If you happen to’ve learn our introductory publish on Miles & Factors for Households, hopefully we’ve satisfied you that the pursuit is worth it to assist your loved ones journey higher and for much less.

In relation to incomes factors for household journey, the problem typically lies in accumulating sufficient factors to cowl journey bills for all the household.

The excellent news is that with some cautious planning round bank cards and your on a regular basis bills it’s an achievable feat, so let’s discover how one can get began.

Miles & Factors for Household Journey – Methods to Begin Incomes

Determining how and the place to start out within the Miles & Factors pastime is commonly the toughest a part of miles and factors journey. With so many factors currencies and bank card choices, how do you determine what to enroll in and what factors to build up?

My recommendation: Begin by working backwards.

Take a look at your previous and future journey plans. Do you usually journey home, trans-border, worldwide, or the entire above? Is there an airline you usually fly with? What vacation spot(s) do you wish to go to within the close to future?

The easiest way to start out your Miles & Factors journey is to decide on a vacation spot, and from there you possibly can decide what airline will get you there and what level currencies you’ll want – then you possibly can begin specializing in how one can earn that foreign money.

We’ve written an excellent newbie’s information that focuses on this precise goal-setting step, so test it out for extra particulars on how one can greatest method this course of.

When selecting which factors currencies to gather, you wish to think about your journey preferences and tailor your selections accordingly, after which pair them with the correct bank card(s).

If you happen to journey to many locations served by Air Canada, then you might wish to concentrate on accumulating Aeroplan factors and join card just like the TD® Aeroplan® Visa Infinite* Card. Along with incomes factors, you’ll additionally get a free checked bag for your self and as much as eight individuals on the identical reserving whenever you fly with Air Canada, which is a good perk.

TD® Aeroplan® Visa Infinite* Card

- Earn 10,000 Aeroplan factors† upon first buy†

- Plus, earn 15,000 Aeroplan factors† upon spending $7,500 within the first 180 days of account opening†

- Plus, earn an extra 15,000 Aeroplan factors† on renewal whenever you spend $12,000 inside 12 months of account opening†

- Earn 1.5x Aeroplan factors† on eligible gasoline, groceries, and Air Canada® purchases, together with Air Canada Holidays®†

- Most popular Aeroplan pricing and free checked bag on Air Canada® flights†

- Minimal earnings: $60,000 private or $100,000 family

- Annual price: $139 (rebated for the primary yr)

If you happen to like to remain in Marriott lodges, you may think about signing up for an Marriott Bonvoy American Categorical Card to earn Marriott Bonvoy factors for lodge stays and an annual Free Night time Award.

Marriott Bonvoy American Categorical Card

- Earn 80,000 Bonvoy factors upon spending $6,000 within the first six months

- Earn an extra 30,000 Bonvoy factors upon making a purchase order within the fifteenth month of Cardmembership.

- Additionally, obtain an annual Free Night time Award price 35,000 Bonvoy factors beginning in your second yr with the cardboard

- Additionally, obtain 15 elite-qualifying nights yearly and computerized Marriott Bonvoy Silver Elite standing

- Bonus Bonvoy factors for referring household and associates

- Annual price: $120

If you happen to are likely to fly with ultra-low-cost or smaller airways, otherwise you favor staying at Airbnbs or different lodging that don’t have loyalty packages, then you definately’ll wish to concentrate on playing cards that earn fixed-value factors that may be redeemed for an announcement credit score in opposition to any journey cost, just like the Scotiabank Gold American Categorical® Card or TD First Class Journey® Visa Infinite* Card.

Scotiabank Gold American Categorical® Card

- Earn 25,000 Scene+ factors upon spending $2,000 within the first three months

- Plus, earn an further 20,000 Scene+ factors upon spending $7,500 within the first yr

- Earn 6x Scene+ factors at Sobeys, IGA, Safeway, FreshCo, and extra

- Plus, earn 5x Scene+ factors on groceries, eating, and leisure

- Additionally, earn 3x Scene+ factors on gasoline, transit, and choose streaming companies

- Redeem factors for an announcement credit score for any journey expense

- No international transaction charges

- Benefit from the unique advantages of being an American Categorical cardholder

- Annual price: $120 (waived for the primary yr)

And what in case you don’t have any journey plans, however nonetheless wish to get began? Then select a card that may earn a versatile and transferable factors foreign money like American Categorical Membership Rewards (MR) factors or RBC Avion factors. With these choices, you can begin accumulating factors instantly, and after getting a visit on the horizon, you possibly can switch your factors to the correct loyalty program for the redemption.

A key factor to recollect is that whenever you’re beginning off it’s greatest to concentrate on just one or two award packages that greatest fit your wants. In a while, when you’ve bought a deal with on the incomes and redeeming course of, you possibly can diversify additional.

Additionally, for worldwide household journey past North America, it’s greatest to plan journeys two years prematurely. At two years out, you can begin accumulating the factors that you simply’ll must get you and your loved ones to your chosen vacation spot, after which at about one yr earlier than your most well-liked journey dates, you can begin redemption choices.

Methods for Incomes Factors for Household Journey

In relation to incomes factors as a household, the onus falls on the adults.

In a household of 4 with two younger children, the 2 adults should earn sufficient factors between themselves to fund journey for all 4 relations. The bigger the household, the extra work the adults may have minimize out for them.

Accumulating sufficient factors for a visit simply by way of day-to-day spending might take fairly some time. Fortunately, there are methods to speed up your factors incomes, however how aggressively you pursue these means will rely in your precise journey objectives.

1. Welcome Bonuses

The quickest and best option to get began incomes factors for household journey is thru bank card welcome bonuses. Welcome bonuses provide a one-time alternative to considerably enhance your stability. Relying on the provide, a welcome bonus from a single card might even be sufficient to cowl flights for one or two individuals in your loved ones.

For instance, the biggest welcome bonus in Canada tends to be provided on the Enterprise Platinum Card® from American Categorical. Whereas the provide might change infrequently, it’s held regular at as much as 120,000 Membership Rewards factors for the previous couple of years, which is nice sufficient for at the least a number of flights in financial system, and even one or two one-way flights in enterprise class.

Enterprise Platinum Card from American Categorical

- Earn 90,000 MR factors upon spending $15,000 within the first three months

- Plus, earn 40,000 MR factors upon making a purchase order in months 15–17 as a cardholder

- And, earn 1.25x MR factors on all purchases

- Additionally, obtain a $200 annual journey credit score

- Switch Membership Rewards factors to Aeroplan, The British Airways Membership, Flying Blue, and different frequent flyer packages for premium flights

- Limitless airport lounge entry for you and one visitor at Precedence Go, Plaza Premium, Centurion, and different lounges

- Credit and rebates for enterprise bills all year long with Amex Gives

- Bonus MR factors for referring household and associates

- Qualify for the cardboard as a sole proprietor

- Annual price: $799

Welcome bonuses are sometimes earned, at the least partially, after assembly a minimal spending requirement on the cardboard. Given this, you wish to be sure that the quantity of minimal spend is achievable earlier than making use of for a card, and by no means spend past your means for the sake of factors.

If you end up needing to pay curiosity since you’re carrying a stability in your bank card, you’ll be paying extra for the factors that you simply’re incomes which considerably cuts into the worth you’re getting. Carrying a stability can even have a unfavourable affect in your credit standing, so all the time think about what’s economically sustainable for your loved ones.

2. Referral Bonuses

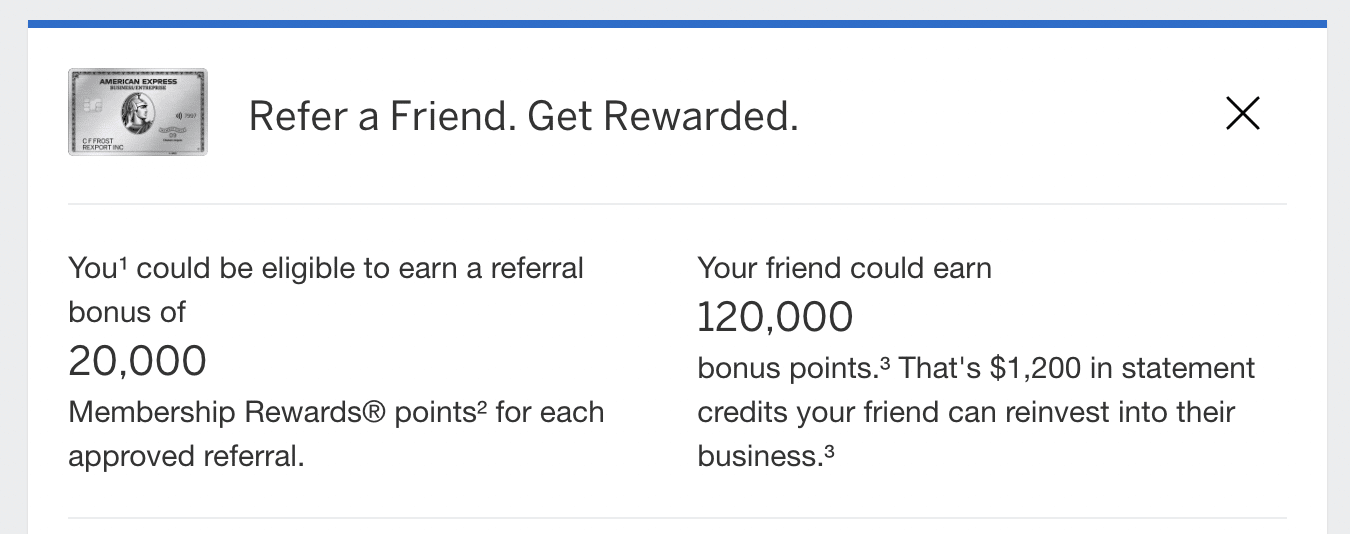

Welcome bonuses aren’t the one option to purchase bigger chunks of factors shortly. With American Categorical, you possibly can earn referral bonuses by referring family and friends for an eligible card. Take for instance the Enterprise Platinum Card® from American Categorical which earns you 20,000 MR factors for every referral, as much as an annual most of 225,000 factors.

If one member of the family has this card and refers it to their partner, they’d earn 20,000 MR factors from the referral, whereas their partner earns one other 120,000 MR factors after assembly the minimal spending requirement (assuming a welcome bonus of 120,000 factors). On this situation, it’d successfully add 140,000 factors to your loved ones’s pool of factors.

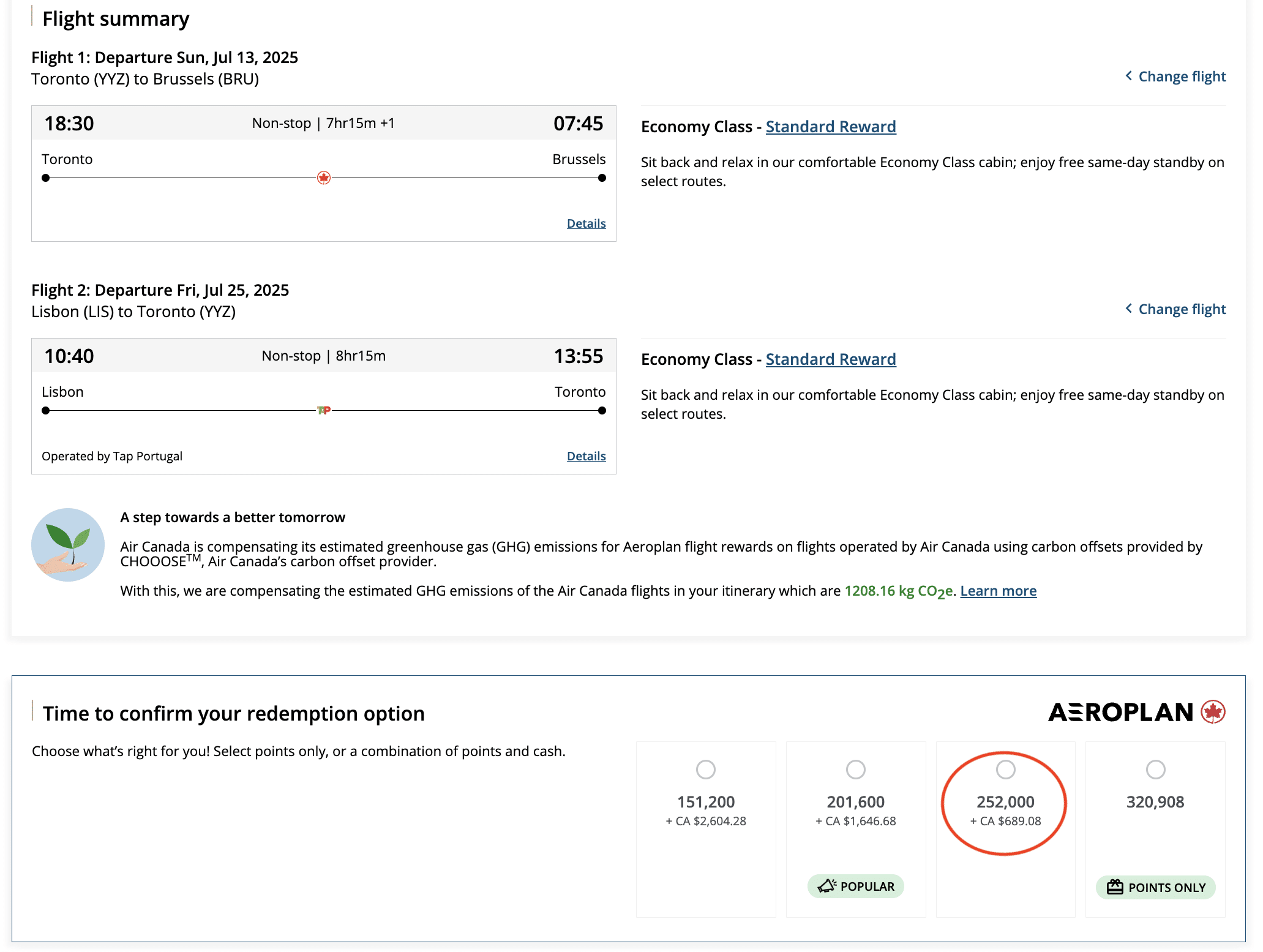

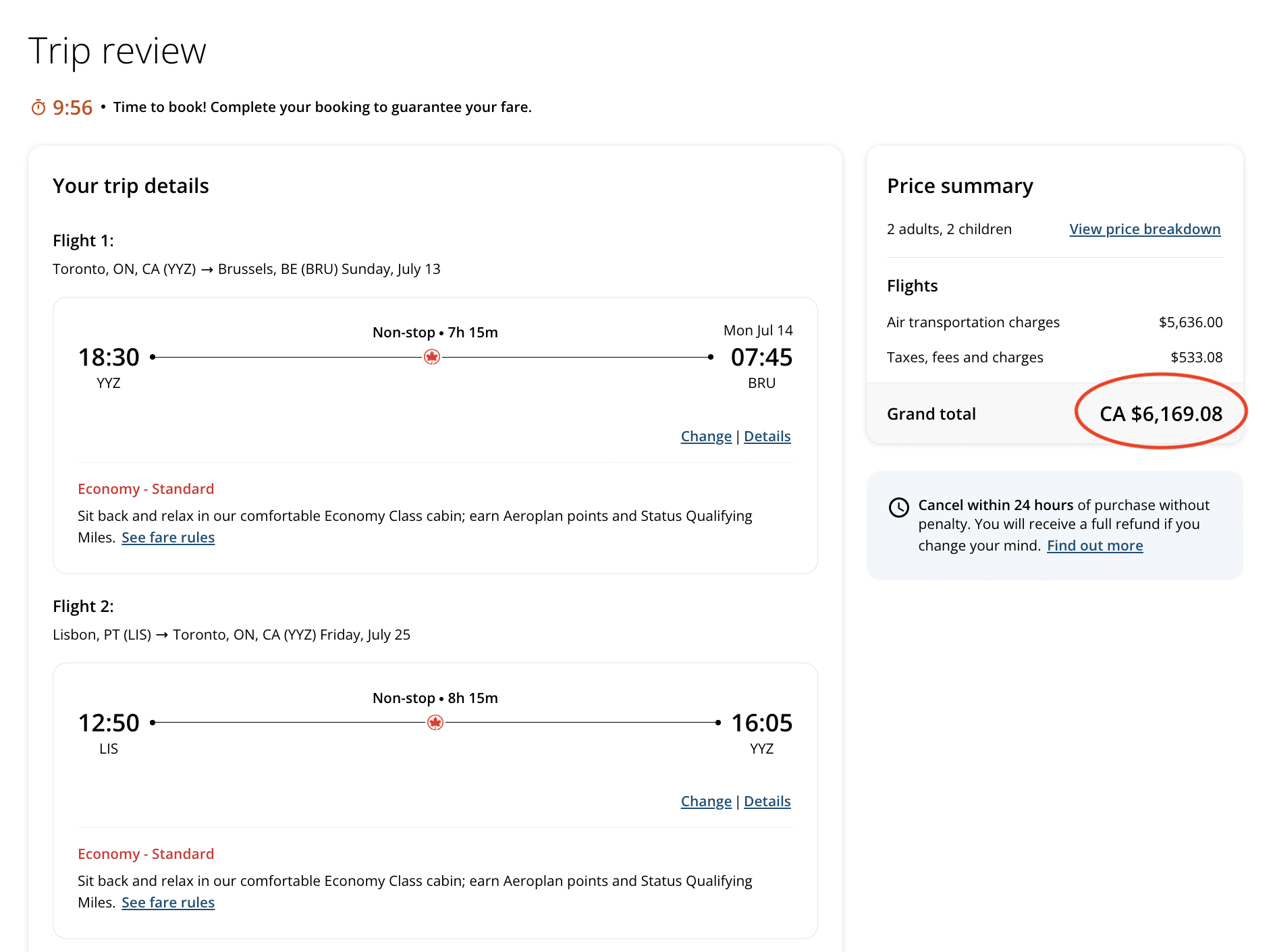

Add this to the welcome bonus earned by the primary member of the family who had the cardboard (once more, assuming that the welcome bonus is 120,000 MR factors) and that’s already 260,000 MR factors earned in a single yr, which may very well be sufficient for a household of 4 to fly round-trip to Europe!

(As a reminder, American Categorical Membership Rewards factors switch to Aeroplan at a 1:1 price).

Comparable flights for the very same dates would have in any other case value over $6,000 (CAD).

You can also refer individuals to totally different playing cards. The Enterprise Platinum Card® from American Categorical can check with virtually each card within the Membership Rewards household, you possibly can earn 20,000 factors for every profitable referral you make to different playing cards, together with the American Categorical Cobalt® Card, the American Categorical® Gold Rewards Card, the American Categorical® Enterprise Gold Rewards Card, and many others.

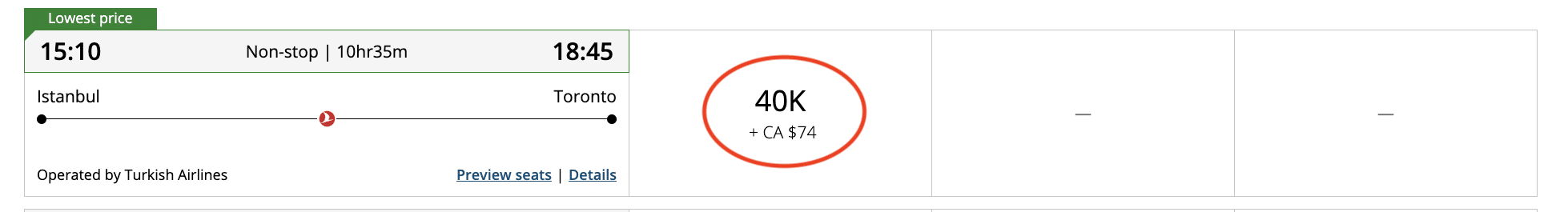

American Categorical has additionally been placing on a promotion every spring the place you possibly can earn double the referral factors. If you happen to time your referrals proper, you can earn a staggering 40,000 factors per referral, which is sufficient for a single one-way financial system ticket from Istanbul to Toronto…

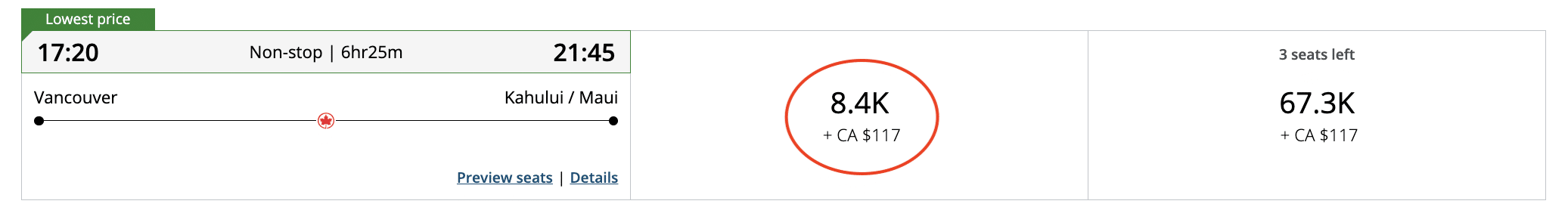

Or two round-trip financial system tickets from Vancouver to Maui…

As soon as your youngster turns eighteen, you possibly can refer them as properly, and don’t overlook that grandparents want bank cards too!

Take a look at our in-depth information about American Categorical’s Referral Program to study extra.

3. Maximizing Earn on Common Spending

If you happen to’re nonetheless pulling out money and debit playing cards to pay for issues, it’s time to cease. Use your bank card at any time when you possibly can and take note of incomes class multipliers.

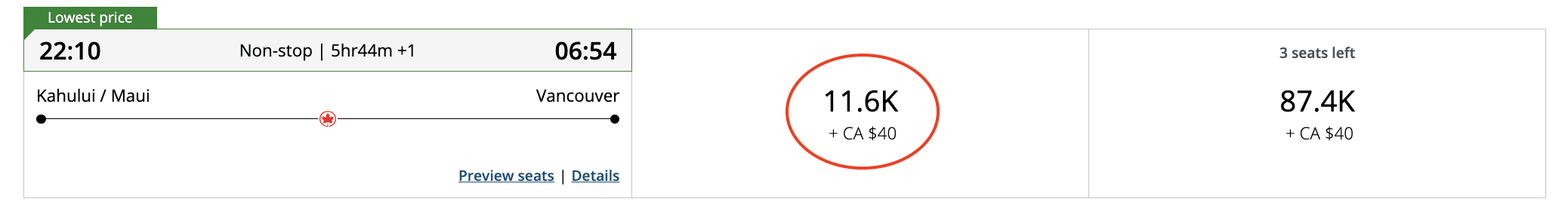

That weekly household journey to McDonald’s for $50 (CAD) might earn you 13,000 factors over the course of the yr if spent on the American Categorical Cobalt® Card that earns 5 factors per greenback spent on eating. The earnings from this expense alone may very well be redeemed for a round-trip flight from Toronto to New York Metropolis with Aeroplan factors.

Many bank cards provide multipliers on varied classes of spend, which you must purpose to maximise as a lot as potential.

For instance, you need to use the American Categorical Gold Rewards Card to earn 2 factors per greenback on gasoline, journey, and transportation bills. If your loved ones flies steadily with Air Canada, put all Air Canada purchases on the American Categorical® Aeroplan®* Reserve Card to earn 3 factors per greenback.

American Categorical Aeroplan Reserve Card

- Earn 60,000 Aeroplan factors upon spending $7,500 within the first three months

- Plus, earn 25,000 Aeroplan factors upon spending $2,500 in month 13 as a cardholder

- All the time earn 3x Aeroplan factors on Air Canada purchases and 2x Aeroplan factors on eating and meals supply

- And, earn 1.25x Aeroplan factors on all different eligible purchases

- Aeroplan most well-liked pricing, free first checked bag, precedence check-in and boarding on Air Canada flights

- Limitless Air Canada Maple Leaf Lounge entry in North America

- Bonus Aeroplan factors for referring household and associates

- Get an Air Canada Annual Worldwide Go upon spending $25,000 annually

- No minimal earnings requirement

- Annual price: $599

Select a number of playing cards with multipliers that make sense for your loved ones, and that may will let you maximize your factors incomes on day by day spending. Learn our detailed information to maximizing your earnings by way of class multipliers to study extra about how one can take advantage of your bills.

Use various cost service suppliers. Some bills historically paid by debit, like summer time camp charges, faculty tuition, hire, and utilities can now, most often, be paid for utilizing a bank card by way of platforms like Plastiq, PaySimply, and Chexy. Tax season and property tax deadlines are additionally nice instances to make use of these companies for assembly a minimal spend requirement on a brand new bank card.

There’s a small price to make use of these platforms, however you possibly can come out forward if utilizing the correct bank card, can write off the service price as an expense, or in case you’re utilizing them for the needs of assembly a minimal spending requirement to earn a welcome bonus.

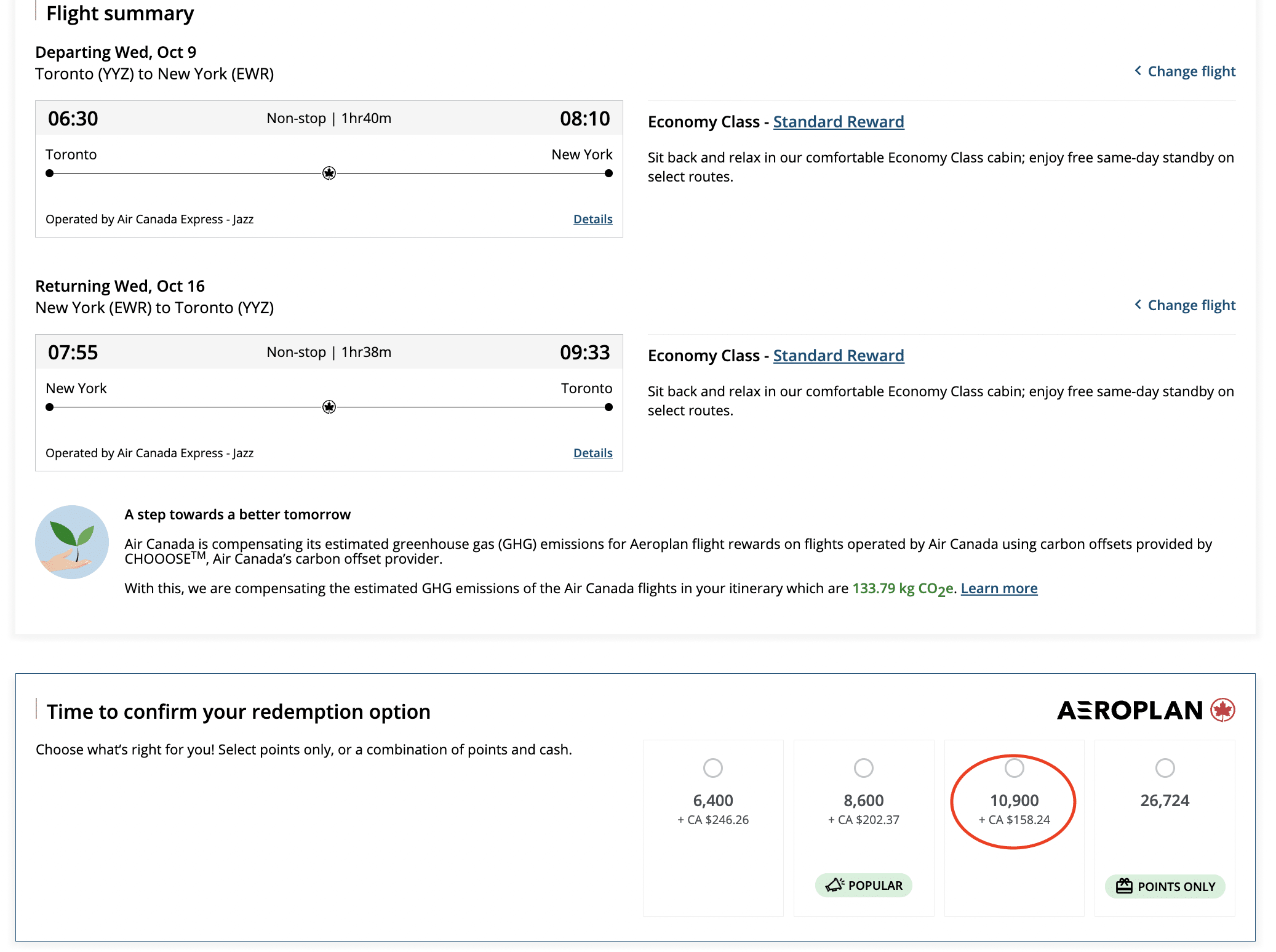

Use purchasing portals. In relation to on-line purchasing, don’t overlook to undergo e-store portals to earn bonus factors in your spending along with the factors you earn by way of your bank card. Most airline packages have their very own portals, so select the one you journey with most.

Air Canada has its Aeroplan eStore, and through sure instances of the yr, they’ll run promotions the place you possibly can earn as much as 10x the Aeroplan factors on on a regular basis purchases at eligible shops. Air France KLM Flying Blue has its Store for Miles portal, though the variety of shops at present provided is sort of restricted.

When reserving journey, you possibly can earn additional money again by going by way of Rakuten or Capital One Procuring for bookings with Marriott, Expedia, Viator, Hertz, and much more. If you happen to favor to earn factors and miles when reserving a lodge keep, look into platforms like Rove which is able to award you with factors for any lodge keep that may even stack on high of what you’ll earn by way of the lodge’s personal loyalty program.

If you happen to’re planning to remain at an Airbnb, think about reserving by way of British Airways’s Avios portal to earn additional Avios.

Conclusion

It takes just a little extra leg work to earn sufficient factors for household journey, nevertheless it’s positively a doable and worthwhile pursuit. By making the most of welcome bonuses, referral bonuses, and maximizing your factors earnings on common spending, you’ll be properly in your option to having a wholesome factors pool for your loved ones.

Remember to get your partner, companion, or mum or dad concerned within the course of too so you possibly can multiply your incomes potential. In the event that they’re hesitant to affix in your enterprise, present them the financial savings; and if that doesn’t do it, fly them in enterprise class after which see what they suppose!

Keep tuned for the third and final a part of our sequence the place we’ll have a look at planning and reserving redemptions for 3 or extra passengers.