The American Specific Cobalt Card has lengthy ranked as one of the best Canadian bank card for on a regular basis spending. This lifestyle-oriented card is one that each Canadian ought to have of their pockets for a mess of causes.

With excellent incomes fee multipliers, a low price, and loads of prime notch switch companions, it’s no surprise that the Cobalt Card has established itself as a prime contender within the Canadian market since its debut in 2017.

In case you’ve but to enroll, let’s have a look at six the reason why the American Specific Cobalt Card must be the subsequent bank card in your portfolio.

American Specific Cobalt Card

- Earn as much as a complete of 15,000 MR factors upon spending $750 in every of the primary 12 months

- Earn 5x MR factors on groceries, eating places, bars, and meals supply

- Earn 3x MR factors on eligible streaming providers

- Earn 2x MR factors on gasoline and transit purchases

- Switch MR factors to Aeroplan, Avios, Flying Blue, Marriott Bonvoy, and extra

- Benefit from the unique advantages of being an American Specific cardholder

- Bonus MR factors for referring household and associates

- Month-to-month price: $12.99

1. Earn 5x Factors on Eats and Drinks

The American Specific Cobalt Card affords an excellent 5 Membership Rewards (MR) factors for each greenback spent at eating places, bars, cafés, meals supply providers, and even grocery shops in Canada.

On the naked minimal, these factors are price 1 cent per level, which equates to a 5% return on eats and drinks. We worth American Specific Membership Rewards factors at 2.2 cents per level, given how versatile they’re.

Utilizing this valuation, you may have a look at the speed of return at 11%, which is unparalleled in Canada. No different Canadian bank card with versatile factors currencies has this type of earn fee, and it’s very satisfying to get 5x factors on each day necessities like groceries and eating out.

You’ll earn this 5x multiplier on as much as $2,500 spent every month, which equates to $30,000 spent per yr. Due to this fact, when you can max it out, that’s a whopping 150,000 MR factors in your account, along with another factors you’d earn on the cardboard.

Curious what number of factors you may earn along with your month-to-month spending habits?

Use the calculator beneath to estimate what number of American Specific Membership Rewards factors you may rack up with the Cobalt Card.

In case your grocery and eating funds doesn’t fairly add as much as $2,500 every month, needless to say grocery shops additionally promote reward playing cards, which you’ll then use at different companies the place you’d in any other case earn much less.

Along with this beneficiant 5x earn fee, you’ll earn 3x MR factors per greenback spent on a plethora of streaming subscriptions in Canada, together with Netflix, Disney+, Crave, Spotify, Apple Music, and extra.

You’ll additionally earn 2x MR factors per greenback spent on gasoline, journey, and public transit purchases in Canada.

Sadly, the incomes fee for journey purchases is dropped to 1 level per greenback spent as of October 8, 2024. Nevertheless, you’ll be able to simply bypass this by having an optimized bank card portfolio, including the American Specific Gold Rewards Card or American Specific Platinum Card, each of which supply 2x MR factors on journey.

2. Modest Welcome Bonus

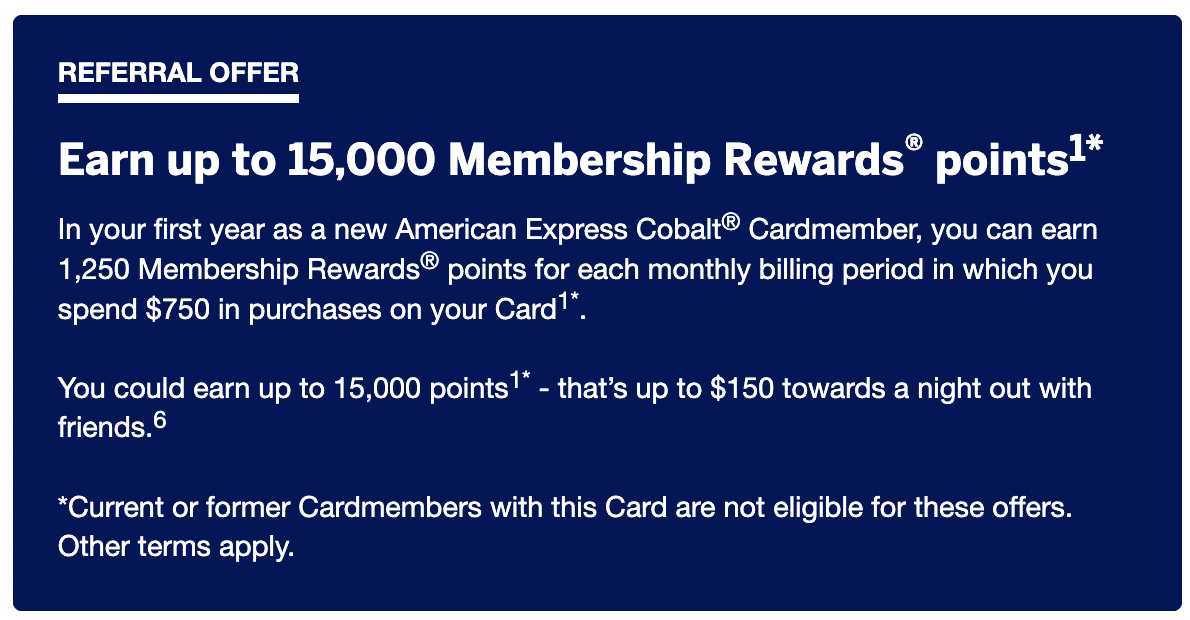

Along with the 5x incomes fee on meals and drinks, there’s a welcome bonus to sweeten the deal for brand new cardholders, too, which comes with a novel construction that encourages month-to-month spending.

As a substitute of a one-time bonus, you’ll obtain 1,250 MR factors for every month within the first yr as a cardholder by which you spend $750, netting you to a complete of 15,000 MR factors for the welcome bonus.

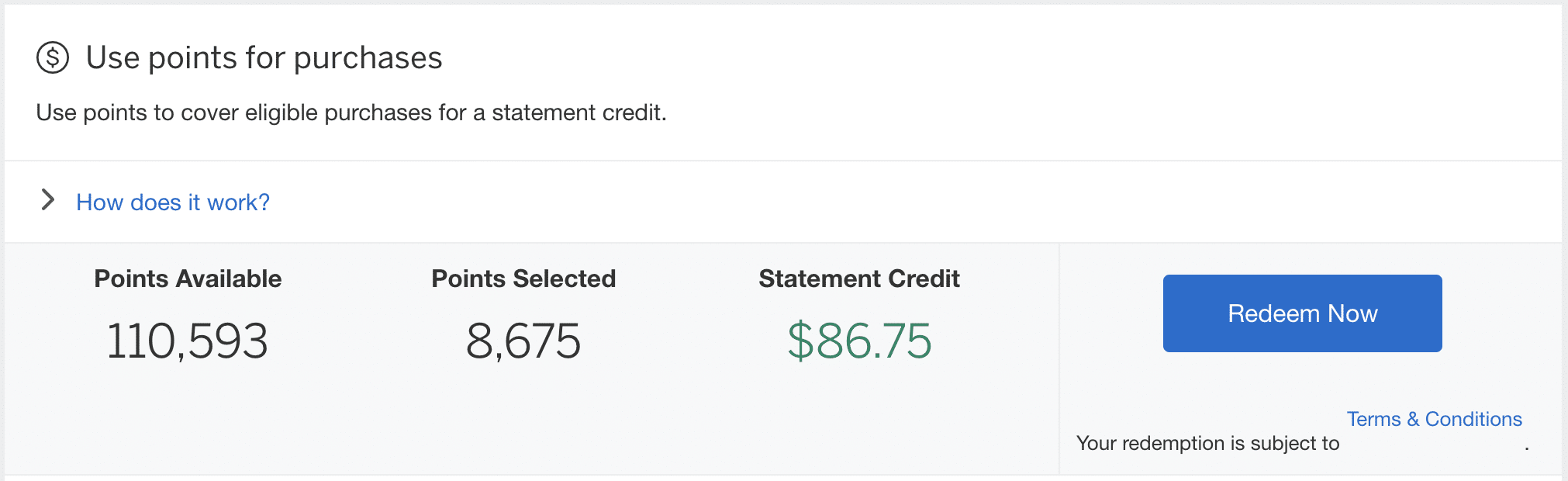

Membership Rewards factors have a tonne of energy, as they offer you a number of choices for redemptions. You possibly can select to switch them to airline or resort loyalty applications, redeem them for flights with the Amex Mounted Factors Journey Program, or apply them as a press release credit score in opposition to any buy.

Whereas there are definitely different playing cards different there with increased welcome bonuses, these typically come at the next price and with much less aggressive incomes charges for on a regular basis spending. Certainly, with the Cobalt Card, you’ll you’ll want to watch your factors steadiness develop shortly with the month-to-month bonuses and your each day spending mixed.

3. Earn Membership Rewards Factors

American Specific Membership Rewards are essentially the most versatile and versatile factors forex in Canada. That’s as a result of they’ll do every little thing {that a} money again or fixed-value factors forex can do, however they’ll additionally do rather more.

For instance, you’ll be able to redeem your factors in opposition to any buy made to the cardboard at a price of 1 cent per level by the “Use Factors for Purchases” redemption choice. Whereas there are definitely different methods to get better worth out of your factors, when you’re in search of a easy option to offset prices, Amex MR factors provide an amazing choice.

Remember that the cardboard earns 5x factors on eats and drinks, and when you redeem factors for a press release credit score at a fee of 1 cent per level, you’re taking a look at a wholesome 5% return on spending, which is nice!

Different factors applications in Canada provide the choice to e book flights at the next worth of round 2 cents per level. Thankfully, Amex MR factors additionally provide this selection by the Amex Mounted Factors Journey Program.

Nevertheless, when you’re in search of essentially the most priceless option to redeem your factors, look no additional than the lengthy checklist of airline and resort loyalty program switch companions accessible by Membership Rewards.

4. Airline & Resort Switch Companions

American Specific lets you switch Membership Rewards factors to 6 completely different airline loyalty applications and two resort loyalty applications. Amongst them are among the hottest frequent traveller applications on the market, together with prime loyalty applications from every of the three main airline alliances.

Aeroplan

Membership Rewards factors might be transferred to Aeroplan factors at a 1:1 ratio in increments of 100 factors, beginning at 1,000 MR factors.

Aeroplan factors are essentially the most priceless kind of airline factors for Canadians to earn, as they’ll simply unlock discounted journey in financial system class, enterprise class, and First Class to locations all around the world.

As a member of Star Alliance, along with reserving Air Canada flights, you can even use Aeroplan factors to e book flights with different Star Alliance members, reminiscent of United Airways, Lufthansa, All Nippon Airways, Thai Airways, Singapore Airways, and lots of extra.

Plus, Aeroplan companions with different airways that don’t belong to Star Alliance, which opens the door for distinctive redemptions all around the world.

Aeroplan stays probably the greatest loyalty applications within the the world, and having the choice to earn MR factors on the Cobalt Card and convert them to Aeroplan factors is likely one of the finest methods to leverage the numerous candy spots in this system.

British Airways Avios

The British Airways Membership is one other nice choice for transferring American Specific MR factors, as there are fairly a number of candy spots for short-haul flights throughout completely different locations on the planet, together with Europe, Asia, and Australia with oneworld airways.

Just like Aeroplan, MR factors might be transferred to British Airways Avios at a 1:1 ratio in increments of 100, and with a minimal of 1,000 MR factors.

Plus, with the partnership between British Airways and Qatar Airways, you can even switch your Avios between the 2 applications immediately, permitting you to e book the world’s finest enterprise class – Qatar Airways Qsuites – beginning at simply 70,000 Avios one-way from North America to Doha.

Air France KLM Flying Blue

Representing the SkyTeam alliance, Air France KLM Flying Blue is likely one of the finest applications for reserving transatlantic flights in financial system, premium financial system, or enterprise class.

That’s as a result of flights with Air France and KLM have the next “Saver”-level costs for flights from anyplace in North America to anyplace in Europe:

- Financial system: 25,000 miles

- Premium financial system: 40,000 miles

- Enterprise class: 60,000 miles

One factor to remember is that the switch ratio to Flying Blue is 1:0.75, so that you’ll must issue that in once you’re deciding which program to e book flights with.

Nevertheless, you’ll additionally need to take note of this system’s month-to-month Promo Rewards, which supply reductions on award journey of as much as 50%. In case you can snag a flight on an eligible route, the sub-par switch fee turns into much less burdensome.

Marriott Bonvoy

Marriott is the world’s largest resort chain, with a formidable world footprint of over 7,500 inns. Membership Rewards factors might be transformed into Marriott Bonvoy factors at a fee of 5:6, which means that you simply’ll get 1,200 Bonvoy factors for each 1,000 MR factors you switch.

Whereas it’s often extra advisable to switch Membership Reward factors to Air Canada Aeroplan, The British Airways Membership, or Air France KLM Flying Blue, there’s nonetheless a number of worth to be discovered within the Marriott Bonvoy program.

That is particularly the case when you’re travelling in locations like Asia or the Center East, the place Marriott Bonvoy Elite standing goes a good distance in direction of elevating your journey expertise.

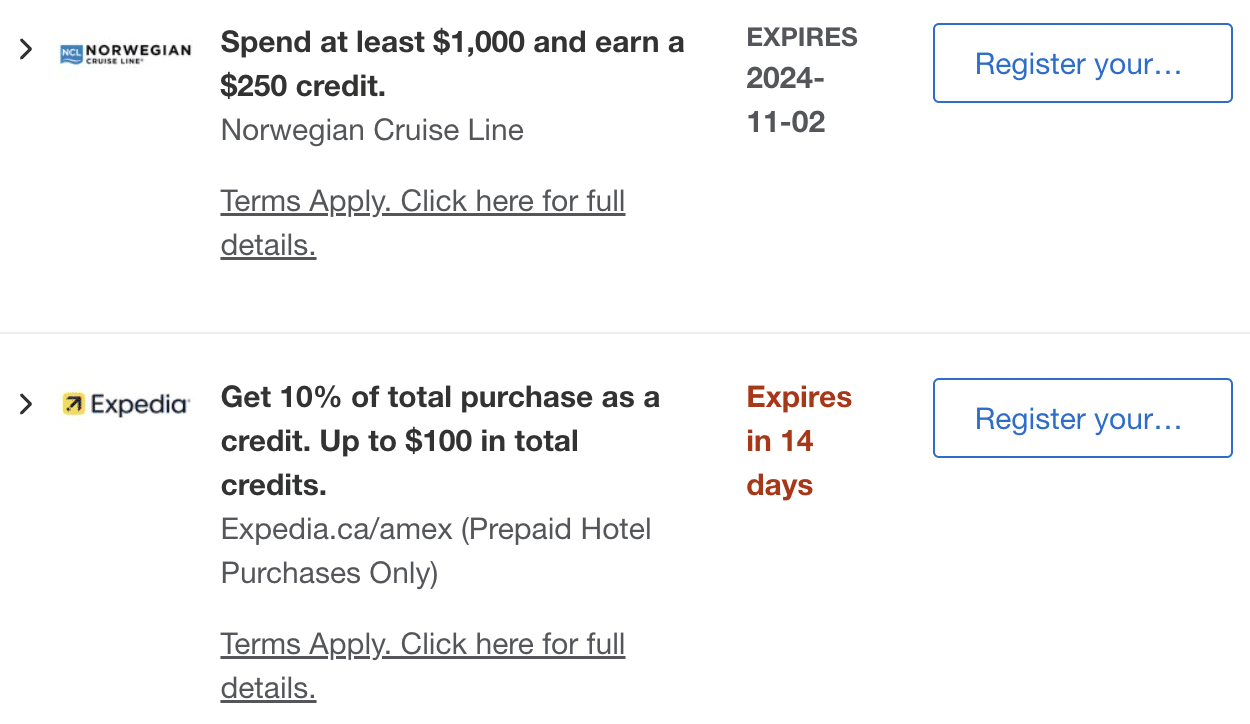

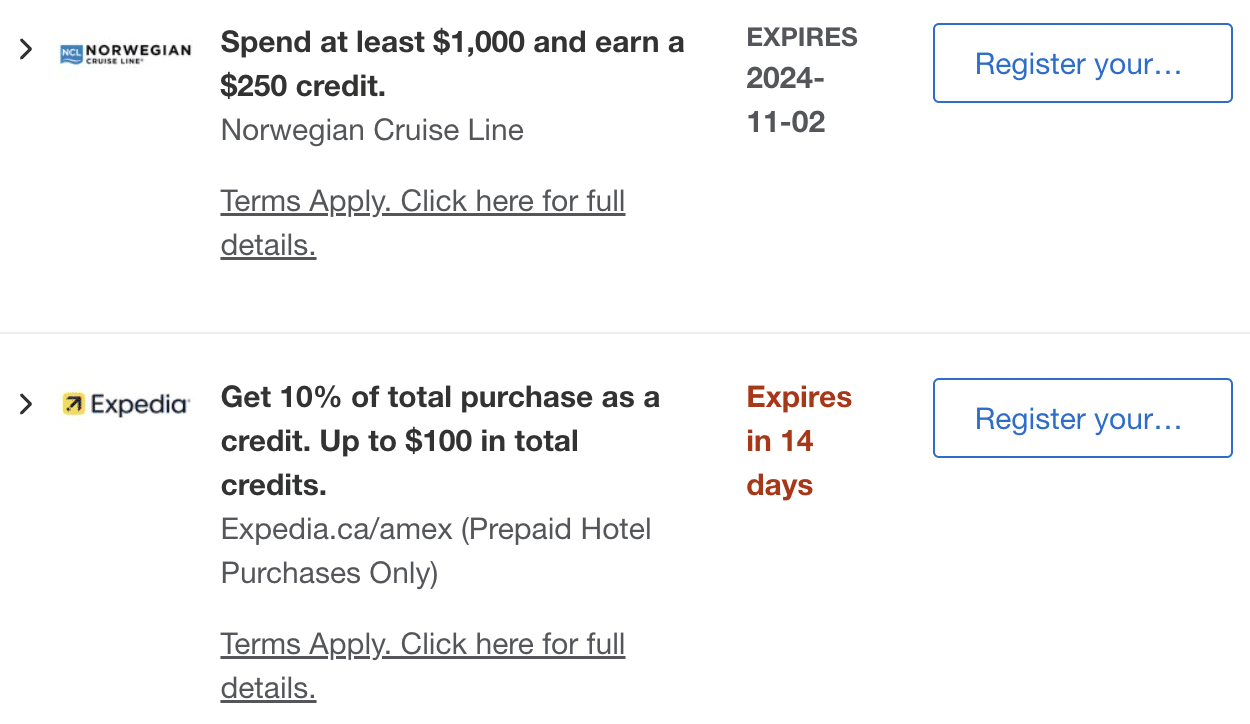

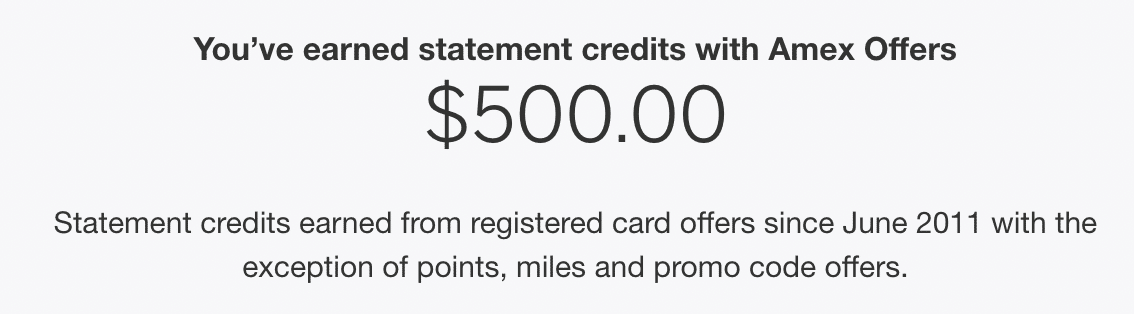

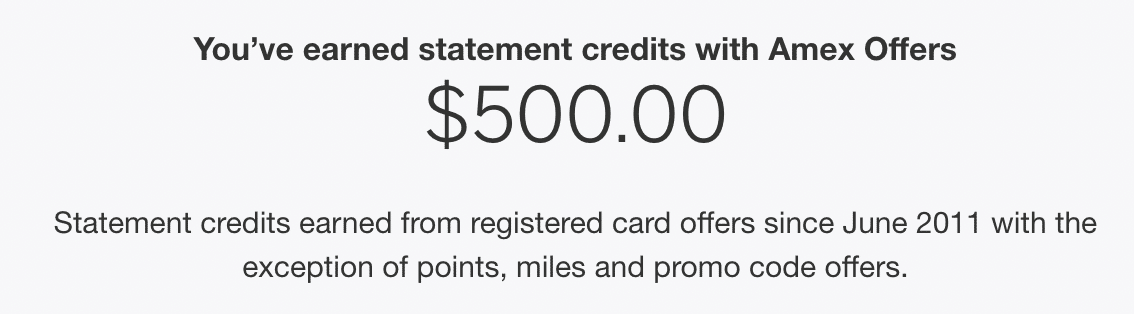

5. Entry to Amex Presents

Holding an American Specific card comes with many further advantages, reminiscent of entry to Amex Presents.

Among the different extra standard Amex Presents we’ve seen just lately are the annual Store Small promotion and the recurring Marriott provide.

With a purpose to make the most of these and different affords that pop up, you’ll should navigate to the Amex Presents part on-line after logging in, or just logging into your account.

The affords undoubtedly add up over time, and might simply offset the month-to-month price with a single buy.

6. Insurance coverage Protection

The American Specific Cobalt Card wraps issues up with a stable checklist of insurance coverage provisions for a card in its worth vary.

Just by being a Cobalt cardholder, you’ll robotically obtain emergency medical insurance coverage for 15 days, as much as a most of $5,000,000, when you’re below the age of 65.

Moreover, when you use your Cobalt Card to pay in your journey bills, you’ll be eligible to obtain many extra forms of journey insurance coverage protection, which incorporates:

- Misplaced or stolen baggage insurance coverage, as much as a most of $500 per journey

- $250,000 journey accident insurance coverage

- Flight and baggage delay insurance coverage, as much as a most of $500

- Resort housebreaking insurance coverage, as much as a most of $500

- Automotive rental theft and injury insurance coverage

Journey cancellation and interruption insurance coverage is a noteworthy omission that you simply’d discover on different bank cards in an analogous price vary, in order that’s one thing to weigh up if these forms of journey insurance coverage are significant to you.

Buy safety, prolonged guarantee, and cell system insurance coverage spherical out the protection varieties.

Conclusion

The American Specific Cobalt Card is one of the best all-around Canadian bank card with regards to on a regular basis spending.

The Membership Rewards factors earned by its welcome bonus and beneficiant class spending multipliers, when transferred to considered one of American Specific’s airline or resort companions, can go a good distance in direction of fuelling your subsequent journey.

Any Canadian family can reliably earn a handful of high-value journey redemptions yr after yr just by utilizing the Cobalt Card to pay for his or her grocery and eating bills – and you’ll’t actually ask for extra from a bank card than that!