Journey insurance coverage usually will get overshadowed by flashy welcome bonuses or airport lounge entry, however for seniors, it’s arguably an important bank card good thing about all.

When you flip 65, most playing cards shrink their protection home windows, impose stricter well being necessities, or cease overlaying you altogether. And after 75, the panorama turns into much more difficult.

On this information, we break down the perfect bank cards for Canadian seniors, splitting protection into two clear age brackets: 65–75 and 75+.

Whether or not you’re planning a fast winter escape or travelling into your golden years with confidence, there’s a card that may assist shield you.

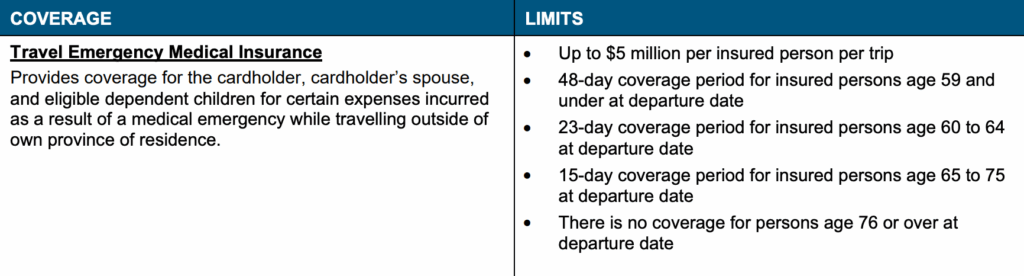

Emergency Medical Care Outdoors of Your Province of Residence

Earlier than delving into the playing cards themselves, it’s vital to go over what this insurance coverage covers, and to determine a baseline of what you’ll be able to count on when it comes to protection.

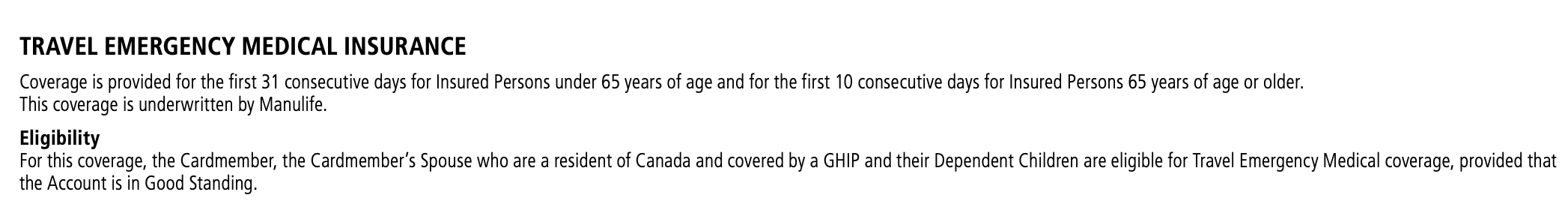

Emergency medical care insurance coverage protection is designed to reimburse you for a sure greenback quantity within the occasion that you just’re injured or expertise a medical emergency whereas travelling outdoors your private home province.

This protection turns into much more related in case you’re travelling internationally, the place it might be tougher to navigate and perceive the native medical system and its prices.

With correct protection, you’re capable of concentrate on getting care immediately with out worrying fairly as a lot in regards to the bill which may in any other case damage your trip, or your retirement plans.

Sadly, most bank cards drastically cut back protection when you flip 65. Premium playing cards that provide 21–60 days of protection for youthful travellers usually drop to only 3–15 days for seniors (though most bank card insurers help you buy extra days of protection earlier than your departure).

After age 75, protection often disappears altogether.

For instance, the American Categorical Cobalt Card, provides emergency medical protection for the primary 15 consecutive days of your journey in case you’re 64 years previous or beneath; nevertheless, as soon as the cardholder turns 65, there’s no protection in any respect.

Due to this fact, you’ll need to take into account a bank card that gives the perfect insurance coverage for anybody travelling of their golden years.

As at all times, you should definitely learn the cardboard’s insurance coverage booklet to know what’s coated in your particular scenario. If you happen to ever have any questions, attain out to the cardboard issuer to substantiate what’s included.

With that in thoughts, let’s take a look at the perfect choices — beginning with travellers aged 65–75.

Greatest Credit score Playing cards for Seniors Aged 65–75

Nationwide Financial institution® World Elite® Mastercard®

- Annual charge: $150

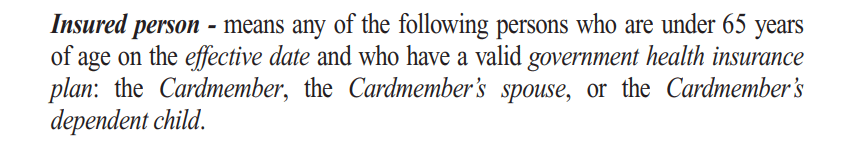

- Protection: 15 days (ages 65–75), as much as $5,000,000

- Protection ends at age 76

In Canada, the gold commonplace of senior-friendly insurance coverage protection is ready by the Nationwide Financial institution® World Elite® Mastercard®. Travellers over 65 years previous are coated for as much as 15 days when travelling out of province. The protection lasts till you flip 76, at which level you’re now not coated.

It’s additionally vital to notice that you probably have a pre-existing sickness or damage or if there have been adjustments to your well being inside six months of your departure date, you received’t be coated in case you endure an accident straight or not directly associated to the pre-existing situation.

If you happen to qualify for protection, Nationwide Financial institution will cowl you as much as $5,000,000 (all figures in CAD) for emergency medical care if you find yourself needing it.

With an annual charge of simply $150 which is successfully offset by the cardboard’s $150 annual journey credit score, we take into account the Nationwide Financial institution® World Elite® Mastercard® as the perfect bank card for insurance coverage in Canada.

Even If you happen to make a reserving with factors, you’ll even be coated which is one other one of many card’s mainstay options.

Nationwide Financial institution® World Elite® Mastercard®

- Earn 5x À la carte Rewards factors on grocery and restaurant spend†

- Get journey insurance coverage on award journey, in addition to medical protection on longer journeys for ages as much as 75†

- Obtain $150 in annual credit for airport parking, baggage charges, seat choice charges, lounge entry, and airline ticket upgrades†

- Minimal revenue: $80,000 private or $150,000 family

- Annual charge: $150

Desjardins Odyssey® Visa Infinite Privilege*

- Annual charge: $295 (members) / $395 (non-members)

- Protection: 15 days (ages 65–75), $5,000,000 restrict

- Protection ends at age 76

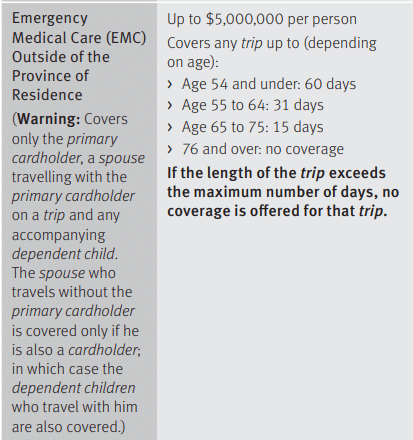

A much less talked about card that deserves a spot on this listing is the Desjardins Odyssey® Visa Infinite Privilege* Card, which has an analogous insurance coverage construction to the Nationwide Financial institution® World Elite® Mastercard®.

If you happen to’re 65 or older, you’re eligible for emergency medical protection for as much as 15 days from if you go away the province by which you reside. Nonetheless, when you flip 76, you’d now not be eligible for any protection.

You’ll be coated as much as a most of $5,000,000 per individual, excluding conditions the place you may have a pre-existing situation.

Observe that your pre-existing situation window goes again 182 days from date of departure.

In contrast to the opposite playing cards on this listing, the Desjardins Odyssey® Visa Infinite Privilege* is a money again card, quite than a travel-focused card. It has an annual charge of $295 for members, or $395 for non-members, which is a reasonably steep charge to pay.

Desjardins Odyssey Visa Infinite Privilege

- Earn 4% money again on restaurant purchases

- Earn 3% money again on grocery and journey purchases

- Earn 1.75% money again on all the pieces else

- Entry DragonPass airport lounges with six complimentary visits

- Greatest in-class medical and journey insurance coverage protection

- Minimal revenue: $200,000 family

- Annual charge: $395

Meridian Visa Infinite* Money Again Card

- Annual charge: $99 (usually first 12 months waived)

- Protection: 15 days (ages 65–75), $5,000,000 restrict

- Protection ends at age 76

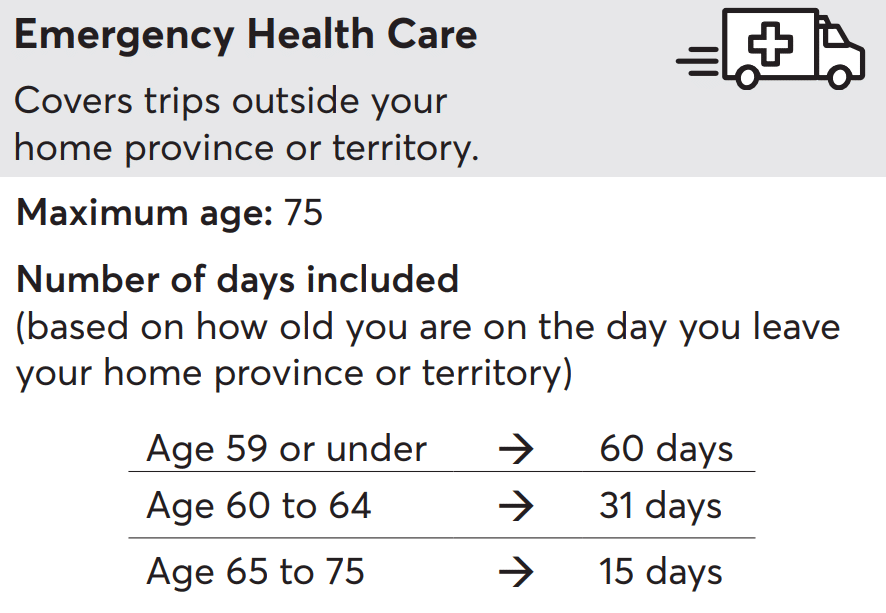

The Meridian Visa Infinite* Money Again Card is likely one of the strongest budget-friendly insurance coverage choices obtainable.

Seniors aged 65–75 obtain 15 days of emergency medical protection, as much as $5,000,000, matching the 2 premium playing cards above at a fraction of the worth.

The trade-off is a stricter six-month pre-existing situation stability requirement for travellers aged 55+, which can restrict eligibility for these with current treatment adjustments.

Nonetheless, for Ontario residents, the worth proposition is excellent: glorious protection, low value, and easy money again rewards.

Meridian Visa Infinite* Money Again Card

- Earn 4 Meridian Rewards Factors per $1 spent on fuel and groceries

- Plus, earn 2 Meridian Rewards Factors per $1 spent on pharmacy and utility invoice funds

- Then, earn 1 Meridian Rewards Level per $1 spent on all different eligible purchases

- Minimal revenue requirement: $60,000 (private), $100,000 (family)

- Annual charge: $99 (rebated within the first 12 months)

Greatest Credit score Playing cards for Seniors Aged 75 and Older

When you flip 76, the sector narrows dramatically. Solely a small handful of Canadian bank cards proceed providing emergency medical protection previous age 75 — and these playing cards differ considerably in each worth and protection necessities.

Under are the three strongest choices.

Scotiabank Platinum American Categorical® Card

The Scotiabank Platinum American Categorical® Card is one other sturdy contender for seniors searching for journey insurance coverage advantages, particularly for shorter journeys.

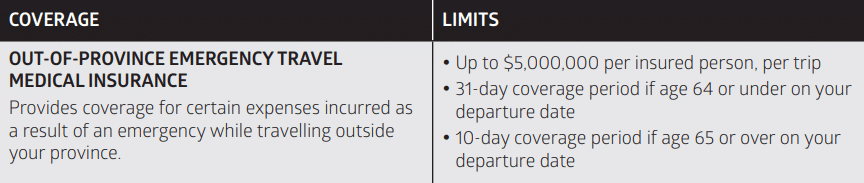

If you happen to’re 65 or older, you’re eligible for emergency medical protection for as much as 10 days from the day you permit your province of residence.

You’ll be coated as much as a most of $2,000,000 per individual, excluding conditions the place you may have a pre-existing situation.

The protection extends even if you flip 75, however the stability requirement window adjustments from 180 days from the date of departure for travellers beneath 75 years of age, and 12 months for 75 years of age or older.

The Scotiabank Platinum American Categorical® Card is travel-focused and earns factors in Scotiabank Scene+ Rewards program, which is likely one of the most versatile factors program to redeem factors in the direction of any kind of journey bills.

It has a barely increased annual charge of $399 per 12 months, which can be offset by its premium perks, together with Precedence Go lounge entry and no overseas transaction charge.

Scotiabank Platinum American Categorical® Card

- Earn 60,000 Scene+ factors upon spending $3,000 within the first three months

- Earn an extra 20,000 Scene+ factors upon spending $10,000 within the first 14 months

- Plus, earn 2x Scene+ factors on all purchases

- Precedence Go membership with 10 complimentary lounge visits per 12 months

- Benefit from the unique advantages of being an American Categorical cardholder, together with Amex Presents

- Annual charge: $399

CIBC Aeroplan® Visa Infinite Privilege* Card

- Annual charge: $599 (reducible with a CIBC Sensible Plus Account)

- Protection: 10 days if age 65 or over, as much as $5,000,000

- Age cap: None said – protection continues previous 75

The CIBC Aeroplan® Visa Infinite Privilege* Card provides 10 days of out-of-province emergency medical protection for anybody 65 or older, with a protection restrict of $5,000,000 per insured individual, per journey.

Importantly, the certificates merely says “age 65 or over” and doesn’t impose an higher age restrict, which means the 10-day protection applies even when you’re nicely previous 75, so long as you meet the standard eligibility standards and stability necessities.

As traditional, pre-existing situations exclude you from protection in case your emergency is said or not directly associated to your current situation.

From a pure insurance coverage standpoint, there are cheaper playing cards that provide related or longer protection. Nonetheless, for frequent Air Canada flyers who will truly use the premium perks: limitless Maple Leaf Lounge entry, precedence companies, most popular pricing, and boosted Aeroplan earn charges.

This card can nonetheless make sense as a “do-it-all” premium choice that additionally quietly covers you into your late 70s and past.

CIBC Aeroplan® Visa Infinite Privilege* Card

- Earn 10,000 Aeroplan factors upon spending $1,000 in your first two months†

- Earn 40,000 Aeroplan factors upon spending $5,000 within the first 4 months†

- Plus, earn an anniversary bonus of 50,000 Aeroplan factors upon renewing the cardboard for a second 12 months, after having spent a minimum of $25,000 within the first 12 months†

- Earn 2x Aeroplan factors on Air Canada purchases†

- Earn 1.5x Aeroplan factors on fuel, groceries, eating, meals supply, electrical automobile charging, and different journey purchases†

- Aeroplan most popular pricing, free checked bag, precedence check-in and boarding on Air Canada flights†

- Limitless Air Canada Maple Leaf Lounge entry†

- Visa Airport Companion Program membership with six free lounge visits per 12 months†

- $200 NEXUS utility credit score†

- Minimal revenue: $150,000 private or $200,000 family

- Annual charge: $599

RBC® British Airways Visa Infinite‡

- Annual charge: $165

- Protection: 7 days (ages 76+), limitless protection quantity

- Stability requirement: 180 days for ages 75+

Greatest referred to as an Avios-earning card, the RBC® British Airways Visa Infinite‡ Card additionally stands out as one of many only a few bank cards in Canada that continues providing emergency medical protection when you attain age 75.

If you happen to’re age 76 or older, you continue to obtain 7 consecutive days of emergency medical protection, with no most greenback restrict past what your provincial well being plan covers. This places the cardboard in uncommon territory: it’s one of many least expensive methods for seniors over 75 to retain any credit-card-based medical safety in any respect.

Seven days isn’t sufficient for an extended winter getaway, however for brief journeys throughout the border or fast warm-weather breaks, this card provides distinctive worth — particularly contemplating its modest annual charge and full suite of journey insurance coverage advantages.

RBC® British Airways Visa Infinite†

- Accumulate a 30,000 Avios† Welcome Bonus if you spend $5,000 (CAD) within the first three months of account opening

- Then, acquire an extra 30,000 bonus Avios† if you spend $5,000 (CAD) in months 4-6 of account opening

- If you don’t meet the $5,000 (CAD) spend within the first three months, you’ll be able to nonetheless acquire 30,000 bonus Avios in case you meet the spend requirement in months 4-6.

- Plus, earn 3 Avios per $1 (CAD) spent† on British Airways and British Airways Holidays†

- And, earn 2 Avios per $1 (CAD) spent† on eating and meals supply purchases

- Lastly, earn 1 Avios per $1 (CAD) spent† on all different eligible purchases

- Get a Companion Award eVoucher for an Avios redemption on British Airways flights upon spending $30,000 in a calendar 12 months†

- Annual charge: $165†

Conclusion

Whereas most bank cards don’t provide journey insurance coverage protection for travellers over the age of 65, and even fewer cowl those that are 76 and older, there are nonetheless a number of standout playing cards that lengthen emergency medical safety to travellers of their golden years.

Having emergency medical protection when you’re travelling is a vital technique to keep secure and wholesome, and to offer your self and your family members with peace of thoughts.

Irrespective of your age, there’s a card on the market that can lengthen some kind of protection to you, so be sure that to maintain that in thoughts earlier than embarking in your subsequent journey.