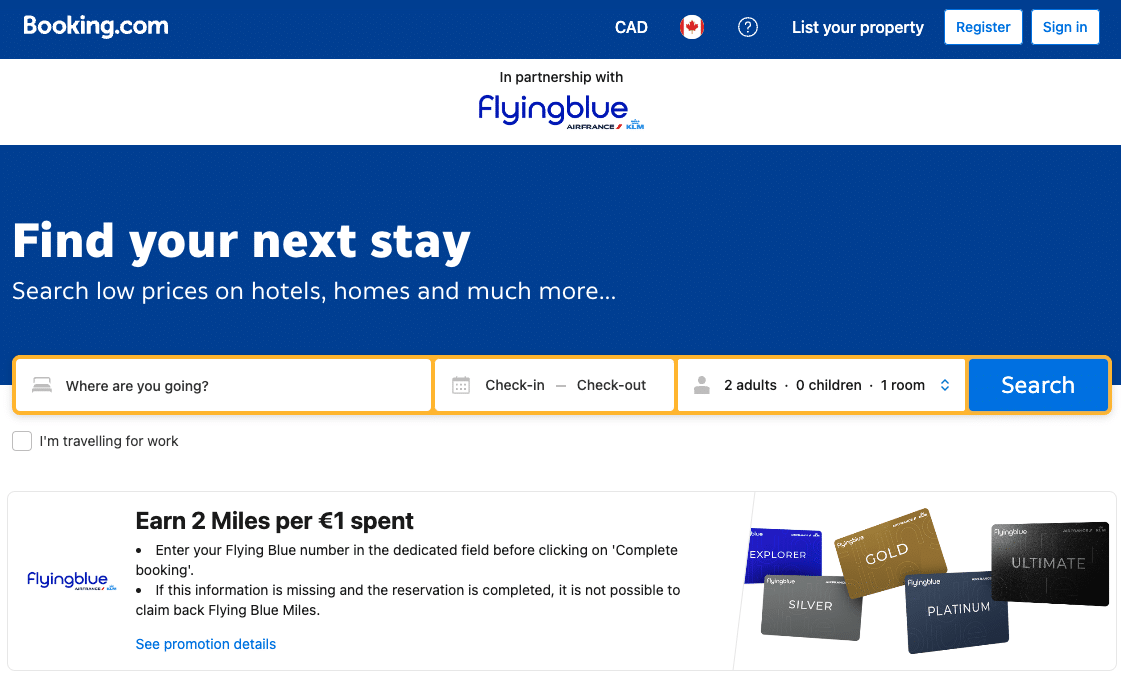

As an example, Air France KLM Flying Blue has partnered with Reserving.com, permitting you to earn 2 Flying Blue miles per euro spent on resort bookings while you undergo the airline’s reserving portal.

Nevertheless, not all airways have a partnership with OTAs (On-line Journey Companies) that present a reserving website like this.

If that’s the case, you may verify the airline’s on-line procuring portal for one more method to preserve your factors from expiring.

For instance, by way of the British Airways Govt Membership eStore, you may earn Avios by clicking their procuring hyperlink for AVIS automotive leases and making a reservation, or by making a reserving by way of Airbnb. That is a simple method to preserve your factors lively whereas reserving important companies like automotive leases or short-term leases.

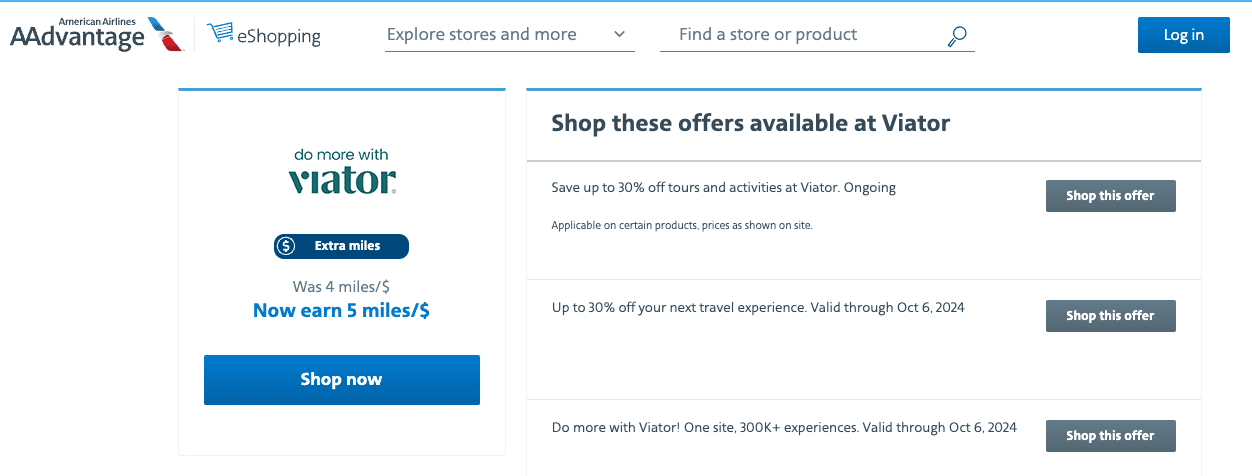

If neither resort stays nor automotive leases are in your plans, you can too think about reserving an exercise to earn factors. For instance, by way of the American Airways AAdvantage eStore, you may earn AAdvantage miles by reserving excursions and actions by way of Viator.

Simply ensure that you’re making your bookings by way of the airline’s on-line reserving portal or procuring portal and never by way of the on a regular basis, public variations of reserving portals in an effort to earn your rewards and preserve your factors from expiring.

To make sure you’re on the fitting website, all the time begin from the airline’s or airline loyalty program’s web site and click on by way of to the related reserving portal.

Use Rideshare and Meals Ordering Apps

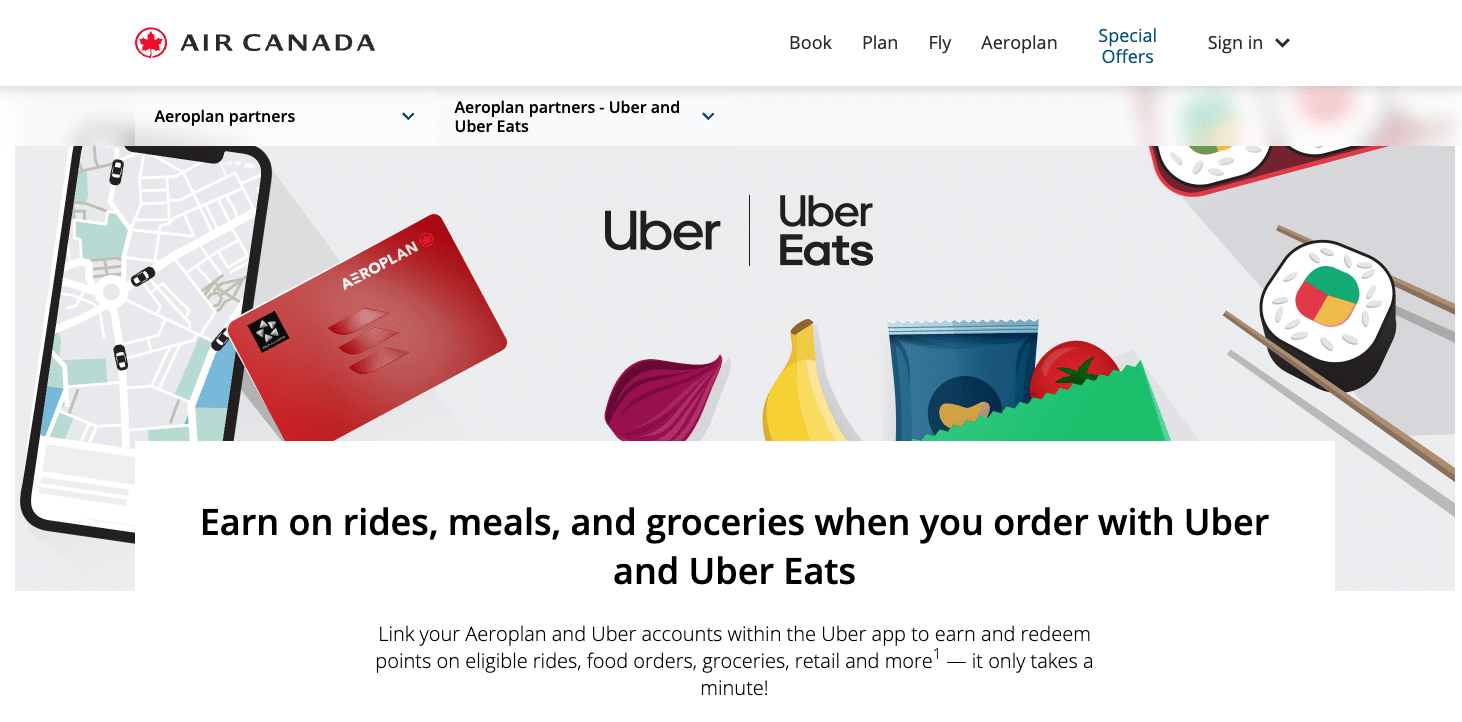

Some airline loyalty packages are linked to rideshare apps like Uber and Lyft, or meals ordering apps like Starbucks. By linking your accounts, you may mechanically earn factors on each journey or meals order, preserving your account in good standing.

For instance, you may hyperlink your Aeroplan account to Uber and earn Aeroplan factors each time you catch an Uber journey or order meals by way of Uber Eats.

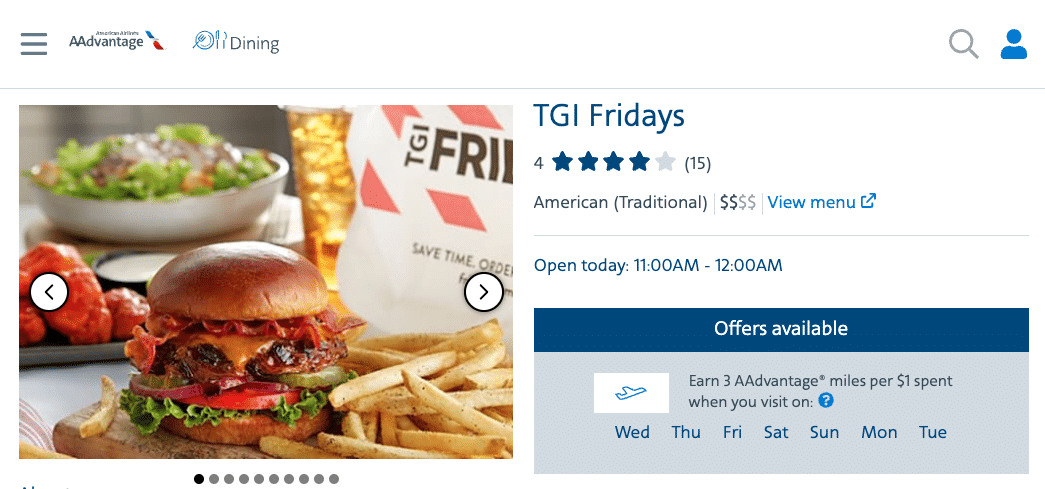

Airline Eating Packages

Airline eating packages are one other nice method to earn miles with out flying. By eating at collaborating eating places and paying with a bank card that’s linked to your loyalty account, you’ll earn miles each time you eat out.

Nevertheless, this selection is just provided within the US in the meanwhile.

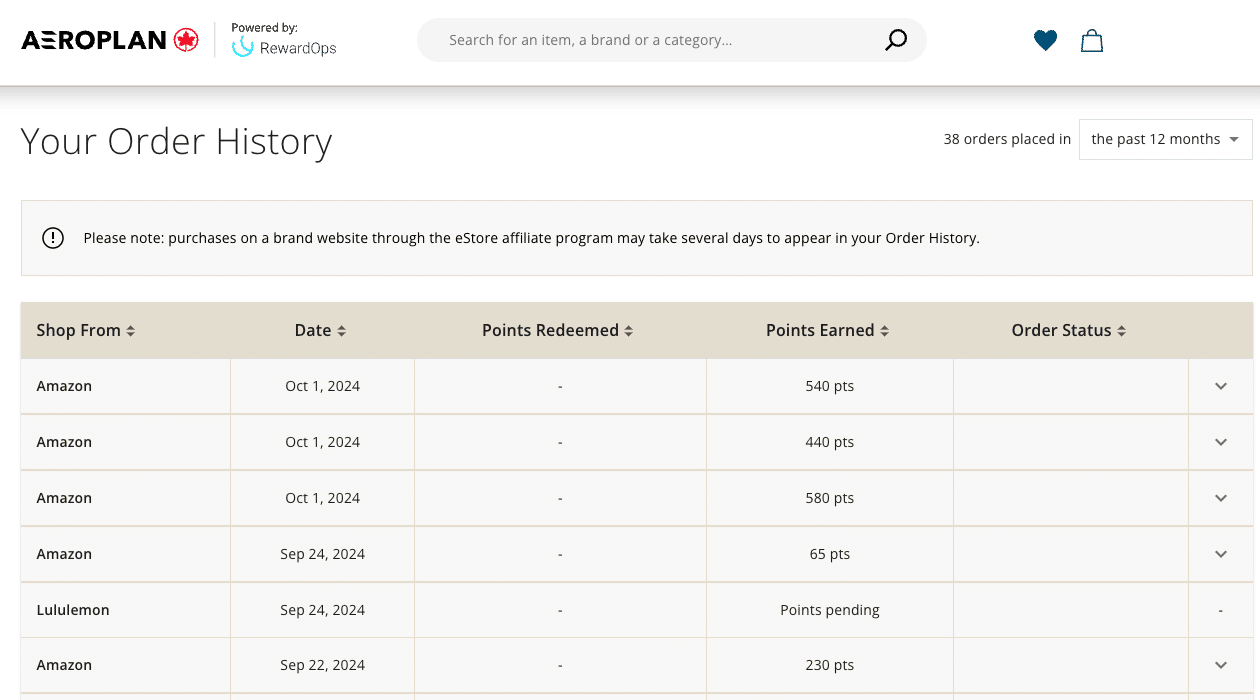

5. Earn By On-line Purchasing Portals

Purchasing by way of your airline’s on-line procuring portal is likely one of the best methods to earn factors from house. These portals associate with a variety of outlets, permitting you to earn factors on lots of your normal purchases.

Top-of-the-line examples of a web based procuring portal is the Aeroplan eStore which has a protracted record of retail companions in Canada, resembling Amazon, Apple, and Lululemon.

To earn factors from procuring, merely discover the retailer you need by way of the airline’s procuring portal and click on the “Store” button to be redirected. Remember to evaluation the small print for every retailer, as sure product classes are sometimes excluded from incomes factors.

Should you’re seeking to maximize your earnings whereas preserving your account lively, preserve an eye fixed out for bonus factors promotions in your airways’ on-line procuring portal.

Ready in your most popular retailer to supply additional factors can actually provide help to construct up your level steadiness from the consolation of your individual house.

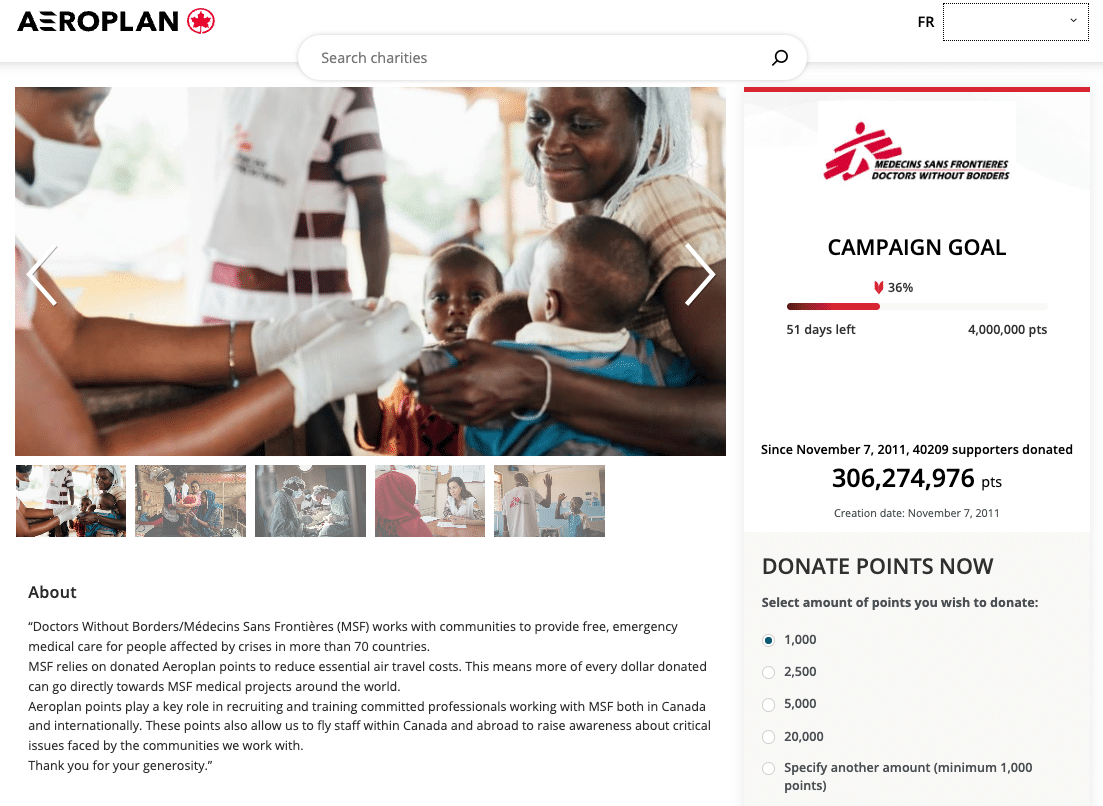

6. Purchase or Donate Factors

Shopping for factors outright is the best manner so as to add a qualifying exercise to your account; nonetheless, comfort usually comes with a price.

Until your factors are about to run out, it’s higher to see if any of the beforehand talked about strategies give you the results you want first since shopping for factors is often not thought-about good worth.

Whereas shopping for factors needs to be a final resort (as it may be dear), it’s nonetheless higher than shedding them altogether.

Equally to transferring factors or making purchases by way of an airline’s on-line procuring portal, it’s a good suggestion to be careful for promotions that provide bonus factors to maximise your buy for those who do determine to purchase factors.

If shopping for factors feels a bit costly, think about donating factors as an alternative. This can be a nice method to preserve your factors account lively whereas doing one thing good!

Many airways permit you to donate factors to pick out charities after which rely the donation as a qualifying redemption exercise – although, understand that some airways solely rely incomes exercise as qualifying exercise, so that you’ll wish to double-check this in your loyalty program of alternative.

7. Set Up Alerts and Monitor Your Factors

One of the best ways to keep away from shedding factors is by staying organized.

One good apply may be to evaluation your loyalty accounts on the finish of every yr and make notice of the expiration dates.

Mark these dates in your calendar and arrange an alert at the very least three months prematurely, providing you with sufficient time to take motion and preserve your factors lively. You probably have a lot of loyalty accounts to maintain observe of, we’ve discovered {that a} spreadsheet is beneficial to maintain observe of your factors.

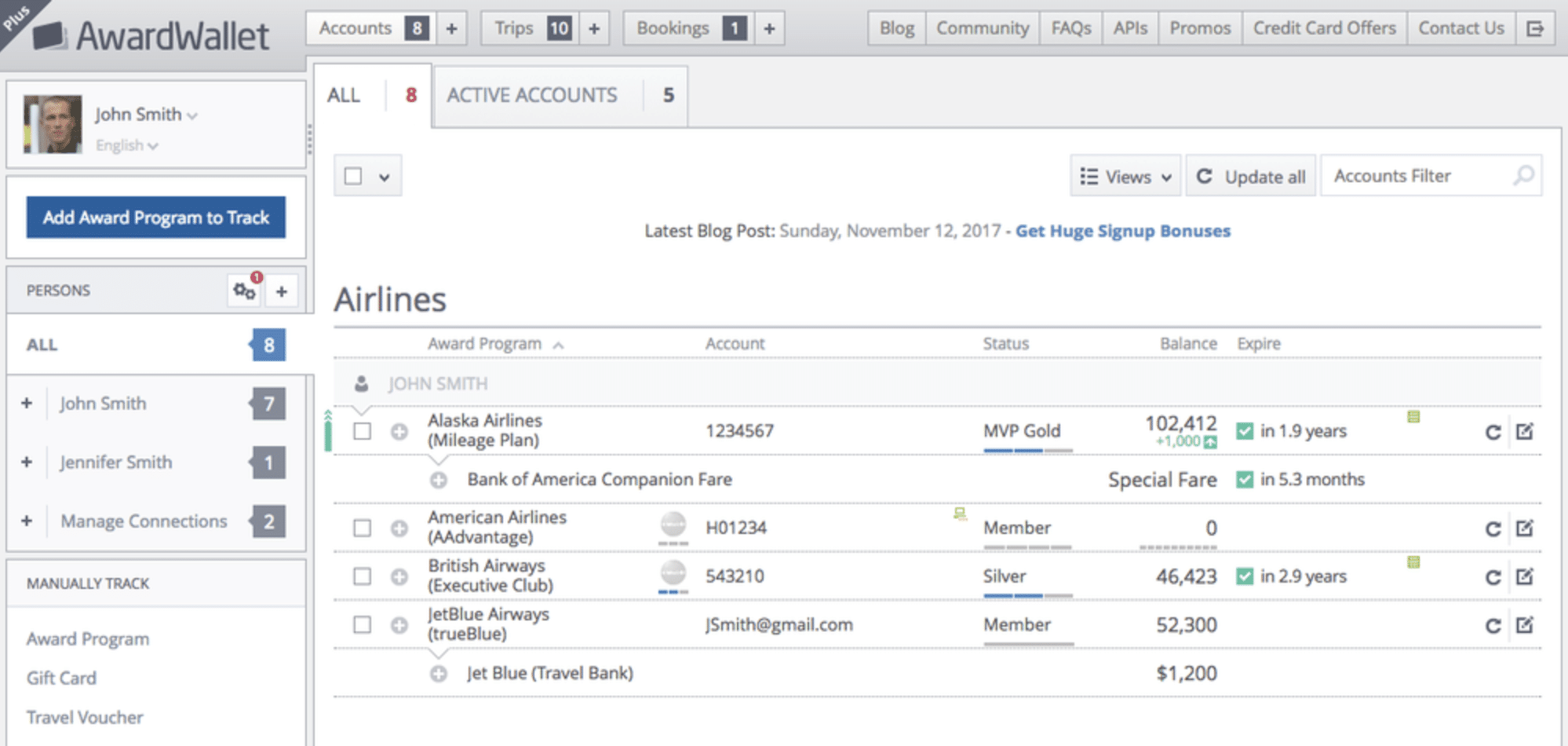

Alternatively, you need to use a platform like AwardWallet to trace your factors balances throughout all of your frequent flyer packages.

AwardWallet securely shops your login credentials for every loyalty program and recurrently checks your accounts for any modifications in factors balances. It additionally screens factors expiration dates and sends you electronic mail alerts if any of your factors are nearing expiration.

Conclusion

Airline loyalty packages usually implement inactivity insurance policies, inflicting factors to run out after a interval of no qualifying account exercise (sometimes round two years of inactivity).

Whereas that may appear to be loads of time, life can get in the best way, and you may simply neglect to maintain your accounts lively and run the danger of shedding all of your hard-earned factors.

Happily, stopping factors from expiring is less complicated than it appears. A number of small actions, like utilizing a co-branded bank card for day by day purchases, reserving a last-minute flight, or procuring on-line, can usually preserve your account lively and your factors protected.

Nevertheless, finally, the most effective apply in your factors is to comply with the “earn and burn” mantra of the Miles & Factors group.

Deal with factors like foreign money that might lose worth or disappear – that manner, you wouldn’t go away any factors to run out within the first place.